As a global economic gateway, the foreign exchange (forex) market enables the conversion and exchange of currencies. Amidst this dynamic environment, commercial banks play a vital role in facilitating currency transactions and ensuring market stability.

Image: marketbusinessnews.com

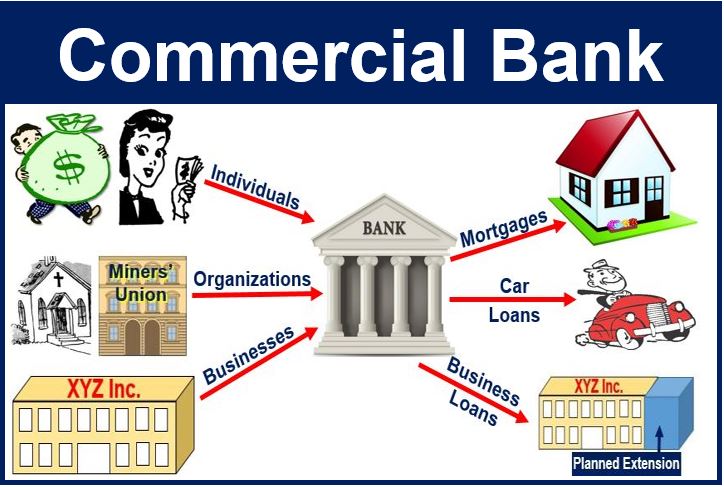

At the heart of their forex operations, commercial banks assume three primary responsibilities:

Providing Liquidity

Commercial banks serve as liquidity providers, maintaining adequate currency reserves to meet the demands of buyers and sellers. By maintaining inventory, they create a dependable market environment, ensuring the smooth execution of trades.

This liquidity reduces price volatility and minimizes the potential for market disruptions, enabling traders to conduct transactions with confidence and efficiency.

Currency Conversion

As intermediaries, commercial banks facilitate currency conversions for individuals, businesses, and governments. They provide competitive exchange rates and execute transactions, acting as a bridge between different currencies.

This service is indispensable for international trade, tourism, and cross-border investments, allowing entities to transact business seamlessly across borders.

Risk Management

Commercial banks play a crucial role in managing risk within the forex market. They offer hedging tools, such as forward contracts and options, which enable traders to mitigate risks associated with currency fluctuations.

By managing and diversifying their portfolios, banks help stabilize the market and protect participants from potential losses. Their sophisticated risk management capabilities provide traders with peace of mind and promote market confidence.

Image: www.tradingview.com

Latest Trends and Developments

The forex market is continuously evolving, driven by technological advancements, economic fluctuations, and evolving regulatory landscapes. To remain competitive, commercial banks are actively embracing:

- Artificial intelligence (AI) and machine learning for enhanced risk management and trade analysis

- Blockchain technology for secure and efficient cross-border transactions

- Automated platforms and mobile applications for seamless trading experiences

These innovations promise to further enhance the efficiency, transparency, and accessibility of the forex market.

Benefits of Engaging Commercial Banks

Partnering with commercial banks in the forex market offers numerous advantages, including:

- Reduced transaction costs due to competitive exchange rates and bulk discounts

- Access to specialized expertise and personalized advice from seasoned traders

- Protection from market volatility and risk through comprehensive hedging strategies

- Secure and regulated platform ensuring the integrity of transactions

By leveraging the services of commercial banks, traders and investors can maximize their potential returns while minimizing risk exposure.

FAQs on Commercial Banks in Forex

-

Q: Why is it important to work with a reputable commercial bank?

A: Reputable commercial banks offer stability, security, and regulatory compliance, ensuring the integrity of your transactions and protecting your funds from fraudulent activities.

-

Q: What factors should I consider when choosing a commercial bank for forex?

A: Look for banks with competitive exchange rates, a strong track record in the forex market, and a proven commitment to customer satisfaction.

Role Of Commercial Banks In Forex Market

Conclusion

Commercial banks are the backbone of the forex market, providing liquidity, facilitating currency conversions, and managing risk. By leveraging their expertise and innovative services, traders and investors can navigate the complexities of the global currency exchange with confidence.

If you’re seeking a reliable and advantageous partner in the forex market, consider engaging the services of a reputable commercial bank. Their comprehensive offerings and commitment to excellence will empower you to achieve your financial goals and thrive in the dynamic world of currency exchange.