Introduction

The world of financial trading has garnered immense popularity in India, with the foreign exchange (forex) market emerging as a particularly lucrative arena. Understanding the ideal time to trade forex in India is crucial for maximizing returns and minimizing risks. This comprehensive guide delves into the intricacies of India’s forex market, exploring the best times to trade for optimal profitability.

Image: www.livemint.com

The Indian Forex Market: An Overview

India’s forex market is the 18th largest globally, with an average daily transaction volume exceeding $100 billion. The Indian rupee (INR) is the base currency traded against various other currencies, including the US dollar (USD), euro (EUR), and British pound (GBP). The Reserve Bank of India (RBI) strictly regulates the forex market to maintain stability.

The Best Time to Trade Forex in India

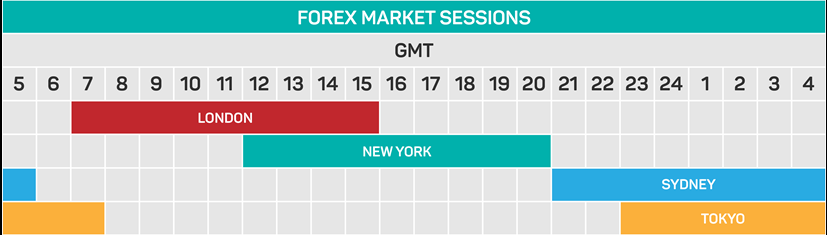

The optimal time to trade forex in India depends on multiple factors, including market conditions, currency pairs traded, and individual trading strategies. However, certain time windows generally offer higher chances of profitability:

10:00 AM – 12:00 PM IST: During this period, the Indian forex market overlaps with the opening of major financial centers in London and New York, leading to increased liquidity and volatility.

1:30 PM – 3:00 PM IST: This timeframe coincides with the London and New York lunchtime, which typically results in lower market volatility. However, it can be an opportune time for strategic trades based on technical analysis or market fundamentals.

7:30 PM – 8:30 PM IST: The evening session aligns with the closure of the London market and the opening of the Sydney market. This time zone often offers high volatility and potential trading opportunities.

Factors to Consider

In addition to the time of day, traders should consider the following factors to optimize their trading strategy:

1. Economic News and Events: Important economic data releases and geopolitical events can significantly impact currency prices. Staying informed about market-moving news can help traders identify potential opportunities and adjust their trading plans accordingly.

2. Currency Correlation: Understanding the correlation between different currency pairs can assist traders in making informed trading decisions. For instance, the EUR/USD and GBP/USD pairs tend to have a strong positive correlation.

3. Risk Tolerance: Traders should carefully assess their risk tolerance before entering the forex market. Higher volatility periods, such as during major news releases, may be suitable for experienced traders with a higher risk appetite, while lower volatility periods may appeal to conservative traders.

Image: kristoferspaulding.blogspot.com

Time For Trading In Forex Market Being In India

https://youtube.com/watch?v=l7Pkx0GD2B0

Conclusion

Understanding the optimal time to trade forex in India is a key factor in maximizing the potential for profitable trading. By considering the factors outlined above, traders can optimize their strategies to suit their individual preferences and risk appetite. Whether you are a seasoned trader or just starting your forex journey, being well-informed about the market conditions and timing your trades strategically can significantly increase your chances of success in the lucrative world of foreign exchange trading.