An Intuitive Look into the Role of the European Central Bank

The European Central Bank (ECB) stands as a pivotal player in the global financial arena, commanding a pivotal role in shaping the economic destiny of the Eurozone. As the monetary authority for the 19 member countries that constitute the European Union, the ECB shoulders the weighty responsibility of steering the Eurozone’s currency, the euro. Its decisions wield far-reaching implications for businesses, consumers, and investors alike.

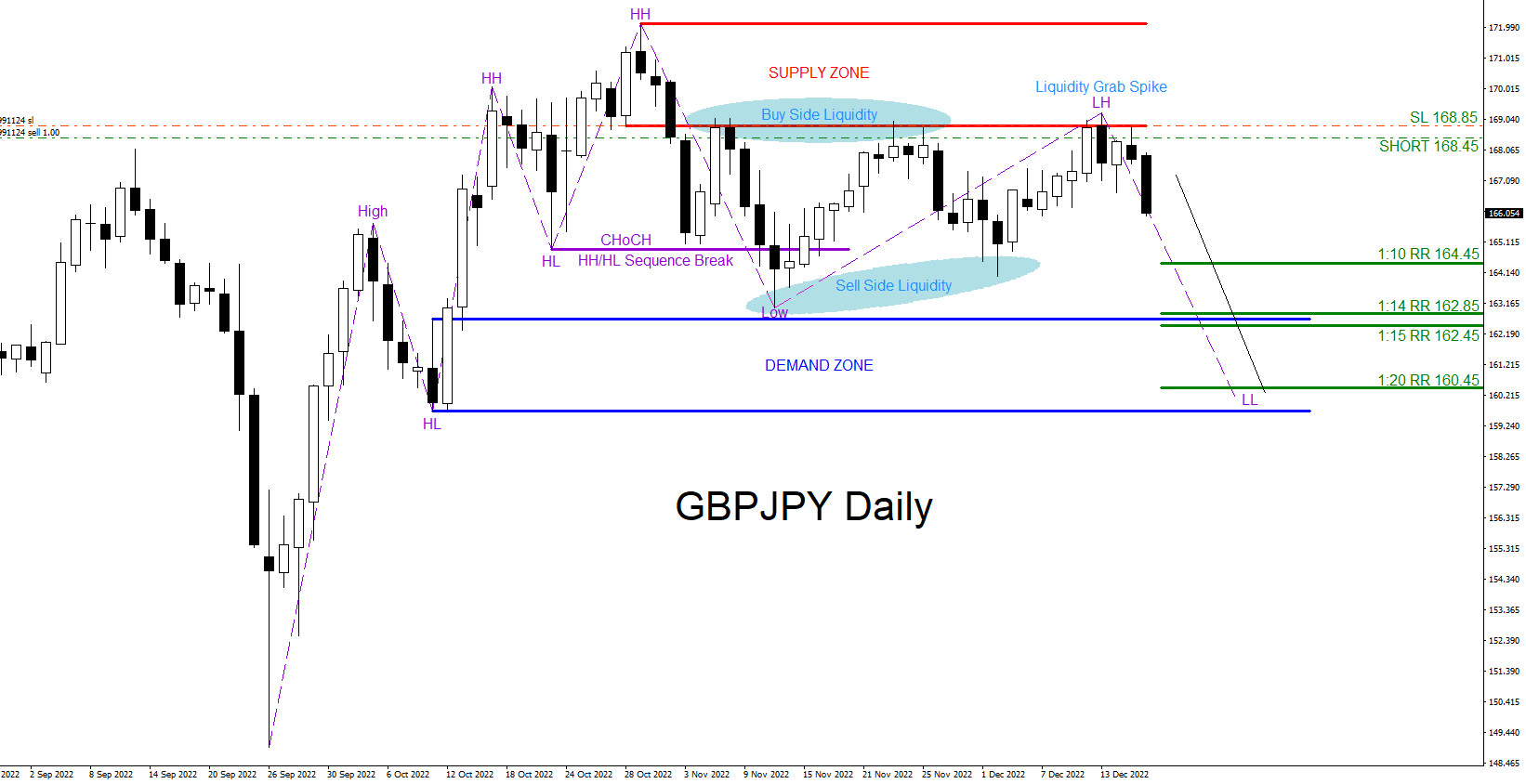

Image: www.forexfactory.com

In this article, we delve into the intricate world of the ECB, shedding light on its genesis, mandate, and the instruments it wields to achieve its objectives. We explore the intricate web of relationships it fosters with other central banks, dissect its impact on the forex markets, and decode the nuanced language it employs to communicate its monetary policy stance.

Genesis of the ECB: A Symphony of European Integration

Conceived in the Treaty on European Union, the ECB emerged as a cornerstone of the broader European integration project. Its creation marked a significant milestone in the Eurozone’s journey towards economic and monetary union, paving the way for the euro’s introduction in 1999. The ECB’s establishment sought to foster price stability, safeguard the euro’s purchasing power, and promote economic growth within the Eurozone.

Mandate: A Trio of Guiding Principles

The ECB’s mandate, as enshrined in the Treaty on the Functioning of the European Union, rests upon a steadfast commitment to price stability, safeguarding the euro’s purchasing power, and promoting economic growth and stability. This Triumvirate of objectives serves as the guiding compass for all its monetary policy decisions.

1. Price Stability: An Unwavering Anchor

Price stability, the ECB’s primary objective, aims to preserve the value of the euro over time, safeguarding consumers and businesses from the adverse effects of inflation. The ECB strives to maintain the harmonized index of consumer prices (HICP) at levels below, but close to, 2% in the medium term. This target provides a stable economic environment, nurturing investment and economic expansion.

Image: www.fxleaders.com

2. Safeguarding the Euro’s Purchasing Power: A Constant Vigil

The ECB holds sacred trust to protect the euro’s purchasing power, underpinning its value against other currencies. Its monetary policy decisions strive to mitigate the risks of excessive appreciation or depreciation of the euro, ensuring stable exchange rates and promoting confidence in the euro as a global reserve currency.

3. Prosperity and Stability: Equitable Growth for All

The ECB’s pursuit of economic growth and stability extends beyond the narrow confines of financial metrics. It seeks to foster an environment conducive to sustainable economic expansion, prioritizing full employment and balanced economic development. By fostering job creation and equitable growth, the ECB contributes to the overall well-being of citizens across the Eurozone.

Monetary Policy Toolkit: Shaping the Eurozone’s Economic Landscape

The ECB wields a diverse array of monetary policy tools to achieve its objectives. These instruments influence the cost and availability of money within the Eurozone, indirectly impacting inflation, economic growth, and the value of the euro. Let’s decipher some of the key tools in the ECB’s arsenal:

1. Interest Rates: A Balancing Act

Interest rates, the cornerstone of monetary policy, play a pivotal role in steering the Eurozone’s economy. The ECB sets key interest rates, influencing the cost of borrowing for businesses and individuals. By raising or lowering interest rates, the ECB can influence economic activity.

2. Open Market Operations: Calibrating Liquidity

Through open market operations, the ECB buys or sells government bonds and other financial assets. By adjusting the supply of money in circulation, the ECB can influence interest rates and liquidity conditions, thus impacting economic growth and stability.

3. Reserve Requirements: Shaping Bank Lending

Reserve requirements, imposed on banks, dictate the amount of funds they must hold in reserve at the central bank. By adjusting reserve requirements, the ECB can influence the amount of money banks have available for lending, thus affecting the cost and availability of credit.

4. Credit Easing: Nurturing Financial Stability

In times of financial stress, the ECB can employ credit easing measures to bolster lending and encourage investment. By providing additional liquidity to banks, the ECB seeks to stimulate economic activity and mitigate the risks of financial instability.

ECB and Other Central Banks: A Tapestry of Cooperation and Interdependence

The ECB’s decisions reverberate beyond the Eurozone’s borders, interacting with the monetary policies of other central banks. Through international cooperation and coordination, central banks strive to maintain global financial stability and economic growth.

1. Cooperation within the Eurosystem

The ECB operates in tandem with the national central banks of the Eurozone, forming the Eurosystem. This collaborative framework ensures a harmonized implementation of monetary policy, fostering financial stability and economic integration within the Eurozone.

2. Global Coordination: A Symphony of Monetary Policies

The ECB actively engages with other major central banks through international organizations like the Bank for International Settlements (BIS) and the G7. These platforms facilitate the exchange of ideas, information, and best practices, fostering global economic stability and preventing disorderly currency movements.

ECB’s Communication: Deciphering the Language of Monetary Policy

The ECB’s communication strategy holds paramount importance in conveying its monetary policy stance and fostering market confidence. It employs a combination of press conferences, speeches, and official statements to articulate its decisions and their rationale.

1. Press Conferences: A Transparent Dialogue

Following each Governing Council meeting, the ECB holds a press conference to elucidate its monetary policy decisions and economic outlook. The ECB President assumes the role of spokesperson, providing insights into the Council’s deliberations and answering questions from journalists.

2. Speeches: A Direct Connection to Markets

ECB officials regularly deliver speeches at conferences and other events, providing their perspectives on economic conditions and monetary policy. These speeches offer valuable insights into the ECB’s thinking and help the markets gauge the central bank’s stance.

3. Official Statements: The Formal Communiqué

The ECB publishes official statements after each Governing Council meeting, outlining its decisions and the rationale behind them. These statements serve as a formal record of the ECB’s monetary policy actions and provide a clear roadmap for future policy direction.

ECB and Forex Markets: A Dynamic Relationship

The ECB’s decisions profoundly impact the foreign exchange (forex) markets, where currencies are traded around the globe. Traders and investors closely monitor the ECB’s monetary policy announcements, seeking to anticipate the potential impact on currency exchange rates.

1. Interest Rate Differentials: A Magnet for Capital Flows

Interest rate differentials between the Eurozone and other economies play a pivotal role in currency movements. Investors are drawn to currencies offering higher interest rates, leading to increased demand and a potential appreciation of the currency. The ECB’s interest rate decisions, therefore, exert a significant influence on the euro’s value relative to other currencies.

2. Inflationary Pressures: A Double-Edged Sword

Inflationary pressures within the Eurozone can have multifaceted effects on the euro’s exchange rate. While higher inflation can erode the currency’s purchasing power, it may also attract investors seeking inflation-linked investments. The ECB’s assessment of inflationary risks and its subsequent monetary policy actions, therefore, influence the euro’s trajectory in the forex markets.

3. Economic Growth Prospects: A Beacon of Confidence

The ECB’s outlook on the Eurozone’s economic prospects can sway investor sentiment and influence currency exchange rates. Optimistic economic projections tend to boost investor confidence in the euro, leading to potential appreciation, while concerns over economic growth can dampen the currency’s allure.

What Is Ecb In Forex

Conclusion: The ECB’s Enduring Legacy and Future Horizons

The European Central Bank stands as a bulwark of monetary stability and economic prosperity within the Eurozone. Its mandate to maintain price stability, safeguard the euro’s purchasing power, and promote economic growth provides a solid foundation for sustainable economic development. Through its diverse monetary policy tools and effective communication strategy, the ECB influences the Eurozone’s financial landscape, fostering trust and confidence in the euro.

As the global economic landscape continues to evolve, the ECB will undoubtedly face new challenges in its quest to fulfill its mandate. Its ability to navigate these challenges and adapt its monetary policy stance accordingly will be critical in ensuring the Eurozone’s continued economic stability and prosperity. The ECB, with its wealth of experience and unwavering commitment to its objectives, stands ready to steer the Eurozone through the ever-changing tides of global finance.