Imagine a world where your debit card can tell you exactly how much money you have left, not in dollars or euros, but in a series of ones and zeros. Sounds like science fiction, right? Well, the concept of a binary debit card, while not yet mainstream, isn’t as far-fetched as it seems. In fact, the very foundation of modern technology, including the way your debit card processes payments, relies on the language of binary code.

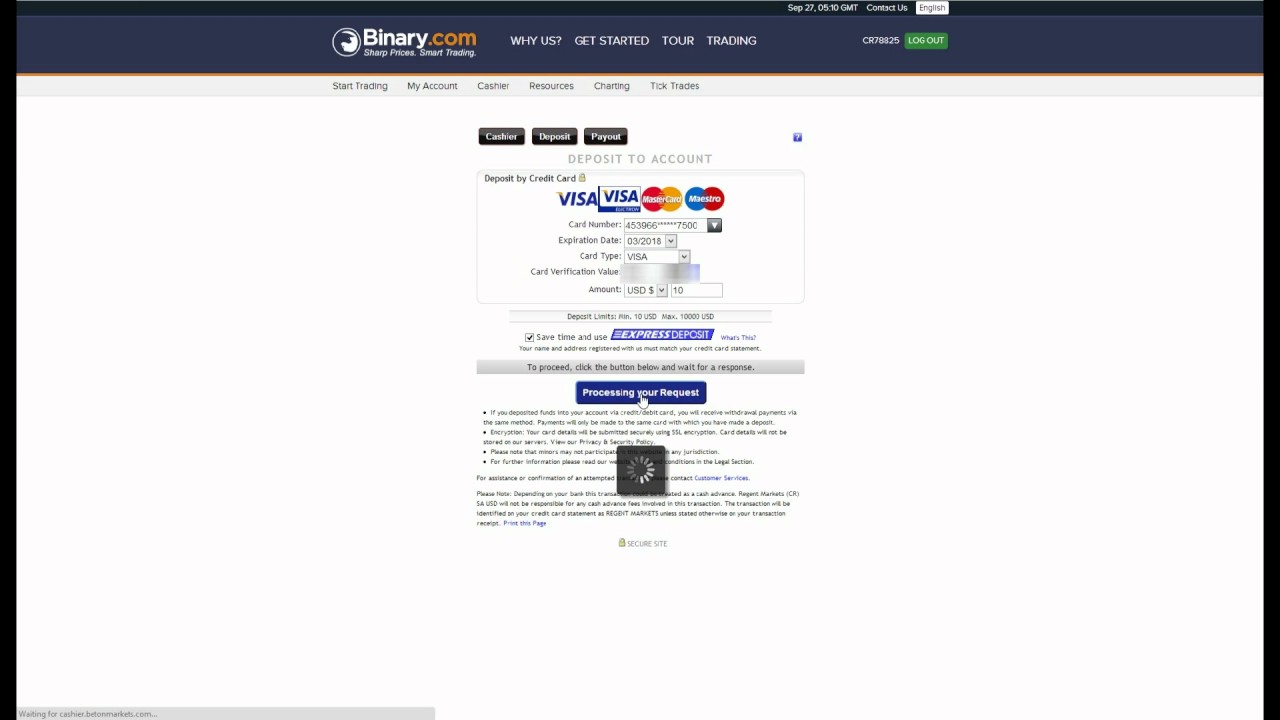

Image: www.youtube.com

But what exactly is a binary debit card? And what makes it different from the plastic card you carry in your wallet? This article dives into the captivating world of binary debit cards, exploring their potential benefits, limitations, and the future of this intriguing financial innovation.

Unveiling the Mystery: What is a Binary Debit Card?

Before we unravel the intricacies of a binary debit card, let’s clarify what it is not. It’s not a physical card with binary code printed on it. Rather, it’s a conceptual framework that leverages the principles of binary code to enhance the functionality and security of traditional debit cards. In essence, a binary debit card is a debit card that operates on a system where every transaction and balance is represented by a series of ones and zeros.

This might sound complex, but it’s actually a very simple idea. Think of it like the on-off switches of a computer. Each digit in a binary code represents a state, either “on” (1) or “off” (0). By combining these states in various sequences, we can represent any numerical value, including your account balance or the amount of a purchase.

The Binary Code Advantage: A Deeper Dive into Functionality

So, what are the potential advantages of a binary debit card? The answer lies in the inherent flexibility and security offered by binary code.

Enhanced Security: A Digital Shield Against Fraud

One of the primary benefits of a binary debit card is its inherent security. By encoding data in a system of ones and zeros, every transaction becomes a complex puzzle, making it much harder for fraudsters to manipulate or intercept. This is because traditional methods relying on encrypted data can be vulnerable to sophisticated hacking techniques. A binary system, however, offers a more robust layer of security by making it much more difficult to decipher and replicate data.

Image: cryptorandgroup.com

Real-Time Tracking: Always in Control of Your Finances

Imagine knowing your exact balance at any given moment, without needing to check your online banking app or call your bank. With a binary debit card, the system could update your balance in real-time with every transaction. This transparency allows for greater control over your finances, ensuring you’re always aware of your spending and avoiding overdrafts, a constant source of frustration for many users.

Beyond the Binary: The Emerging Landscape of Debit Card Innovations

While the concept of a binary debit card remains in its nascent stage, the financial world is experiencing a rapid evolution in debit card technology. The quest for enhanced security, improved user experience, and greater financial control has led to numerous advancements, some of which we can expect to see integrated into future debit card models.

Biometric Authentication: A Secure Touch

The integration of biometric authentication, such as fingerprint or facial recognition, is already making its way into the debit card landscape. This technology promises greater security than traditional PIN codes by verifying your identity based on your unique biological characteristics. Imagine simply holding your card up to a scanner to unlock and pay, with no need for a physical PIN or signature.

Tokenization: A Digital Proxy for Secure Transactions

Tokenization is another exciting development gaining traction. Instead of transmitting your actual debit card number during transactions, a unique digital token is created as a proxy. This token, even if intercepted by fraudsters, is useless without the accompanying cryptographic key, making it impossible for them to use your card for fraudulent purposes.

Mobile Payments: The Rise of Digital Wallets

The rise of mobile payment platforms, such as Apple Pay and Google Pay, has transformed the way we pay. These platforms allow users to store their debit card information in a secure digital wallet, enabling them to make contactless payments with their smartphones. As these platforms become more integrated with banking systems, we can expect a seamless transition to a future where physical debit cards become increasingly obsolete.

The Future of Debit Cards: A Glimpse into Tomorrow’s Financial Landscape

The future of debit cards is undoubtedly exciting, with innovations constantly pushing the boundaries of convenience and security. While the binary debit card remains a theoretical concept, the principles it embodies – security, transparency, and user control – are guiding the development of next-generation debit card technologies.

We can expect to see a convergence of technologies, seamlessly integrating biometric authentication, tokenization, and mobile payment platforms into a single, intuitive user experience. This evolution will likely lead to a future where our debit cards become more personalized, adapting to our financial needs and preferences.

Binary Debit Card

Embracing the Digital Evolution: A Call to Action

As we embrace the evolving digital landscape, it’s crucial to stay informed about the latest developments in debit card technology. Research the various security features and functionalities offered by different banks and payment providers. Don’t be afraid to explore new payment methods and embrace the convenience and security they offer. By staying informed and adapting to the changing financial landscape, we can unlock a future where our finances are more secure, transparent, and user-friendly than ever before.