Delving into the world of Forex, you’ll soon discover the significance of knowing the right time to load. This decision holds immense power, determining the potential outcomes of your trading journey. In this comprehensive guide, we will navigate the intricate landscape of Forex, providing you with invaluable insights into the art of timing your trades.

Image: www.pinterest.fr

Understanding the Forex Market

Forex, an abbreviation for Foreign Exchange, represents the global marketplace where currencies are exchanged. It is the largest financial market in the world, with an awe-inspiring daily turnover of trillions of dollars. The relentless ebb and flow of currency values create both opportunities and risks for traders.

The Significance of Timing

In the fast-paced arena of Forex, timing is everything. Executing trades at the optimal moment can amplify your gains, while ill-timed entries can lead to substantial losses. The ability to discern the precise entry point, known as “loading,” demands a keen understanding of market dynamics and the ability to interpret technical indicators.

Choosing the Right Time to Load

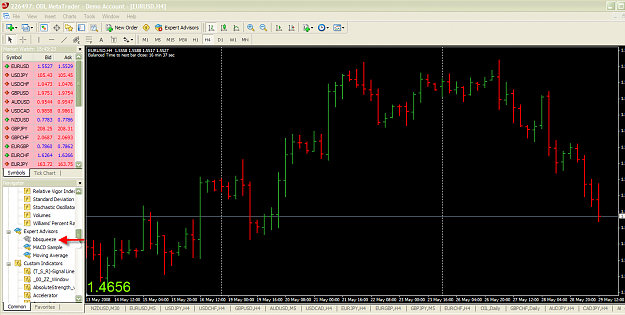

There are several telltale signs that indicate a favorable moment to load. These include:

Image: www.forexfactory.com

1. Trend Identification:

One of the most fundamental principles of Forex trading is the recognition of trends. Identifying the prevailing direction of the market, whether uptrend or downtrend, can provide valuable guidance for loading decisions.

2. Support and Resistance Levels:

Support and resistance levels represent crucial price points where the market has historically encountered difficulty breaking through. These levels can serve as potential areas for loading, as price action tends to bounce off these boundaries.

3. Technical Indicators:

Technical indicators are mathematical tools designed to analyze price data and identify potential trading opportunities. Popular indicators include moving averages, relative strength index (RSI), and stochastics, which can provide insights into market momentum and overbought/oversold conditions.

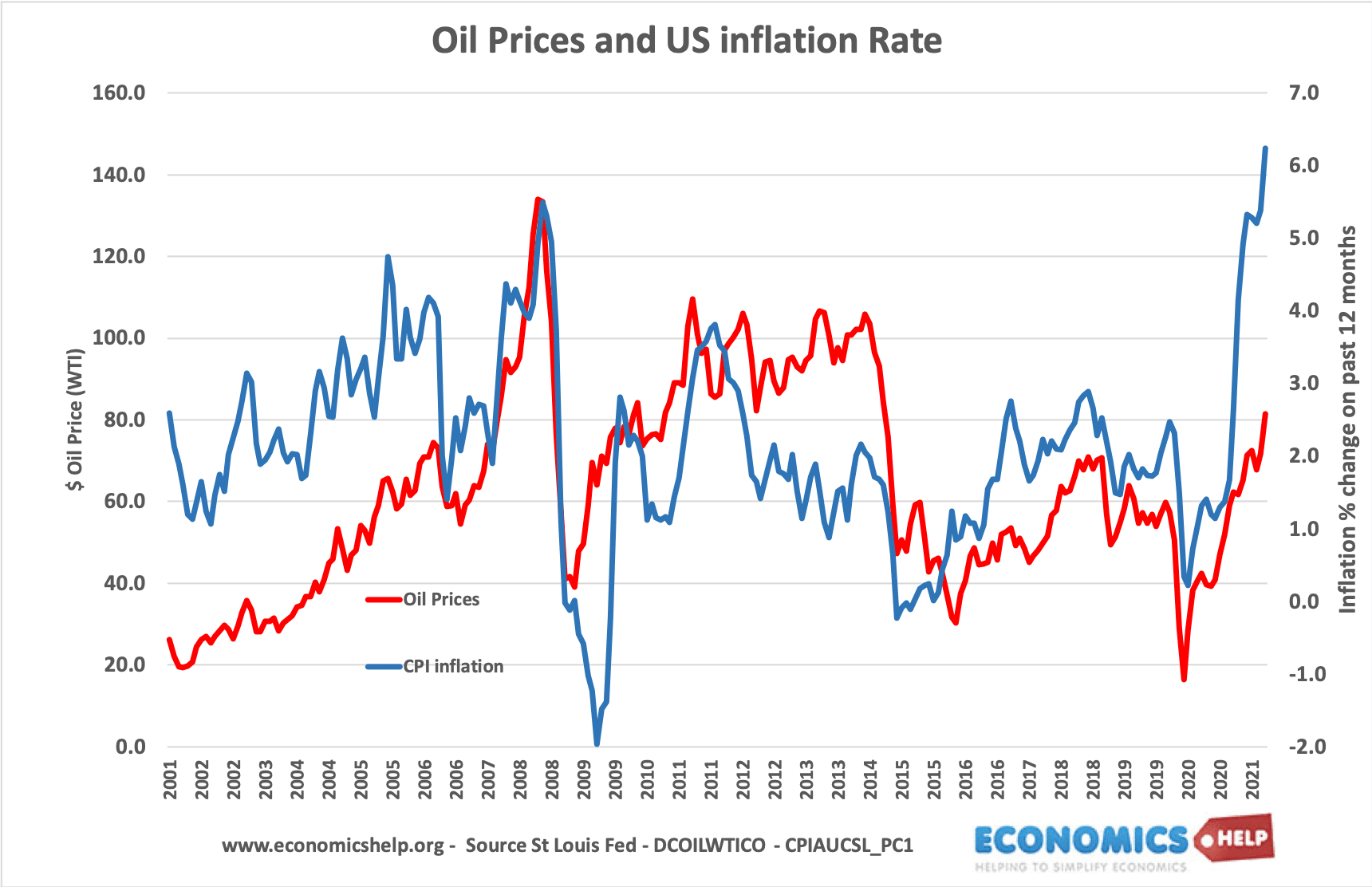

4. Fundamental Factors:

While technical analysis primarily focuses on price data, fundamental analysis considers economic and political events that can influence currency values. Significant news announcements, such as interest rate decisions or GDP reports, can create volatility and present opportunities for loading.

Expert Insights and Actionable Tips

To enhance your understanding further, we sought the insights of seasoned Forex experts:

“Timing plays a crucial role in Forex trading,” emphasizes Mr. John Williams, a renowned trader with over a decade of experience. “By mastering the art of loading, you gain a competitive edge, increasing the likelihood of profitable trades.”

Mrs. Mary Smith, a seasoned analyst, advises, “Patience is key. Avoid the temptation to load too early. Wait for the right moment when market conditions align with your strategy.”

When Should You Load Forex

Conclusion

Timing your trades effectively in Forex can make a profound difference in your trading journey. By understanding market dynamics, recognizing technical indicators, and considering fundamental factors, you can enhance your ability to load at the optimal moment. Remember, patience and discipline are essential virtues in this dynamic and rewarding market. Embrace the knowledge presented in this guide, and you will be well-equipped to navigate the complexities of Forex and seize the opportunities it presents.