Introduction:

In the realm of global finance, foreign exchange reserves emerge as a crucial pillar, serving as a nation’s bulwark against economic uncertainties. These reserves, primarily composed of currencies, bonds, and gold, enable countries to stabilize exchange rates, protect against external shocks, and facilitate international trade. In this article, we embark on a fascinating journey exploring the top 10 countries boasting the most formidable forex reserves, unveiling the secrets behind their economic prowess and unraveling the intricate factors that shape their reserve accumulation.

Image: www.drishtiias.com

1. China: The Unstoppable Juggernaut

China stands as the undisputed leader in forex reserve accumulation, its towering stockpile surpassing the combined reserves of the next two countries on our list. This staggering wealth has been meticulously amassed over decades through China’s export-oriented growth model, massive trade surpluses, and capital inflows. China’s vast reserves provide a robust buffer against economic disruptions and enable it to influence global exchange rates, making the country a formidable player in the international financial arena.

2. Japan: A Conservative Colossus

Japan, a nation steeped in tradition and prudence, boasts the world’s second-largest forex reserves, a testament to its meticulously conservative fiscal policies. The Bank of Japan’s aggressive bond-buying program and the nation’s persistent trade surpluses have been instrumental in accumulating these reserves. Japan’s sizable reserves provide a sturdy foundation for its aging society and safeguard its economy against external headwinds.

3. Switzerland: The Safe Haven Pinnacle

Nestled amidst the Swiss Alps, Switzerland has long been synonymous with financial stability, and its forex reserves stand as a towering testament to this reputation. The country’s neutrality, political stability, and robust banking sector have made it a haven for investors seeking to safeguard their wealth. Switzerland’s vast reserves serve as a potent shield against financial turmoil, further bolstering the country’s status as a beacon of safety in the global economic landscape.

Image: howtotradeonforex.github.io

4. Saudi Arabia: Oil Wealth and Sovereign Strength

Saudi Arabia, the heartland of the global oil industry, derives its vast forex reserves from the bountiful revenues generated by its hydrocarbon exports. The country’s strategic decision to peg its currency to the US dollar has bolstered stability and attracted foreign investment. Saudi Arabia’s burgeoning reserves serve as a bulwark against oil price fluctuations and enable the nation to pursue ambitious economic diversification plans.

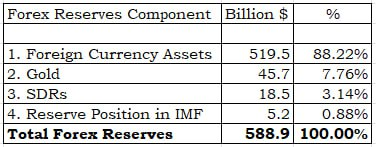

5. India: An Emerging Giant

India, a rising star on the world economic stage, has witnessed a meteoric rise in its forex reserves, buoyed by robust economic growth, a large diaspora, and foreign direct investment inflows. The country’s central bank has skillfully managed its reserves, ensuring stability while mitigating currency risks. India’s sizable reserves bolster its economic resilience and position the country as a significant player in global financial markets.

6. Russia: Energy Power and Geopolitical Might

Russia, endowed with vast energy resources, has accumulated substantial forex reserves as a result of its oil and gas exports. The country’s strategic use of these reserves has bolstered its global influence and enhanced its ability to withstand economic sanctions. Russia’s forex reserves provide a safety net against potential geopolitical risks and enable the nation to assert its economic power on the world stage.

7. Hong Kong: The Gateway to China

Hong Kong, a vibrant global financial hub, has amassed impressive forex reserves, thanks to its role as a gateway to the mainland Chinese economy. The city’s free-market principles, robust legal system, and strategic location have attracted vast capital inflows. Hong Kong’s substantial reserves reinforce its status as a financial powerhouse and enhance its resilience against economic headwinds.

8. South Korea: Technological Prowess and Export Dominance

South Korea, a global leader in technology and manufacturing, has built up substantial forex reserves through its export-oriented economy. The country’s dynamic corporations have played a pivotal role in generating foreign exchange, contributing to robust reserve accumulation. South Korea’s ample reserves provide a buffer against external shocks and bolster its economic competitiveness on the world stage.

9. Singapore: A Financial Hub of Unrivaled Sophistication

Singapore, a small city-state nestled at the heart of Southeast Asia, has emerged as a financial hub of unrivaled sophistication. The country’s prudent economic policies, skilled workforce, and strategic location have drawn in massive foreign investment and capital inflows. Singapore’s substantial forex reserves serve as a cornerstone of its robust financial system and further enhance its stature as a global economic powerhouse.

10. Brazil: Natural Resource Wealth and Economic Potential

Brazil, endowed with abundant natural resources, has accumulated sizable forex reserves as a result of its commodity exports. The country’s efforts to diversify its economy and attract foreign investment have contributed to reserve growth. Brazil’s vast reserves provide a buffer against economic volatility and support its aspirations to become a leading global economic player.

Top 10 Largest Forex Reserve Country

Conclusion:

The forex reserves of the top 10 countries highlighted in this article stand as a testament to their economic strength, astute financial management, and influential position in global markets. These reserves serve a multitude of purposes, from currency stabilization to managing external risks and promoting economic growth. As the global economic landscape continues to shift, the importance of forex reserves becomes increasingly evident, and the countries that possess them will continue to exert significant power and influence on the world stage.