The United Kingdom’s decision to leave the European Union, commonly known as Brexit, was a watershed moment in global politics and economics. The consequences of this historic vote have been felt far and wide, not least in the foreign exchange market. In the lead-up to the referendum, numerous forex analysts confidently predicted that a vote to leave would cause the pound sterling to plummet. However, the post-Brexit reality has defied these predictions, leaving many investors wondering what went wrong.

Image: seekingalpha.com

The Doomsday Forecasts

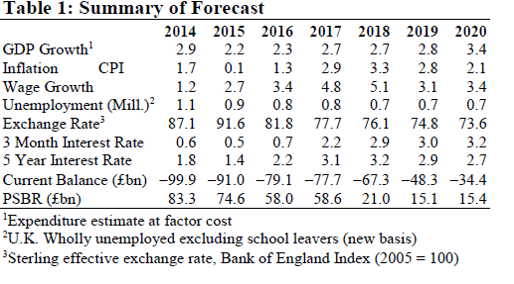

In the months preceding the Brexit referendum, the financial media was awash with dire warnings about the potential impact on the pound. A survey of 57 economists by Bloomberg found that a majority predicted that a vote to leave would result in a fall of at least 10% in the value of the pound against the US dollar. Some analysts went even further, predicting a drop of as much as 20%.

These forecasts were based on the assumption that Brexit would damage the UK economy by reducing trade and investment. With the UK outside the EU’s single market and customs union, businesses would face new barriers to doing business with European partners. This, it was argued, would lead to a loss of economic growth and a decline in the value of the pound.

The Reality

The reality, however, has been very different. In the immediate aftermath of the referendum, the pound did indeed fall sharply. However, it has since recovered most of its losses and is now trading at around the same level it was before the vote.

There are a number of reasons for this unexpected resilience. Firstly, the UK economy has performed better than expected since the referendum. Growth has been positive, unemployment has fallen, and inflation has remained low. This has helped to support the value of the pound.

Secondly, the Bank of England has been quick to respond to the challenges posed by Brexit. The central bank has cut interest rates and increased its quantitative easing program in order to stimulate the economy and support the pound.

Thirdly, the global economy has been relatively strong in recent months. This has helped to boost demand for the pound, as investors seek out safe haven assets.

Lessons Learned

The Brexit forex forecast fiasco serves as a valuable reminder that economic forecasting is a notoriously difficult business. Even the most experienced analysts can get it wrong, and it is important to remember that all forecasts are subject to a degree of uncertainty.

For investors, this means that it is crucial to diversify their portfolios and not put all of their eggs in one basket. It is also important to have a long-term investment horizon, as markets can be volatile in the short term.

Image: www.youtube.com

The Future of Brexit

The future of Brexit remains uncertain. The UK is still negotiating its withdrawal from the EU, and it is unclear what the final deal will look like. However, the resilience of the pound in the face of Brexit suggests that the UK economy is more resilient than many people thought.

Investors should continue to monitor the Brexit negotiations closely, and be prepared to adjust their portfolios accordingly. However, there is no need to panic. The UK economy is in a relatively strong position, and the pound is likely to remain a safe haven asset for investors in the years to come.

Brexit Forecast Forex Wrong Prediction

Conclusion

The Brexit forex forecast fiasco is a cautionary tale about the perils of economic forecasting. However, it is also a reminder that the UK economy is more resilient than many people thought. Investors should continue to monitor the Brexit negotiations closely, but there is no need to panic. The pound is likely to remain a safe haven asset for investors in the years to come.