In the world of fast-paced financial markets, understanding the nuances of trading fees is crucial for maximizing profitability and mitigating risks. One essential aspect to grasp is the concept of all-day swap charges in forex trading. For both novice and experienced traders alike, navigating these charges can be a game-changer for both short-term and long-term trading strategies.

Image: walletinvestor.com

Defining All-Day Swap Charges: A Cornerstone of Informed Trading

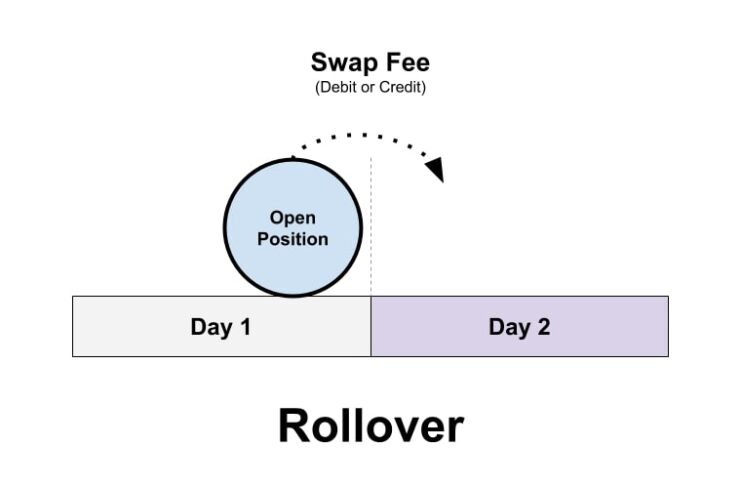

An all-day swap charge, also known as a rollover fee, arises due to the time value of money in forex transactions. When you hold a position overnight, the interest rate differential between the two currencies being traded must be taken into account. The calculation of the swap charge is determined by the difference between the two interest rates multiplied by the notional value of the position and the number of days the position is held.

Understanding the impact of all-day swap charges is particularly important for traders who engage in carry trading or overnight positions. Carry trading involves profiting from interest rate differentials by borrowing one currency with a lower interest rate and investing in another with a higher interest rate. For instance, if you buy the Australian dollar (AUD) against the Japanese yen (JPY) and the AUD has a higher interest rate than JPY, you may benefit from the positive carry or swap charge. Conversely, if the JPY has a higher interest rate than the AUD, you may incur a negative carry or swap charge.

Breaking Down the Mechanics: Demystifying Swap Charge Calculations

The formula for calculating an all-day swap charge is:

Swap Charge = (Notional Value Interest Rate Differential) Number of Days

The notional value refers to the underlying currency in the currency pair being traded, the interest rate differential represents the difference in interest rates between the two currencies, while the number of days signifies the duration for which the position is held.

To understand this better, let’s consider an example. Suppose you hold a long position of 100,000 units of EUR/USD with a notional value of 100,000 euros. Additionally, assume that the EUR interest rate is 1% and the USD interest rate is 0.5%. The calculation would be:

Swap Charge = (100,000 (1% – 0.5%)) 1

Swap Charge = 50 euros

This calculation implies that for holding the position overnight, you would receive a swap charge of 50 euros.

Expert Insights: Leveraging All-Day Swap Charges for Strategic Advantage

Acknowledging the dynamics of all-day swap charges empowers traders to make strategic decisions and potentially improve their trading outcomes. Seasoned industry experts emphasize considering these charges when determining entry and exit points, as well as position sizing.

For instance, if you anticipate a positive interest rate differential, you may hold positions overnight or even extend the position over numerous days to maximize the potential carry. In contrast, if you expect a negative interest rate differential, adjusting your trading strategy by closing positions before the swap reset time may be beneficial to minimize potential losses.

Image: pipsedge.com

Navigating All-Day Swap Charges with Confidence: Essential Tips for Traders

-

Stay Vigilant: Pay keen attention to interest rate announcements and economic events that could influence interest rate differentials.

-

Calculate Accurately: Utilize online calculators or trading platforms to precisely determine swap charges before entering trades.

-

Be Disciplined: Maintain strict trading discipline by setting clear entry and exit points considering swap charges.

-

Embrace Transparency: Opt for brokers that disclose swap charges upfront and provide transparent trading conditions.

-

Seek Knowledge: Continuously expand your knowledge of all-day swap charges and their implications in different market conditions.

All Day Swap Charges Of Forex

Conclusion: Empowering Traders with Clarity and Control

Understanding all-day swap charges is essential for making informed trading decisions, particularly when holding positions overnight or engaging in carry trading. By breaking down the mechanics, utilizing expert insights, and following practical tips, traders can harness these charges to maximize profitability and optimize risk management strategies. Mastering all-day swap charges empowers traders with the clarity, control, and confidence needed to navigate the complexities of the forex market effectively.