The ever-evolving forex market presents traders with a vast array of currency pairs, each characterized by unique correlations and trading patterns. Among these, the Australian dollar (AUD) and New Zealand dollar (NZD) stand out as closely intertwined currencies, forming a compelling trading opportunity for those seeking diversification and risk management.

Image: backtothefuturetrading.com

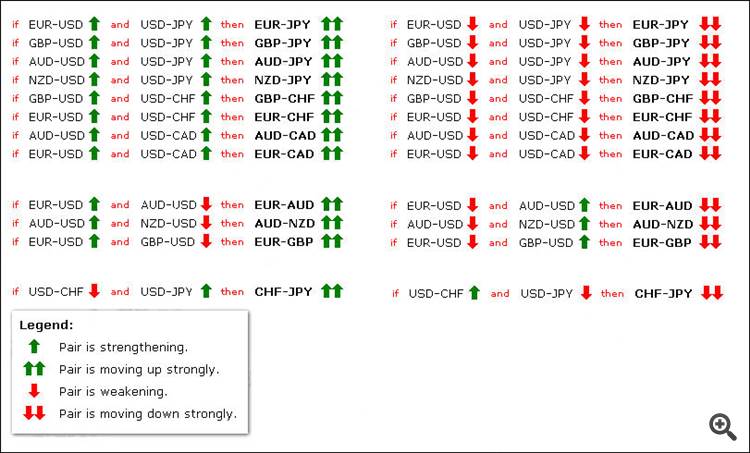

The correlation between AUDUSD and NZDUSD, often referred to as the “Antipodean Connection,” arises from the geographical proximity and shared economic foundations of Australia and New Zealand. Both nations are major exporters of commodities, such as minerals and agricultural products, which subjects their currencies to similar external influences. Additionally, the two economies have historically exhibited high levels of trade and investment, further strengthening their interconnectedness.

Comprehending the correlation between AUDUSD and NZDUSD is crucial for traders seeking to harness the benefits of diversification. Diversification aims to reduce risk by spreading investments across multiple assets that exhibit different performance patterns. By incorporating AUDUSD and NZDUSD into a portfolio, traders can potentially mitigate the impact of market fluctuations on a single currency pair, thereby enhancing overall portfolio stability.

Moreover, knowledge of these correlated pairs can provide valuable insights for currency traders. When AUDUSD and NZDUSD move in the same direction, traders may capitalize on potential opportunities for increased profits. Conversely, when the correlation breaks down and the pairs diverge, it can indicate potential trading discrepancies, offering opportunities for astute traders to exploit market inefficiencies.

To delve deeper into the dynamic relationship between AUDUSD and NZDUSD, let’s explore the factors influencing their correlation:

Economic Data and Central Bank Decisions

Economic data releases, such as GDP growth, inflation rates, and employment figures, can significantly impact the valuations of AUD and NZD. When positive economic data is released for both countries, it typically strengthens both currencies, leading to a positive correlation. Conversely, weak economic data can weaken both currencies, resulting in a negative correlation.

Central bank decisions, particularly interest rate adjustments, can also influence the correlation between AUDUSD and NZDUSD. Interest rate changes affect the relative attractiveness of currencies by altering borrowing and lending costs. When interest rates move in the same direction in both countries, it can reinforce the correlation between the currency pairs.

Commodity Prices

As mentioned earlier, Australia and New Zealand heavily rely on commodity exports for economic growth. Fluctuations in commodity prices, particularly those of gold, coal, and iron ore, can impact the demand for AUD and NZD. When commodity prices rise, both the AUD and the NZD tend to strengthen, enhancing their correlation.

Risk Sentiment and Market Volatility

The overall risk sentiment in the financial markets can also influence the correlation between AUDUSD and NZDUSD. During periods of high risk aversion, investors flock to safe-haven assets, leading to a weakening of both the AUD and the NZD. Conversely, an environment of higher risk appetite tends to bolster both currencies, strengthening their positive correlation.

Image: www.mql5.com

Recent Trends and Trading Strategies

Over time, the correlation between AUDUSD and NZDUSD has demonstrated a range of strengths and weaknesses. In the past decade, the correlation has generally been positive, averaging around 0.75. However, periods of reduced correlation or even negative correlation have occurred during market turmoil or diverging economic circumstances.

Traders seeking to exploit the correlation between AUDUSD and NZDUSD can employ several strategies:

- Carry Trade: This strategy involves borrowing in a low-interest currency (e.g., JPY) and investing in a higher-interest currency (e.g., AUD or NZD). The positive correlation between AUDUSD and NZDUSD can amplify the potential returns on carry trades involving these currencies.

- Hedging: Traders can use the negative correlation between AUDUSD and NZDUSD for hedging purposes. By holding both currency pairs in opposite positions (e.g., long AUDUSD and short NZDUSD), traders can potentially offset potential losses on one pair with gains on the other.

- Correlation Trading: Monitoring the correlation coefficient between AUDUSD and NZDUSD can provide insights for trading opportunities. If the correlation weakens or reverses, traders can adjust their positions to capitalize on potential market inefficiencies.

Forex Correlated Pairs Audusd Nzdusd

Conclusion

The correlation between AUDUSD and NZDUSD offers unique trading opportunities for both diversification and risk management. By understanding the underlying factors that influence this correlation and employing appropriate trading strategies, traders can harness the power of these correlated pairs to achieve their financial goals.

Whether you’re a seasoned trader seeking to expand your portfolio or a novice looking to explore new market dynamics, a thorough understanding of the relationship between AUDUSD and NZDUSD is essential for navigating the complexities of the forex market. Utilize the insights provided in this article to empower your trading decisions and unlock the potential of forex correlated pairs.