Introduction:

Image: planbtutor.com

The currency market, commonly known as Forex, is the largest financial market in the world, where trillions of dollars are exchanged daily. For those seeking financial freedom and the potential for substantial returns, understanding the basics of the Forex system is crucial. In this comprehensive guide, we will delve into the inner workings of Forex, empowering you with the knowledge to navigate this dynamic and potentially lucrative market.

Understanding Forex Basics:

Forex is a decentralized global marketplace where currencies are traded in pairs, with one currency being bought and another sold simultaneously. Each currency pair is represented by a three-letter code, the first two letters representing the base currency and the third letter representing the counter currency. For example, EUR/USD indicates that the Euro (EUR) is being purchased against the US Dollar (USD).

The value of a currency pair is constantly fluctuating, influenced by a multitude of factors such as economic data, political events, and market sentiment. Traders speculate on these price movements, buying or selling currency pairs in anticipation of future appreciation or depreciation.

How the Forex System Works:

The Forex market operates 24 hours a day, five days a week, with trading taking place in various financial centers around the globe. Traders can access the market through online brokerages, which provide platforms for executing trades and accessing market information.

When a trader enters a trade, they are essentially making a contract with another trader to exchange a certain amount of one currency for another at a specified price. This price is determined by the market and can change rapidly, creating both opportunities for profit and potential for loss.

Leveraging and the Power of Margin:

One of the key features of Forex trading is the use of leverage, which allows traders to control a larger amount of capital than their initial investment. This can magnify potential returns but also increases the risk of significant losses. Margin, expressed as a ratio, determines the amount of leverage a trader can utilize.

Managing Forex Risks:

Forex trading, like any other investment, carries inherent risks. To mitigate these risks, traders employ various risk management strategies, including setting stop loss orders to limit potential losses, using protective stop limits, and diversifying their portfolio by trading multiple currency pairs.

Expert Insights and Practical Tips:

To enhance your understanding of the Forex system, consider the following expert insights:

- “Technical analysis is an essential tool to predict price movements, but it should be used in conjunction with fundamental analysis.” – John Bollinger, renowned technical analyst

- “The best Forex traders are those who can control their emotions and trade with discipline.” – Alexander Elder, expert trader and author

- “Stay informed about economic and political news as these events can significantly impact currency prices.” – George Soros, legendary investor

Conclusion:

Navigating the Forex market requires a deep understanding of its basic principles and a commitment to continuous learning. By embracing the guidance provided in this comprehensive guide, aspiring traders can equip themselves with the knowledge and strategies to unlock the potential for financial freedom and grow their wealth through the dynamic world of Forex.

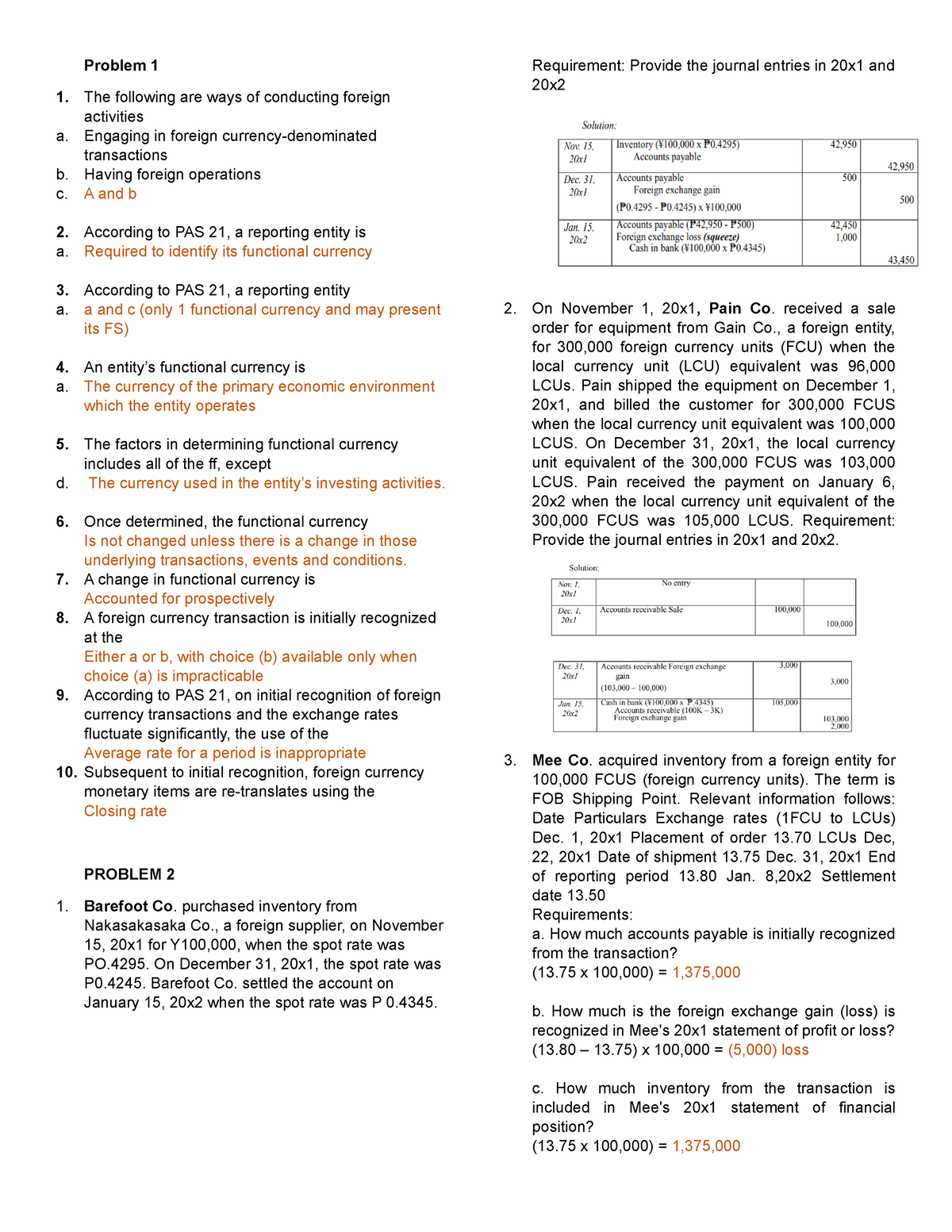

Image: www.studocu.com

Add Comment Basic Principle Of Forex System Work Blogspots