In the ever-evolving world of international trade and finance, understanding foreign exchange rates is crucial for businesses and individuals transacting across borders. Among the key currency pairs, the Australian dollar (AUD) and Indian rupee (INR) play a significant role in facilitating trade between Australia and India. This article delves into the intricacies of the AUD/INR exchange rate, providing insights into its determinants, historical trends, and practical implications. By gaining a comprehensive understanding of AUD/INR, you can make informed decisions and effectively manage your financial transactions.

Image: forexstrategiesexplained.blogspot.com

The Significance of AUD/INR Exchange Rate

The AUD/INR exchange rate determines the value of the Australian dollar relative to the Indian rupee, effectively setting the price at which these currencies can be traded. This rate is crucial for businesses engaged in import-export activities between Australia and India. A higher AUD/INR rate implies that the Australian dollar is stronger against the Indian rupee, making Australian imports more expensive for Indian businesses and Indian exports more attractive to Australian consumers. Conversely, a lower AUD/INR rate makes it cheaper for Indian businesses to import from Australia while reducing the profitability of Indian exports to Australia.

Beyond trade, the AUD/INR exchange rate also impacts individuals involved in cross-border remittances and investments. Indian students studying in Australia, for instance, may need to convert INR to AUD for tuition fees and living expenses. Similarly, Australian investors eyeing opportunities in India’s burgeoning economy would be affected by the AUD/INR rate when converting their funds.

Factors Driving AUD/INR Exchange Rate

Several economic and market factors influence the AUD/INR exchange rate. These include:

-

Economic Growth: Positive economic growth prospects in Australia and India can strengthen their respective currencies. Strong GDP growth, low unemployment rates, and stable inflation contribute to currency appreciation.

-

Interest Rates: Central bank decisions on interest rates can impact currency values. Higher interest rates in Australia compared to India make Australian investments more attractive, increasing demand for AUD and pushing up the AUD/INR exchange rate.

-

Commodity Prices: Australia is a major exporter of commodities such as iron ore and coal, while India is a large importer of these commodities. Movements in commodity prices can impact the AUD/INR exchange rate as they affect the value of Australian exports and India’s import costs.

-

Political and Economic Stability: Political stability and economic reforms in Australia and India can enhance investor confidence, leading to increased inflows of foreign capital. This demand for domestic currencies can boost their respective values and influence the AUD/INR exchange rate.

Historical Trends and Long-Term Outlook

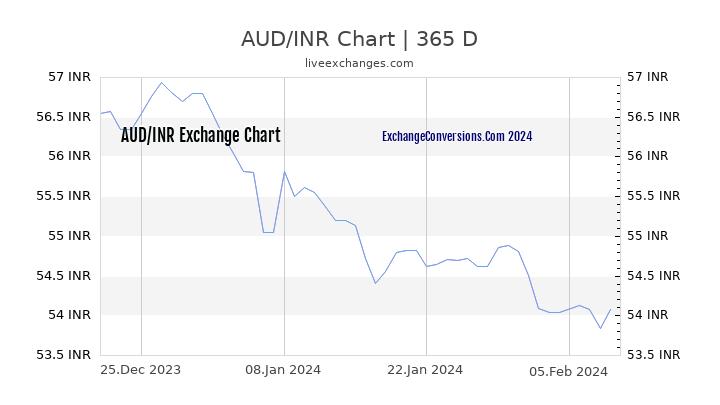

The AUD/INR exchange rate has fluctuated over the years, reflecting changes in the aforementioned economic factors. In recent years, the Australian dollar has generally been stronger than the Indian rupee, with the AUD/INR rate moving within a range of 45 to 55. The long-term outlook for AUD/INR remains influenced by the economic and geopolitical landscape of both countries. Continued economic growth, prudent monetary policies, and stable political environments are likely to support the strength of both currencies.

Image: aud.exchangeconversions.com

Practical Implications for Businesses and Individuals

For businesses, understanding AUD/INR exchange rate movements is essential for effective currency risk management. Importers and exporters can use hedging instruments to mitigate currency volatility and protect their profit margins. Individuals sending remittances or making investments across borders should monitor exchange rate trends to optimize their transactions.

In addition, travelers exchanging currency for travel expenses can benefit from comparing exchange rates offered by different banks and services. By choosing the most favorable exchange rate, travelers can save money and maximize the value of their currency.

Aud To Inr Today Forex Rate

https://youtube.com/watch?v=knfpkdxx_c4

Conclusion

The AUD/INR exchange rate plays a pivotal role in facilitating trade, remittances, and investments between Australia and India. Economic factors such as growth prospects, interest rates, commodity prices, and political stability drive the value of these currencies relative to each other. By understanding the determinants and historical trends of AUD/INR, businesses and individuals can make informed decisions and effectively manage their cross-border financial transactions.