In an increasingly interconnected global economy, foreign exchange reserves serve as a financial cornerstone for nations worldwide. These reserves, primarily held in the form of currencies, gold, and Special Drawing Rights (SDRs), are instrumental in maintaining economic stability and safeguarding financial sovereignty. In this comprehensive guide, we will delve into the realm of forex reserves, unravel their significance, and equip you with actionable strategies to bolster your nation’s economic resilience through prudent management of these precious assets.

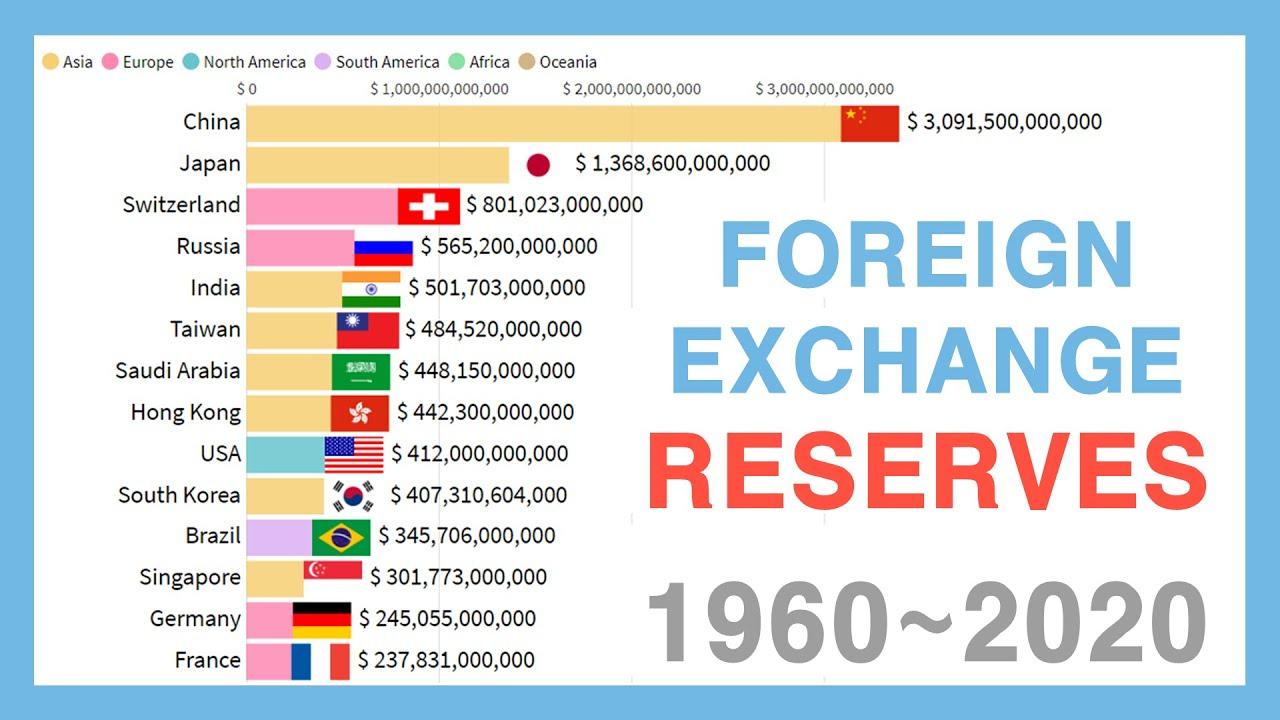

Image: forextraders.guide

Why Forex Reserves Matter

Forex reserves play a critical role in ensuring the smooth functioning of a nation’s economy. Let’s dissect their functions and benefits:

- Stability in Foreign Exchange Rates: Forex reserves act as a buffer against external shocks that could destabilize exchange rates. They provide a ready source of foreign currency to intervene in the market, smoothing out fluctuations and preserving economic stability.

- Import Capacity and Trade Confidence: Adequate forex reserves assure traders and investors of a nation’s ability to import essential goods and services. This enhances trade confidence, fosters economic growth, and mitigates external debt risks.

- Maintaining Sovereign Control: Sufficient forex reserves empower nations to repay foreign debt obligations and finance essential imports without resorting to unpredictable external borrowings. This bolsters sovereign financial independence and safeguards economic decision-making.

- Creditor Confidence and International Standing: A healthy level of forex reserves instills confidence in international creditors, enhancing access to global capital markets. It also serves as a positive indicator of a nation’s economic strength and creditworthiness.

Strategies to Increase Forex Reserves

Building robust forex reserves requires a combination of prudent fiscal and monetary measures. Here are some effective strategies to consider:

1. Macroeconomic Policies

- Current Account Surplus: Maintaining a positive trade balance by exporting more goods and services than importing boosts foreign currency earnings and increases forex reserves.

- Budget Discipline: Prudent fiscal management, including controlling government spending and minimizing budget deficits, reduces the need for external borrowing and strengthens the nation’s overall financial standing.

- Interest Rate Management: Higher interest rates incentivize capital inflows, boosting foreign exchange inflows and increasing forex reserves. However, careful consideration of potential inflationary pressures is crucial.

- Foreign Exchange Intervention: Central banks can conduct open market operations, selling foreign currency when its value is high and buying it when its value is low, smoothing out exchange rate fluctuations and stabilizing forex reserves.

- Attracting Foreign Direct Investment (FDI): Encouraging foreign businesses to invest in the domestic economy promotes job creation, technology transfer, and foreign exchange inflows, bolstering forex reserves.

- Diaspora Remittances: Establishing policies that facilitate remittances from citizens working abroad can increase foreign currency inflows and contribute to forex reserves.

- Gold Reserves: Gold, a valuable asset, can be included in a nation’s forex reserves to diversify holdings and provide a hedge against inflation or currency fluctuations.

- SDR Allocation: Participating in the International Monetary Fund’s SDR system, which supplements member countries’ official reserves, can boost a nation’s forex holdings.

Image: tradingroom.co.ke

2. Monetary Policy Tools

3. Foreign Investment and Capital Flows

4. Managing Gold and SDRs

How To Increase Forex Reserves

Conclusion

Managing forex reserves is a complex but indispensable aspect of sound economic governance. By implementing prudent strategies, nations can safeguard their financial sovereignty, foster economic growth, and navigate global economic challenges with confidence. Remember, robust forex reserves are an asset to any nation, a pillar of