Have you ever felt the thrill of watching currency exchange rates fluctuate in real-time? The AUD/USD currency pair, representing the Australian dollar against the US dollar, is a popular choice for traders of all experience levels. It’s known for its volatility, offering the potential for substantial profits but also the risk of significant losses.

Image: elliottwave-forecast.com

Navigating this dynamic market requires a well-defined strategy, a deep understanding of the underlying factors that influence its movement, and the ability to remain calm under pressure. This comprehensive guide will equip you with the knowledge and tools necessary to become a confident AUD/USD trader, empowering you to make informed decisions and potentially generate significant returns.

Unveiling the Secrets of AUD/USD Trading

The AUD/USD currency pair, often referred to simply as “Aussie Dollar,” is a highly liquid and volatile market, reflecting the economic relationship between Australia and the United States. Understanding the factors that influence its direction is paramount for successful trading.

Key Factors Driving AUD/USD Movement:

- Australian Interest Rates: When the Reserve Bank of Australia (RBA) raises interest rates, it makes the Australian dollar more attractive to foreign investors seeking higher returns, leading to an increase in demand for AUD and strengthening its value against USD.

- Commodity Prices: Australia is a major exporter of commodities, particularly iron ore and coal. When commodity prices rise, it boosts demand for AUD, strengthening its value. Conversely, declining commodity prices weaken the Australian dollar.

- US Economic Performance: The US dollar is considered a safe-haven currency. During times of global uncertainty, investors tend to shift their assets towards the US dollar, weakening the AUD/USD exchange rate.

- Global Risk Sentiment: Shifts in global risk sentiment can impact the AUD/USD pair. When investors are optimistic about the global economy, the AUD, considered a risk-on currency, tends to appreciate against the US dollar.

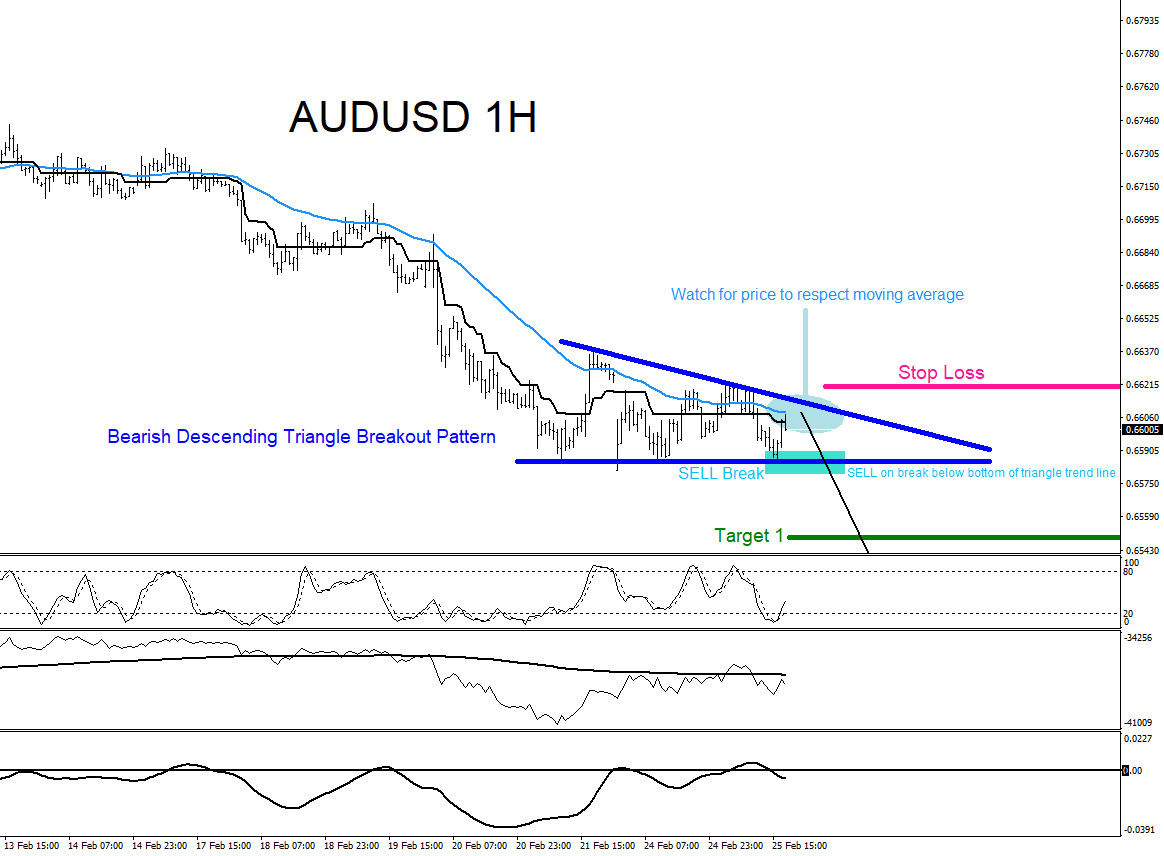

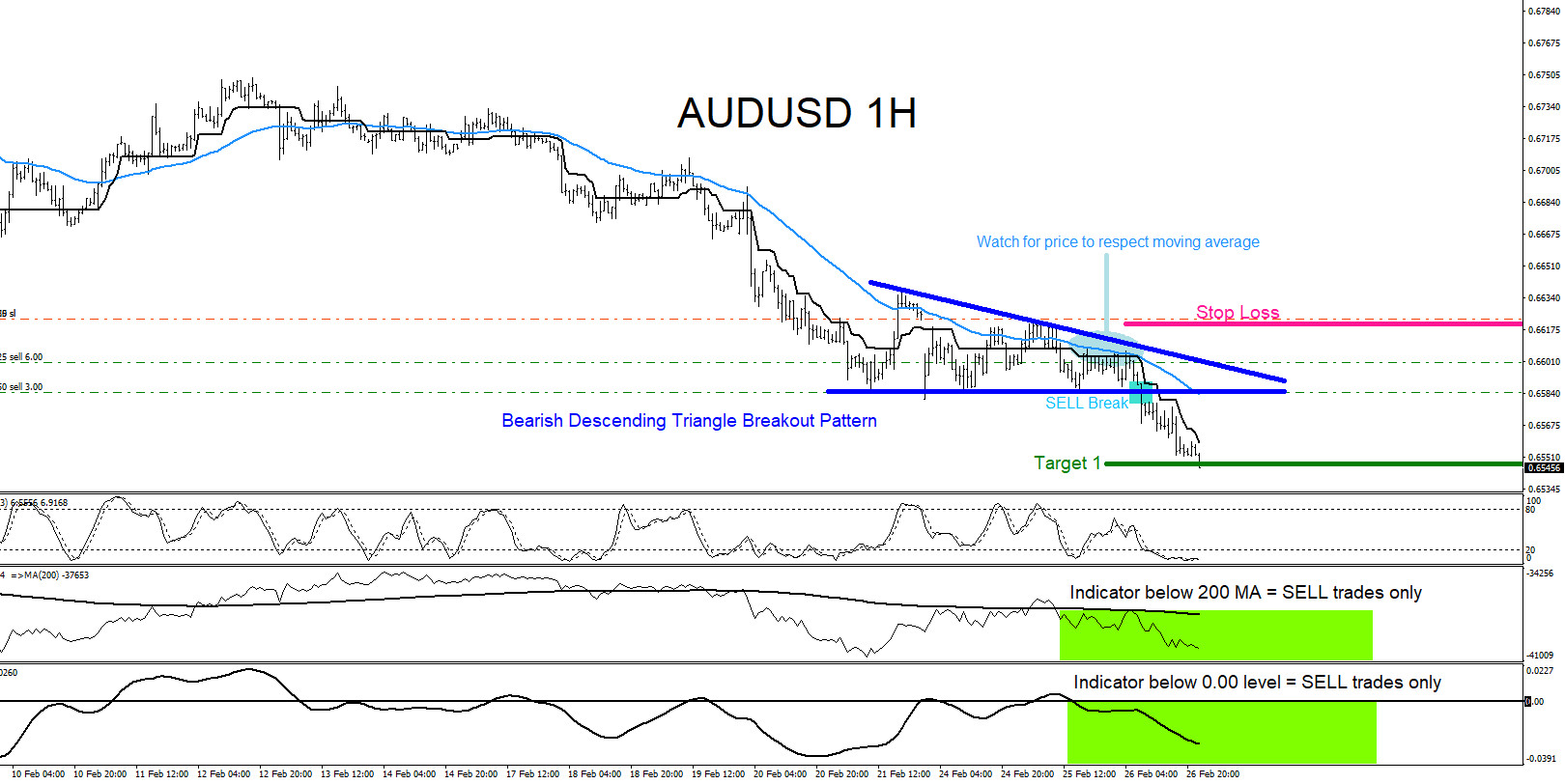

Decoding Technical Analysis for AUD/USD:

Technical analysis plays a crucial role in understanding the behavior of the AUD/USD market. This method involves studying price charts and other market data to identify patterns and trends that can help predict future price movements.

- Support and Resistance Levels: These are specific price levels where the AUD/USD pair has historically shown resistance to moving further up or down. Identifying these levels can help determine potential entry and exit points for trades.

- Moving Averages: These are calculated by averaging the closing prices over a specific period, providing a smoother representation of price trends. Traders often use moving averages to determine potential buy or sell signals.

- Relative Strength Index (RSI): This momentum oscillator measures the magnitude of recent price changes to evaluate overbought and oversold conditions.

Example: A rising RSI above 70 indicates that the AUD/USD pair is overbought and may be due for a correction. Conversely, an RSI below 30 suggests oversold conditions, potentially indicating a bullish reversal.

Image: elliottwave-forecast.com

Navigating Fundamental Analysis of AUD/USD:

While technical analysis focuses on price action, fundamental analysis delves into economic factors that can influence the AUD/USD exchange rate.

- Economic Reports: Monitoring key economic indicators, such as GDP growth, inflation rates, unemployment figures, and trade balances, provides insights into the health of the Australian and US economies. Positive economic data tends to strengthen the AUD.

- Political Events: Political developments in Australia and the US can also impact the AUD/USD pair. For instance, policy changes, elections, or geopolitical tensions can create volatility in the market.

- Central Bank Statements: Statements from the RBA and the Federal Reserve (Fed) often provide valuable insights into future monetary policies, potentially impacting exchange rates.

Example: If the RBA signals a hawkish stance by hinting at potential future interest rate hikes, it could strengthen the AUD/USD pair as investors anticipate higher returns from investing in Australian assets.

Expert Tips for Successful AUD/USD Trading:

- Start with a Demo Account: Practice your strategies and gauge your risk tolerance in a simulated trading environment before committing real capital.

- Develop a Trading Plan: Define your trading objectives, risk management strategy, and entry and exit points for trades to ensure disciplined trading.

- Master Risk Management: Never risk more than you can afford to lose. Employ stop-loss orders to limit potential losses on individual trades.

- Stay Informed: Keep up-to-date on economic news, central bank statements, and market developments to make informed trading decisions.

- Seek Guidance from Experienced Traders: Consider consulting with professional traders or joining trading communities to learn from their expertise.

Audusd Trading View

Conquering the Waves: Your Journey Begins Now

Navigating the AUD/USD currency market requires a combination of knowledge, discipline, and a keen understanding of the factors that influence its movements. By mastering technical and fundamental analysis, developing a sound trading plan, and practicing responsible risk management, you can position yourself for success in this dynamic market. Remember, patience, discipline, and continuous learning are key to achieving consistent profits and riding the waves of the AUD/USD trading landscape.

Call to Action: Take charge of your trading future. Start with a demo account today and explore the world of AUD/USD trading. Embrace the learning journey and let your passion for currency markets propel you towards financial gains. Join the community of traders and share your experiences, insights, and challenges as you embark on this exciting trading adventure.