Introduction:

Image: candlestickstrading.blogspot.com

In the realm of forex trading, where fortunes are made and lost in a matter of seconds, the ability to decipher the hidden messages in candlestick charts holds the key to success. Candle patterns, with their intricate shapes and colors, speak a language that experienced traders have mastered. This article embarks on a captivating journey, unraveling the secrets of these enigmatic formations, empowering you with the knowledge to navigate the turbulent waters of the financial markets with precision and intuition.

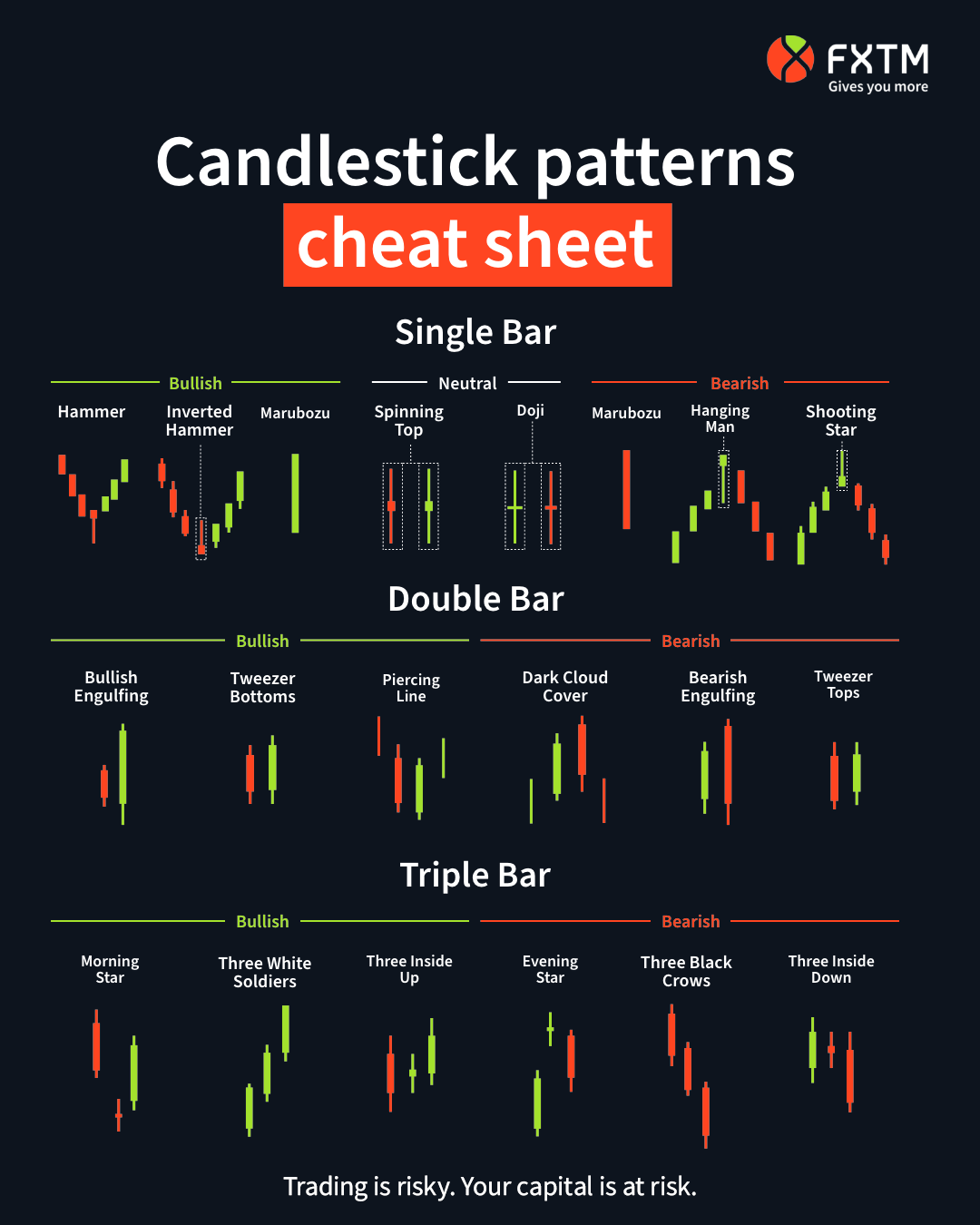

Types of Candlesticks and their Significance:

-

Bullish Candlesticks:

a) Doji: A十字形 candlestick, with open and close prices nearly equal, signaling market indecision.

b) Hammer: A small body supported by a long lower shadow, indicative of a potential bullish reversal.

c) Inverted Hammer: Similar to a hammer, but with a long upper shadow, suggesting an attempted bearish trend reversal.

-

Bearish Candlesticks:

a) Hanging Man: A long upper shadow and small body near the top of the candlestick, foreshadowing a potential bearish reversal.

b) Shooting Star: A candlestick with a long upper shadow and small body near the bottom, indicating a potential bearish trend continuation.

c) Bearish Engulfing: When a bearish candlestick completely engulfs the previous bullish candle, it signals strong selling pressure.

-

Neutral Candlesticks:

a) Spinning Top: A small body with equal-length upper and lower shadows, representing market equilibrium.

b) *Gravestone Doji:** A tombstone-shaped candlestick with no shadow, indicating indecision and a possible trend reversal.

-

Combination Patterns:

a) Bullish Harami: A small bullish candlestick inside a larger bearish candle, signifying a potential bullish breakout.

b) Bearish Harami: Similar to a bullish harami, but with a small bearish candlestick inside a larger bullish candle, suggesting a possible bearish reversal.

c) Three White Soldiers: Three consecutive bullish candlesticks with minimal shadows, indicating a strong bullish trend.

Expert Insights and Actionable Tips:

-

“Successful forex trading is about recognizing candlestick patterns and understanding the emotions behind them,” says renowned forex analyst Mark Douglas.

-

“Emotions, both fear and greed, drive traders’ actions. Candlesticks help us identify these emotions and make informed decisions,” adds John Bollinger, developer of the Bollinger Bands.

-

Always consider the broader market context and macroeconomic factors when interpreting candlestick patterns.

-

Practice patience and discipline in your trading. Patience allows for optimal timing, while discipline prevents emotional biases from clouding your judgment.

Conclusion:

Mastering the art of reading forex candlesticks is a transformative journey that empowers traders with the ability to read market sentiment, predict trends, and make informed decisions. By understanding the nuances of these patterns and the emotions that drive them, you can unlock the secrets of successful trading and navigate the forex markets with confidence and finesse. Remember, true trading mastery comes from a blend of technical analysis, emotional intelligence, and a deep understanding of market dynamics.

Image: www.vrogue.co

Types Of Forex Candle Sticks And Names