Introduction

Embarking on a journey into the world of forex trading can be both exhilarating and daunting, especially for novice traders. Navigating through the complex landscape of currency markets requires a solid understanding of various factors, one of which is leverage. Understanding leverage’s role and its optimal application for beginners is crucial for unlocking the potential for profitability while mitigating risks. This comprehensive guide delves into the complexities of leverage, providing a clear and practical roadmap for forex beginners to make informed decisions and establish a foundation for successful trading.

Image: www.fxstreet.com

Defining Leverage: A Double-Edged Sword

In its essence, leverage refers to utilizing borrowed capital or funds to amplify the potential returns on an investment. In the context of forex trading, leverage allows traders to control a larger position size than their account balance would permit. While this magnifies profit opportunities, it also intensifies potential losses, rendering leverage a double-edged sword. Understanding the mechanics and prudent application of leverage is paramount for forex beginners to harness its benefits while effectively managing risks.

Optimal Leverage for Beginners: Striking a Balance

For novice traders, the optimal leverage ratio depends on several factors, including risk tolerance, trading strategy, and market conditions. A general rule of thumb suggests that beginners should start with a low leverage ratio, typically ranging from 1:10 to 1:50. This conservative approach allows for gradual learning and acclimatization to the dynamics of forex trading before venturing into higher leverage territories. It is worth noting that some regulated brokers may impose lower leverage limits for retail traders to safeguard against excessive risk-taking.

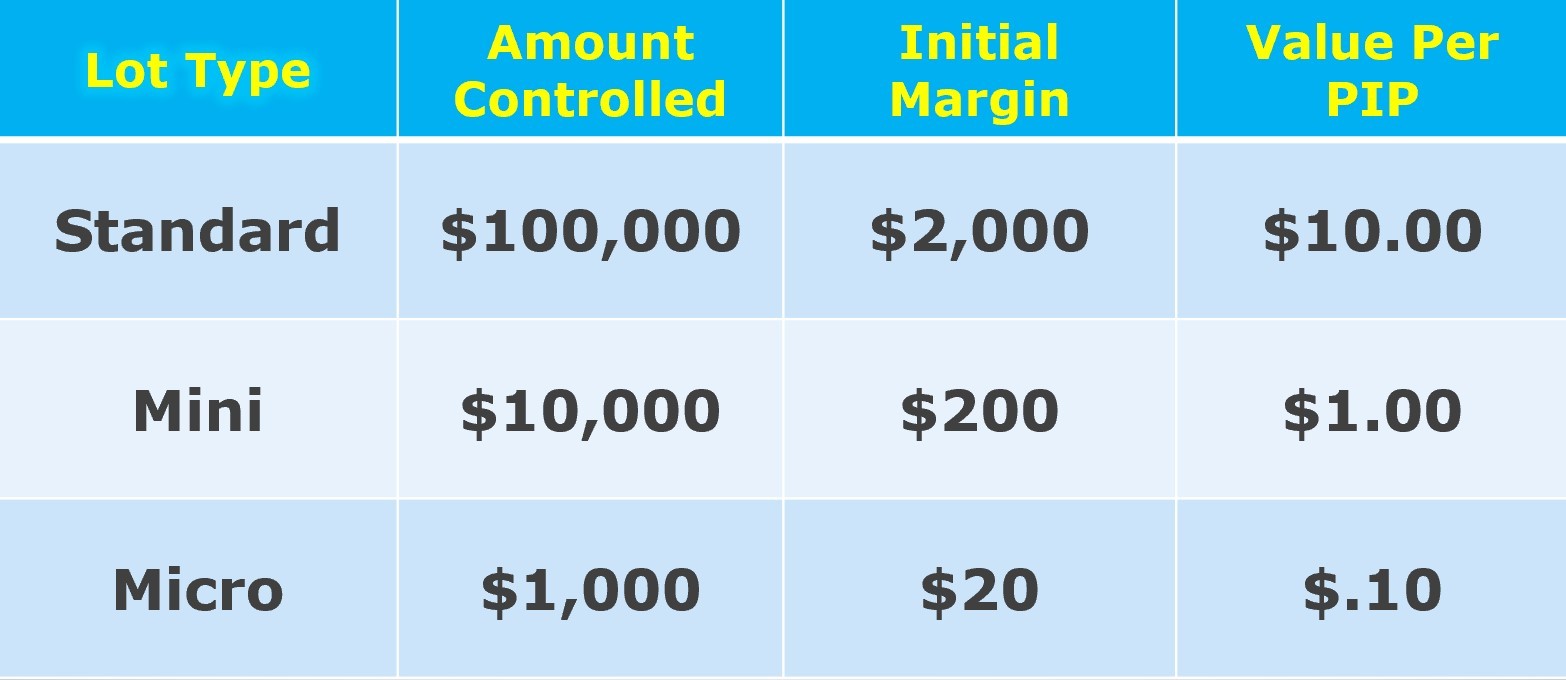

Understanding the Mechanics of Leverage: A Real-World Example

To illustrate the practical implications of leverage, consider a scenario where a trader with a $1,000 account balance uses a 1:10 leverage ratio. This implies that the trader can control a position worth up to $10,000, ten times their initial capital. A 1% price movement in their favor would yield a $100 profit, an amount that would have taken $1,000 to earn without leverage. Conversely, a 1% adverse price movement would result in a $100 loss.

Image: invspe.blogspot.com

Benefits and Considerations of Leverage for Beginners

Leverage offers enticing benefits, particularly for beginners with limited capital. By magnifying trading positions, leverage can accelerate profit accumulation. However, it is crucial to approach leverage with a measured and prudent mindset, considering both its advantages and potential drawbacks. The following points elaborate on the benefits and considerations associated with leverage utilization:

Benefits:

- Magnified Profits: Leverage amplifies both gains and losses, potentially accelerating wealth accumulation.

- Efficient Capital Utilization: Traders can control larger positions with less capital outlay, maximizing potential returns on investment.

- Flexibility and Versatility: Leverage allows traders to adapt to changing market conditions and fine-tune their trading strategies accordingly.

Considerations:

- Heightened Risk: Magnified profits also translate into amplified losses, intensifying the financial impact of adverse market movements.

- Margin Calls: If losses exceed the trader’s account balance, a margin call may occur, requiring additional funds to maintain the position. Failure to meet a margin call can result in forced liquidation of positions.

- Psychological Impact: Unwise use of leverage can lead to overconfidence and reckless trading, potentially resulting in substantial financial losses.

Risk Management Strategies for Forex Beginners

Effective risk management is the cornerstone of successful forex trading, and leverage plays a pivotal role in this regard. Here are some crucial risk management strategies for forex beginners:

- Predefined Leverage Limits: Establish明確的槓桿限制並始終遵守它們,以避免過度風險。

- Stop-Loss Orders: 自動獲利和止損單有助於限制損失,防止重大回撤對帳戶餘額造成毀滅性影響。

- Position Sizing: 根據槓桿率和風險承受度明智地確定頭寸規模,避免過度暴露。

- Hedging Techniques: 通過使用對沖技術,可以降低特定交易或整體投資組合的風險。

Trading Psychology: Controlling Emotions and Mitigating Risks

The psychological aspect of forex trading cannot be overstated, and leverage can significantly influence a trader’s emotional state. Maintaining a level-headed and disciplined approach is paramount to making sound trading decisions and managing risks effectively. Here are some psychological factors to consider:

- Fear and Greed: Leverage can exacerbate fear and greed, leading to impulsive decisions that can have detrimental consequences.

- FOMO (Fear of Missing Out): The desire to capitalize on perceived opportunities may lead traders to overextend their leverage, increasing their exposure to risk.

- Discipline and Patience: Successful forex trading requires discipline and patience, which are especially crucial when utilizing leverage.

Best Leverage For Forex Beginner

Conclusion

Understanding the optimal leverage for forex beginners is essential for maximizing profit potential while effectively managing risks. Conservative leverage ratios, prudent risk management strategies, and a controlled emotional state lay the foundation for a successful trading journey. By embracing a disciplined and measured approach to leverage, novice traders can harness its benefits and navigate the complexities of forex trading with greater confidence.