Unveiling the Forex World: Live Charts and Trading Strategies

The foreign exchange market, commonly known as forex, serves as a global marketplace where currencies are traded incessantly. Here, trillions of dollars exchange hands each day, reflecting the ever-fluctuating values of currencies worldwide. Amidst this dynamic landscape, the USD/INR exchange rate stands as a crucial indicator of the relative strength of the U.S. dollar and the Indian rupee.

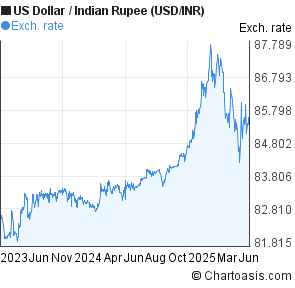

Image: howtotradeonforex.github.io

In an interconnected global economy, understanding the USD/INR exchange rate is paramount for businesses engaged in international trade and expatriates navigating cross-border transactions. By deciphering the intricacies of this currency pair, investors can leverage advantageous opportunities and mitigate financial risks.

Anatomy of the USD/INR Live Chart: Deciphering Currency Fluctuations

A live USD/INR chart depicts the real-time value of the U.S. dollar in relation to the Indian rupee. This graphical representation empowers traders and investors with a comprehensive view of the currency pair’s movements over time. The y-axis of the chart showcases the exchange rate, expressed as the number of Indian rupees required to purchase one U.S. dollar. The x-axis, on the other hand, represents the progression of time.

By analyzing the live chart, traders can identify trends and patterns that inform their trading decisions. For instance, a consistent upward trajectory suggests that the U.S. dollar is appreciating against the Indian rupee, while a downward trend indicates the reverse. Additionally, the chart provides insights into market volatility, manifested as sharp fluctuations in the exchange rate.

Unveiling the Factors Influencing the USD/INR Exchange Rate

The USD/INR exchange rate is subject to myriad factors that drive its fluctuations. Understanding these determinants is essential for comprehending the currency pair’s movements:

- Interest Rate Differentials: Central bank policies significantly influence exchange rates. When the U.S. Federal Reserve raises interest rates compared to the Reserve Bank of India, it makes dollar-denominated investments more attractive, resulting in an appreciation of the U.S. dollar against the Indian rupee.

- Economic Growth: The growth prospects of India relative to the United States play a pivotal role. Robust economic growth in India, accompanied by increased demand for its goods and services, can strengthen the Indian rupee against the U.S. dollar.

- Inflation: When inflation rises in India at a higher rate than in the United States, it erodes the purchasing power of the Indian rupee and can lead to its depreciation.

- Current Account Deficit: India’s current account deficit, indicating an excess of imports over exports, exerts downward pressure on the Indian rupee. Conversely, a surplus strengthens the rupee.

- Political and Economic Stability: Market sentiment towards India’s political and economic stability can influence investors’ confidence in the Indian rupee, leading to fluctuations in its value.

Exploiting Trading Opportunities: Navigating the USD/INR Currency Pair

Traders can capitalize on the USD/INR exchange rate’s movements by employing well-informed strategies:

- Trend Trading: Identifying and trading in the direction of established trends can yield substantial profits. Long trades are initiated when the market exhibits an upward trend, while short trades are executed when the trend is downward.

- Range Trading: Certain currency pairs, like the USD/INR, exhibit price movements within predefined ranges. Traders can profit from these fluctuations by buying near the lower boundary and selling near the upper boundary of the range.

- Carry Trading: Investors seeking higher returns can engage in carry trading, involving borrowing in a low-interest-rate currency and investing in a currency with a higher interest rate. The USD/INR currency pair presents carry trading opportunities when the interest rate differential between India and the United States is significant.

Image: forexmoneyinkenya.blogspot.com

Mitigating Forex Risks: Protecting Against Market Volatility

The foreign exchange market is inherently volatile, and the USD/INR currency pair is no exception. Prudent traders adopt effective risk management strategies to safeguard their investments:

- Stop-Loss Orders: These orders automatically sell (buy) a position if the market price falls (rises) below (above) a predetermined level, limiting potential losses.

- Hedging: Employing hedging techniques, such as currency forward contracts, can mitigate exposure to adverse exchange rate movements and stabilize cash flows.

- Diversification: Allocating investments across various currency pairs and asset classes reduces overall risk exposure and enhances portfolio resilience.

Delving into the USD/INR Live Chart: A Practical Application

To illustrate the USD/INR live chart in action, consider the following hypothetical scenario:

Assume that on January 1, 2023, the USD/INR exchange rate stands at 75.00, indicating that one U.S. dollar can be purchased for 75 Indian rupees.

Over the ensuing months, the Indian economy exhibits robust growth, bolstered by increased foreign investment and a burgeoning export sector. As a result, demand for the Indian rupee strengthens, leading to an appreciation against the U.S. dollar.

By the end of June 2023, the USD/INR exchange rate has risen to 70.00. This means that one U.S. dollar now fetches only 70 Indian rupees, reflecting the rupee’s appreciation.

Traders who identified this trend and initiated long positions in the USD/INR currency pair would have profited from the rising exchange rate. Conversely, those who held short positions would have incurred losses.

Forex Usd Inr Live Chart

Conclusion: Unveiling the USD/INR Exchange Rate’s Significance

The USD/INR currency pair serves as a critical indicator of the relative strength of the U.S. dollar and the Indian rupee. Understanding the factors influencing its fluctuations and employing sound trading strategies can empower investors and businesses to navigate the ever-changing forex landscape.

By harnessing the insights provided by live USD/INR charts, traders can identify opportunities and mitigate risks, paving the way for profitable investments and seamless cross-border transactions.