As an ardent forex trader, I’ve had my fair share of triumphs and tribulations. One of the most significant challenges I faced early on was the enigmatic world of swap fees. These seemingly innocuous charges can stealthily erode your profits or amplify your losses, leaving you bewildered and frustrated.

Image: quantmatter.com

In this comprehensive guide, I’ll take you on a journey through the intricacies of swap fees, empowering you with the knowledge to avoid these forex market pitfalls and maximize your trading strategy. Let’s dive into the heart of this topic.

Unveiling Swap Fees: A Forex Enigma

Swap fees, also known as rollover fees or overnight financing charges, emerge when you hold a forex position open overnight. They represent the interest rate differential between the two currencies you are trading. In other words, it’s the cost of borrowing one currency to fund a position in the other.

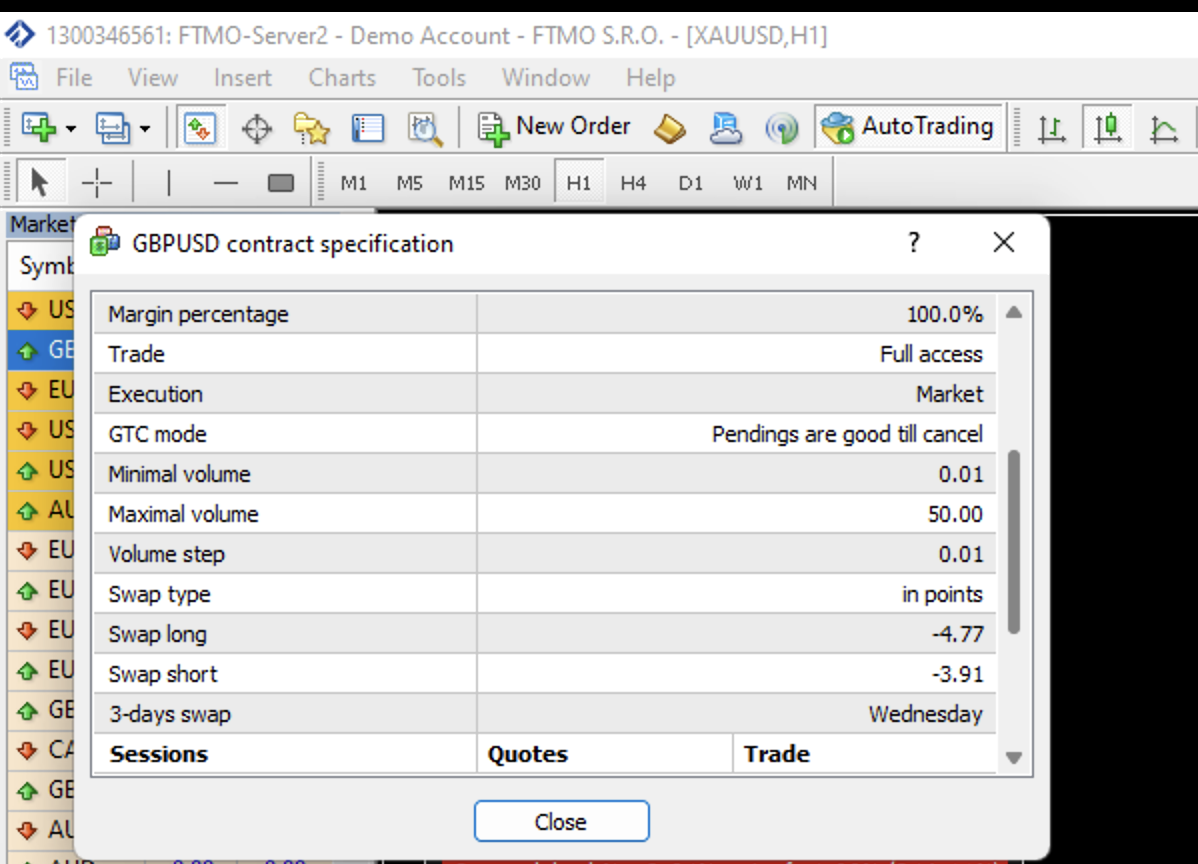

Forex traders should be aware that swap fees can vary greatly depending on the currency pair traded, the broker you use, and the prevailing market conditions. It’s crucial to factor in these fees when calculating your trading strategy, as they can significantly impact your bottom line.

The Mechanics of Swap Fee Calculation

Understanding how swap fees are calculated is essential for managing their impact. The calculation formula typically involves the following elements:

- Trade size: The number of units of the base currency being traded.

- Swap rate: The interest rate differential between the two currencies.

- Holding period: The number of days the position is held open overnight.

The swap fee is then calculated by multiplying the trade size by the swap rate and the holding period. The result is the amount that will be debited or credited to your trading account.

Exploring the Significance of Swap Rates

Swap rates play a pivotal role in determining the swap fees you’ll incur. They reflect the prevailing interest rate differentials between currencies, indicating the cost of borrowing one currency relative to the other.

Currencies with higher interest rates will generally have positive swap rates, indicating that you’ll receive a positive adjustment on your trading account when holding positions overnight in these currencies. Conversely, currencies with lower interest rates typically have negative swap rates, resulting in you paying a fee to hold these positions overnight.

Image: creative-currency.org

Strategies to Bypass the Swap Fee Maze

Now that you have a firm grasp of swap fees, let’s explore some strategies to minimize or avoid them altogether:

- Trade during regular market hours: Swap fees are typically applied at the end of each trading day. By closing your positions before the market closes, you can sidestep these charges.

- Choose currency pairs with low swap rates: Research different currency pairs and select those with minimal swap rate differentials.

- Use a forex broker that offers competitive swap rates: Not all brokers are created equal. Compare swap rates offered by different brokers to find the most favorable terms.

Investing in Education and Collaboration

Education is a powerful tool in the forex market. Seek out educational resources, attend webinars, and engage with other traders in online forums and social media platforms to stay abreast of the latest insights and trading strategies.

Collaborating with experienced traders can also be invaluable. Consider joining trading groups or mentorship programs to gain access to their knowledge and expertise.

FAQs: Addressing Forex Swap Fee Conundrums

- Q: Are swap fees always negative?

A: No, swap fees can be positive or negative depending on the interest rate differential between the two currencies being traded. - Q: How do I determine the swap rate for a specific currency pair?

A: Swap rates can be obtained from your forex broker or calculated using online tools. - Q: Can I negotiate swap fees with my broker?

A: In some cases, you may be able to negotiate swap rates with your broker, especially if you are a high-volume trader.

How To Avoid Swap Fees Forex

Conclusion: Master the Art of Swap Fee Avoidance

Understanding and managing swap fees is an integral aspect of successful forex trading. By employing the strategies outlined in this guide, you can minimize these costs and maximize your profit potential.

Remember, the forex market is a dynamic and ever-evolving landscape. Stay informed about swap fee policies, embrace education, and don’t hesitate to seek guidance from experienced traders. By doing so, you’ll equip yourself with the knowledge and skills to navigate the complexities of swap fees and emerge as a confident and profitable forex trader.

Are you ready to embark on your journey to conquer swap fees and unlock the full potential of the forex market? Share your experiences, questions, and insights in the comments below. Together, let’s master the art of forex trading and achieve financial freedom.