The foreign exchange (forex) market is a global, decentralized marketplace where currencies are traded. The euro (EUR) and the US dollar (USD) are two of the most heavily traded currencies in the world, and the EUR/USD exchange rate is one of the most closely watched currency pairs.

Image: www.dailyfx.com

In recent weeks, the EUR/USD exchange rate has been volatile, as investors have grappled with a number of economic and political uncertainties. The European economy has been slowing down, and the eurozone is facing a number of political challenges, including the ongoing Brexit negotiations and the rise of populist parties. The US economy, on the other hand, has been growing steadily, and the Federal Reserve is expected to raise interest rates in the coming months.

These factors have all contributed to the volatility of the EUR/USD exchange rate. In the next week, we can expect to see continued volatility, as investors continue to assess the economic and political landscape.

Factors Affecting the EUR/USD Exchange Rate

A number of factors can affect the EUR/USD exchange rate, including:

- Economic data: Economic data from both the eurozone and the US can have a significant impact on the EUR/USD exchange rate. For example, strong economic data from the eurozone can boost the value of the euro, while weak economic data from the US can weaken the value of the dollar.

- Political events: Political events can also have a major impact on the EUR/USD exchange rate. For example, the Brexit negotiations have weighed on the value of the euro, and the rise of populist parties in Europe has also created uncertainty.

- Interest rates: Interest rates are another important factor that can affect the EUR/USD exchange rate. When interest rates are high in one country, it can attract investors to that country’s currency. For example, the Federal Reserve is expected to raise interest rates in the coming months, which could support the value of the dollar.

EUR/USD Outlook for the Next Week

In the next week, we can expect to see continued volatility in the EUR/USD exchange rate. The following factors could all have an impact on the exchange rate:

- Economic data: There will be a number of important economic data releases from both the eurozone and the US in the next week. This data could have a significant impact on the EUR/USD exchange rate.

- Political events: There are also a number of political events that could affect the EUR/USD exchange rate in the next week. These events include the Brexit negotiations and the upcoming elections in Italy.

- Interest rates: The Federal Reserve is expected to raise interest rates in the coming months. This could support the value of the dollar.

Overall, we can expect to see continued volatility in the EUR/USD exchange rate in the next week. Investors should be aware of the factors that could affect the exchange rate and adjust their trading strategies accordingly.

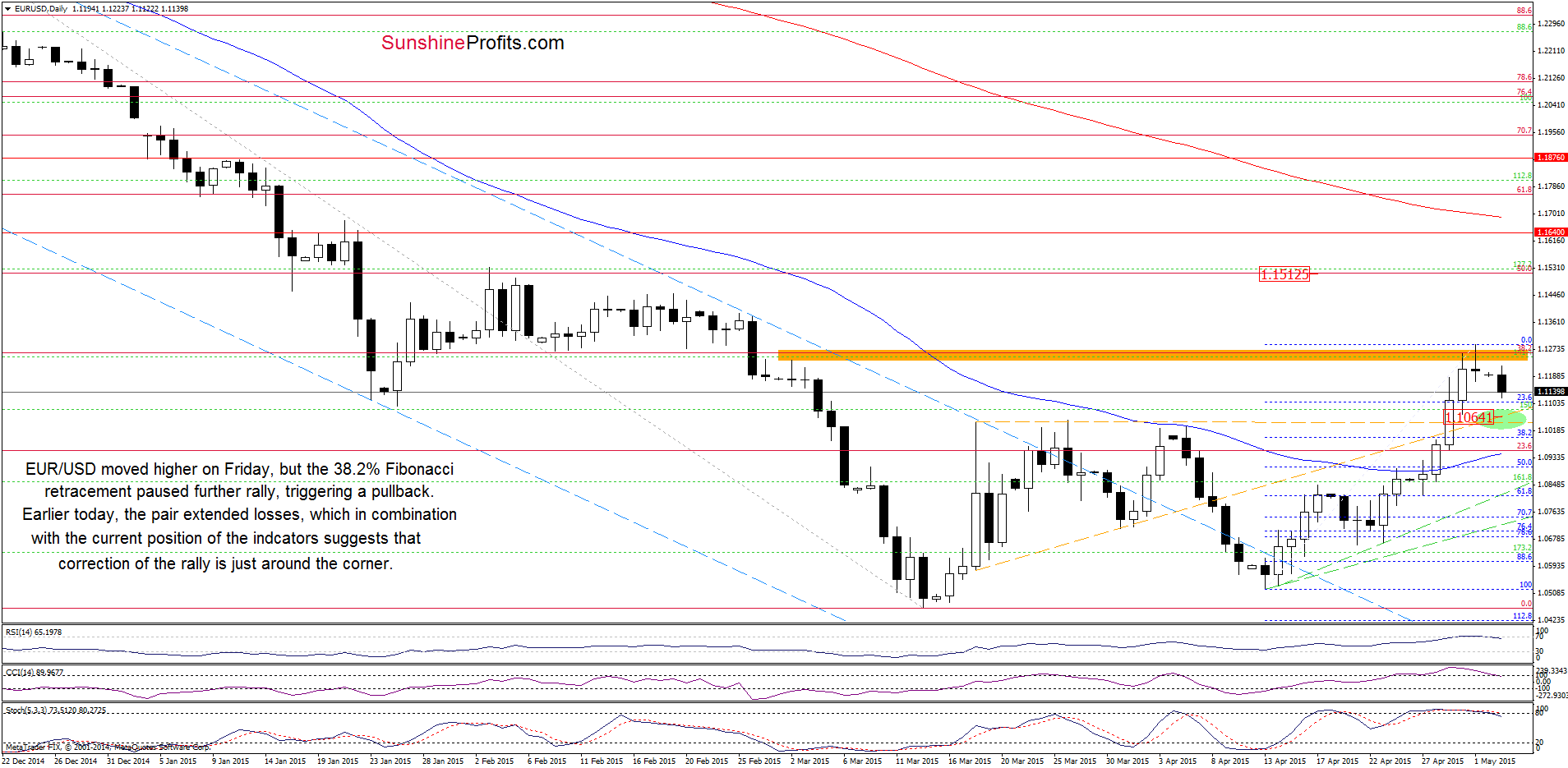

Image: www.sunshineprofits.com

How Will Be Eur Usd Forex In The Next Week

Conclusion

The EUR/USD exchange rate is one of the most heavily traded currency pairs in the world. The exchange rate is affected by a number of factors, including economic data, political events, and interest rates. In the next week, we can expect to see continued volatility in the EUR/USD exchange rate. Investors should be aware of the factors that could affect the exchange rate and adjust their trading strategies accordingly.