Have you ever felt like the financial markets are speaking a secret language? Like a seasoned trader peering into a crystal ball, you see the mesmerizing dance of price fluctuations, but fail to decipher their message? The truth is, you’re not alone. Understanding the language of the market requires practice, patience, and a keen eye for detail. But, within this seemingly chaotic world, lie hidden patterns, unspoken clues that can reveal the hidden intentions of both buyers and sellers. And it all starts with mastering the art of candle pattern trading.

Image: www.aiophotoz.com

Candle patterns, those enchanting graphical representations of price action, are more than just pretty pictures. They are the visual language of the market, narrating tales of greed and fear, hope and despair. These patterns, born from countless trading battles, encode the collective psychology of market participants, offering a glimpse into the future direction of prices. This is where candle pattern trading comes into play, unlocking the potential to navigate the market’s turbulent waves with a greater sense of confidence and control.

Unveiling the Secrets of Candle Patterns: A Journey into the Heart of Trading

Candle patterns are the visual fingerprints of market sentiment. Each candle embodies a battle between buyers and sellers, its body representing the price difference between the opening and closing of a trading period, its wicks (shadows) reflecting the highs and lows touched during that time. These patterns, when observed in specific configurations, reveal the market’s underlying strength or weakness, providing crucial insights into potential price movements.

Embracing the Basics: The Bullish and Bearish Candles

The foundation of candle pattern analysis lies in understanding the nature of bullish and bearish candles. A bullish candle, with its body entirely green (or white), signifies a period where buyers dominated sellers, pushing prices higher. Conversely, a bearish candle, characterized by a red (or black) body, indicates a period where sellers prevailed, driving prices down.

Unveiling the Power of Reversal Patterns

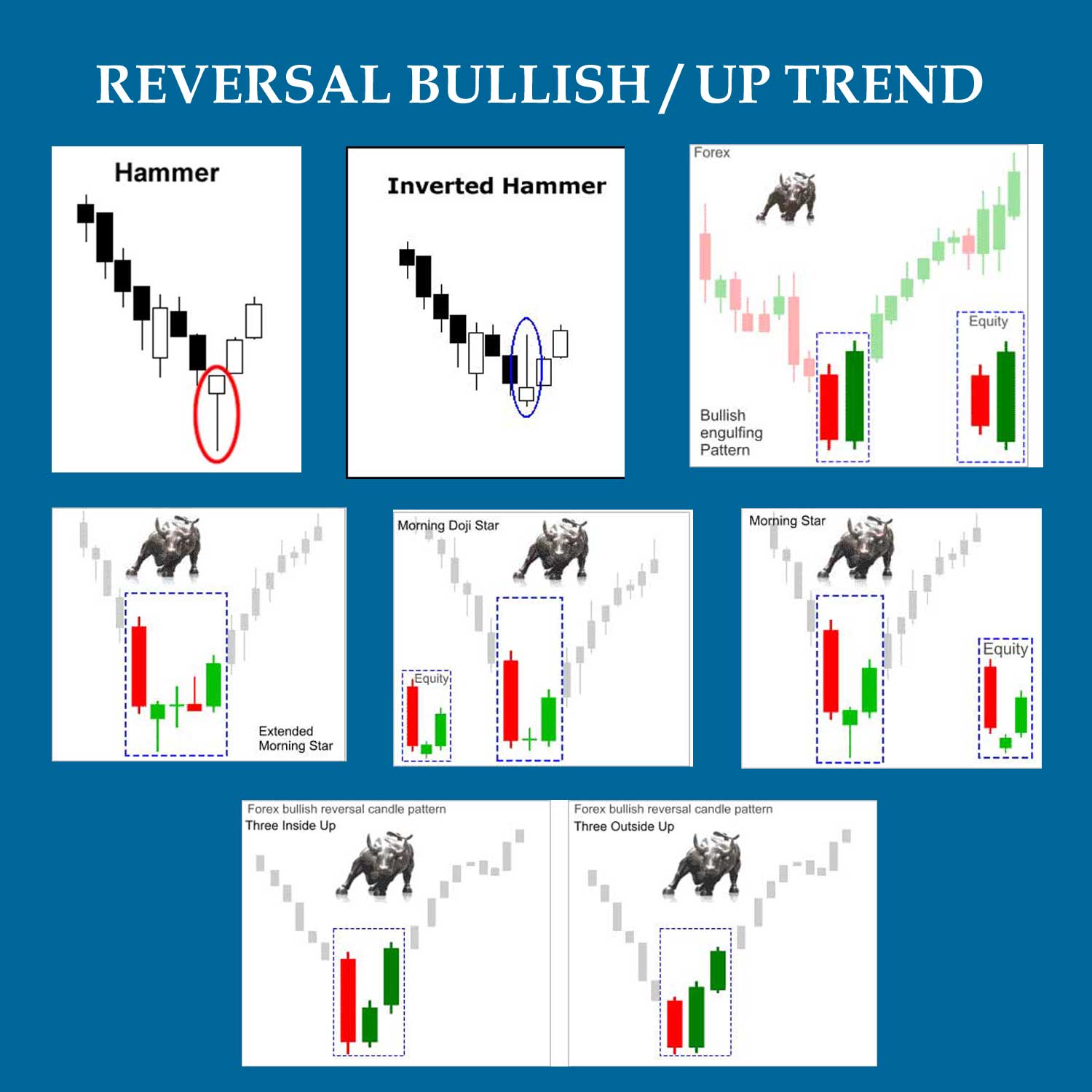

One of the most common and potentially profitable applications of candle patterns is identifying market reversals. A reversal pattern signals a shift in the prevailing trend, indicating a potential change in momentum.

-

The Hammer: This pattern, resembling a hammer, is a bullish reversal pattern that arises at the bottom of a downtrend. A small body, with a long lower wick, and a small upper wick, signals a strong push by buyers to stop the downtrend, suggesting a potential rebound.

-

The Shooting Star: This bearish reversal pattern emerges at the peak of an uptrend. Its small body, with a long upper wick and little to no lower wick, indicates selling pressure pushing prices down, potentially marking a trend reversal.

Recognizing Continuation Patterns: Riding the Wave of Momentum

Candle patterns can also act as confirmation of existing trends, highlighting a continuation of established momentum.

-

The Engulfing Pattern: The engulfing pattern, powerful in its simplicity, occurs when the current candle’s body completely encompasses the body of the previous candle. A bullish engulfing pattern occurs when a green (or white) candle engulfs a red (or black) candle, indicating a trend continuation upwards. Conversely, a red (or black) candle engulfing a green (or white) candle suggests a potential continuation of the downtrend.

-

The Morning Star: This bullish continuation pattern signifies a trend reversal after a downward move. It consists of a small red (or black) candle, followed by a small green (or white) candle that doesn’t touch the previous candle’s body, and then finally a large green (or white) candle engulfing the second candle.

Beyond the Individual Candles: The Power of Combining Patterns

The real magic of candle patterns begins when we start to see them in conjunction with other patterns and indicators. Combining candlestick analysis with supporting technical indicators, like moving averages, MACD, or RSI, can help confirm the strength of a potential trade setup and greatly enhance trading decision-making.

Learning from Experts: Bridging the Gap Between Theory and Practice

The world of candle pattern trading is rich with wisdom accumulated from generations of traders. Countless individuals have dedicated their lives to mastering this complex art, offering invaluable insights and practical guidance.

-

Steve Nison: Often referred to as the “Father of Candlestick Charting”, Nison’s seminal work, “Japanese Candlestick Charting Techniques,” laid the groundwork for modern candle pattern analysis. His book dissects the historical origins, technical applications, and practical strategies associated with candle patterns.

-

Thomas Bulkowski: A renowned technical analyst and author, Bulkowski is known for his extensive research and analysis of candlestick patterns. His book “Encyclopedia of Candlestick Patterns” offers a comprehensive guide to hundreds of different candle patterns, including their historical performance, trading implications, and real-world examples.

-

Adam Grimes: This leading trader and educator stresses the importance of combining multiple technical indicators, including candle patterns, to generate trading signals. His book “The Art and Science of Technical Analysis” provides a practical framework for incorporating candlestick analysis into a comprehensive trading system.

![Candlestick Patterns Explained [Plus Free Cheat Sheet] |TradingSim](https://f.hubspotusercontent10.net/hubfs/20705417/Imported_Blog_Media/CANDLESTICKQUICKGUIDE-Mar-18-2022-09-42-46-01-AM.png)

Image: www.tradingsim.com

Candle Patterns Trading

Beyond the Chart: The Human Element in Trading

Candle patterns, despite their power, are not a foolproof system. The market, driven by human emotions and unpredictable events, is rarely purely technical. It is essential to recognize that candle patterns are just tools, valuable guides to be combined with sound risk management, disciplined trading strategies, and a genuine understanding of the market’s psychology.

Navigating the Market with Prudence: The Cornerstones of Successful Trading

-

Risk Management: Before entering any trade, define your maximum loss for each position. Use stop-loss orders to automatically exit positions when prices move against your trades, minimizing potential losses.

-

Trading Plan: Develop a clear trading plan defining your trading strategy, entry and exit points, risk management rules, and the specific candle patterns you will be looking for.

-

Continuous Learning: The market is a dynamic entity, constantly evolving. Stay informed about market developments, economic indicators, and the latest research on candlestick patterns. Invest in your trading education by attending workshops, webinars, and reading books on technical analysis.

The Journey Continues: Building a Trading Legacy

Candle patterns are a powerful tool, a language that unlocks the secrets of the market, but they are not a shortcut to riches. Only through consistent practice, dedicated learning, and unwavering discipline can you truly harness the power of candle pattern trading, building a foundation for confident and profitable market navigation. This is a continuous journey, a path paved with knowledge, experience, and the unwavering pursuit of market mastery.

So, begin your journey today. Start by learning the basic candle patterns, studying their evolution within the market, and incorporating them into your trading strategy. The language of the markets awaits, ready to be deciphered. The future of your financial success may depend on how well you learn to speak it.