Understanding the Core Concept of NOP

In the dynamic world of forex trading, comprehending the intricacies of various terminologies and metrics is crucial for navigating the market effectively. One such significant concept is the Net Open Position (NOP), which holds immense importance in managing risk and optimizing trading strategies. NOP represents the total amount of exposure a trader has in the market at any given point in time. By calculating the difference between the number of units bought and sold for each currency pair being traded, traders can determine their overall position.

Image: calculator.academy

NOP’s Role in Risk Management

Understanding one’s NOP is essential for prudent risk management. Forex trading involves inherent risks, and NOP serves as a quantifiable measure of the potential loss a trader might face if the market moves against their position. By monitoring their NOP, traders can adjust their strategies accordingly to mitigate risk and protect their capital. For instance, suppose a trader has a positive NOP, indicating a net long position. In such a scenario, a significant drop in the currency pair’s value could result in substantial losses. Therefore, recognizing and managing NOP enables traders to make informed decisions, such as reducing their exposure or adjusting stop-loss levels.

NOP’s Significance in Strategy Optimization

NOP plays a pivotal role in optimizing trading strategies. Skilled traders frequently employ multiple trading strategies simultaneously, each with its own set of entry and exit points. By calculating the NOP for each strategy, traders can gauge the overall risk-to-reward ratio and make informed decisions about allocating their capital. This comprehensive understanding empowers traders to identify underperforming strategies and allocate their resources more effectively, maximizing their trading results.

NOP Calculation: A Step-by-Step Guide

Calculating NOP is a straightforward process that involves understanding the trader’s net exposure in each currency pair. Here’s a step-by-step guide to help you determine your NOP:

• Step 1: Identify the Number of Units Bought and Sold

For each currency pair being traded, determine the number of units bought and the number of units sold.

• Step 2: Calculate the Net Position

Subtract the number of units sold from the number of units bought for each currency pair. This will provide you with the net position for each pair.

• Step 3: Sum the Net Positions

Add up the net positions for all currency pairs being traded. The resulting figure represents your overall NOP.

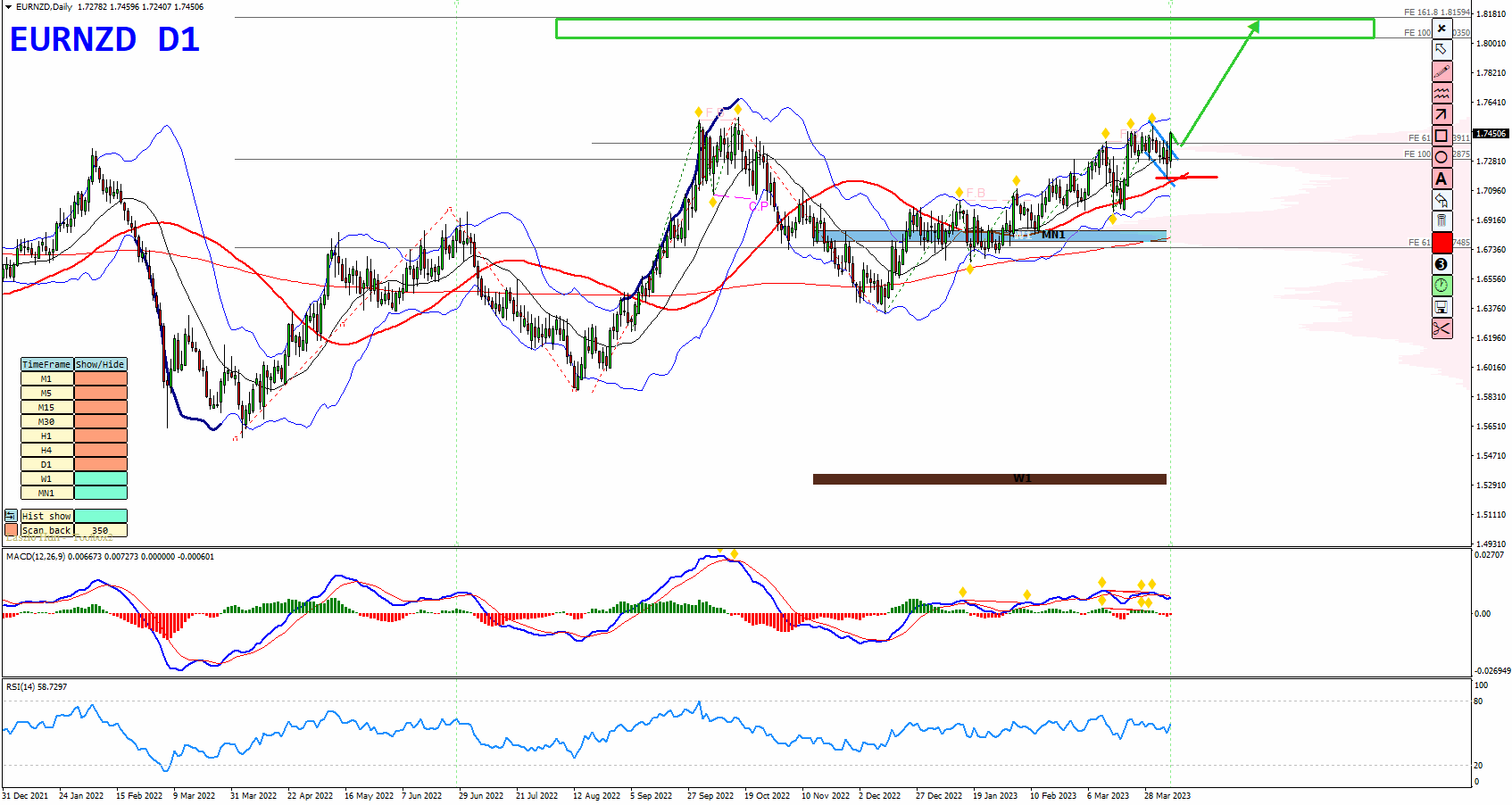

Image: vladimirribakov.com

Trading Tips to Leverage NOP

-

Set Realistic Trading Goals: Define clear and achievable trading goals based on your risk tolerance and financial objectives.

-

Monitor NOP Regularly: Continuously track your NOP to assess your risk exposure and make necessary adjustments to your trading strategies.

-

Use NOP to Adjust Stop-Loss Levels: Utilize NOP to determine appropriate stop-loss levels for each trade, ensuring that potential losses are proactively managed.

-

Optimize Strategy Allocation: Calculate NOP for various trading strategies to optimize capital allocation and enhance overall performance.

-

Consider NOP in Risk-Reward Analysis: Factor NOP into your risk-reward analysis, ensuring a balanced approach to trading, considering potential gains against potential losses.

FAQs on Net Open Position (NOP) in Forex

Q: Why is NOP important in forex trading?

A: NOP enables traders to quantify their market exposure, manage risk, and optimize their trading strategies effectively.

Q: How do I calculate my NOP?

A: Calculate NOP by subtracting the number of units sold from the number of units bought for each currency pair and then summing up the individual net positions.

Q: Can NOP be negative?

A: Yes, NOP can be negative, indicating a net short position, wherein the trader has sold more units than they have bought in a currency pair.

Q: Is it always necessary to have a positive NOP?

A: Not necessarily, as both positive and negative NOPs can be utilized in trading strategies. The crucial factor is to manage NOP prudently to mitigate risks.

Q: What are the risks associated with high NOP?

A: High NOP can increase the potential for substantial losses if the market moves against the trader’s position. It’s essential to monitor NOP and adjust strategies accordingly to manage risk effectively.

What Is Net Open Position In Forex

Conclusion

Comprehending the concept of Net Open Position (NOP) is vital for all forex traders, regardless of their experience level. NOP serves as an indispensable tool for risk management and strategy optimization. By understanding their NOP, traders can make informed decisions, protect their capital, and enhance their overall trading performance.

If you’re curious about the topic, I encourage you to dive deeper into the world of NOP to gain a competitive edge in your forex trading endeavors.