In the dynamic realm of global finance, the European foreign exchange market looms large as a hub of currency trading and investment opportunities. Understanding its operating hours is paramount for traders and investors alike who seek to capitalize on market fluctuations and make well-informed decisions. This article delves into the intricacies of the European forex market, illuminating its opening hours, factors that influence them, and strategies for optimizing trading within this timeframe.

Image: freeforexcoach.com

Understanding the European Forex Market: A Global Powerhouse

The European forex market is an interconnected network of financial institutions, traders, and investors engaged in currency exchange. Spanning across several countries, including the United Kingdom, Germany, Switzerland, and France, it accounts for a significant portion of global forex trading volume. The market’s deep liquidity, diverse range of currency pairs, and accessibility to traders of all levels contribute to its status as a preferred destination for currency trading.

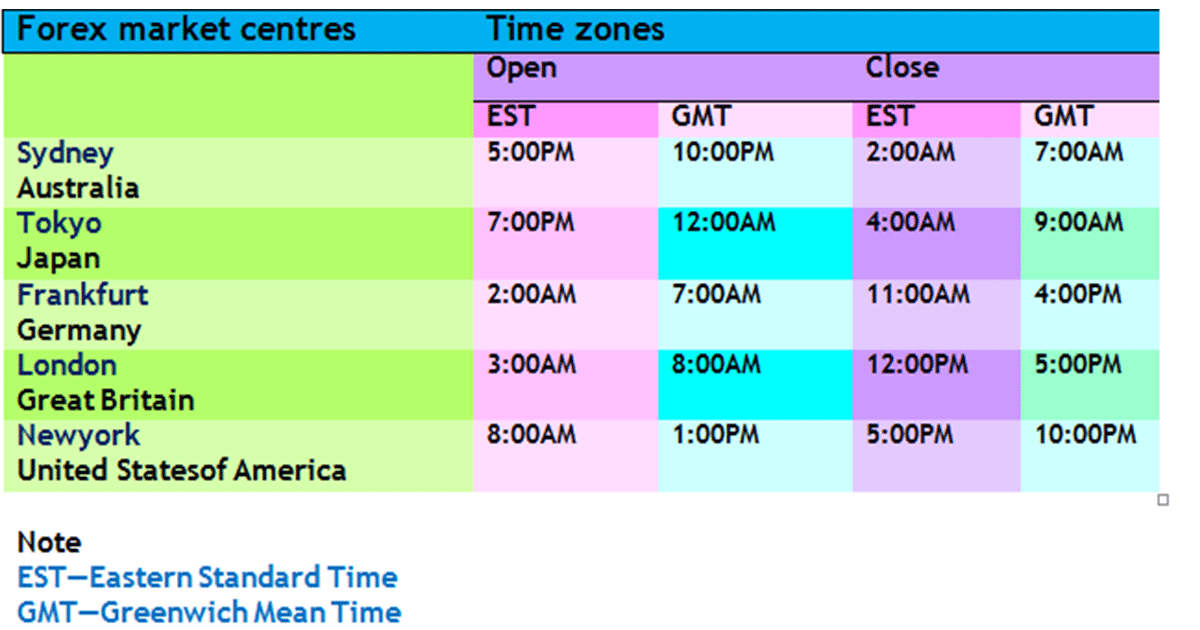

Delving into the Opening Hours: A Precise Schedule

The European forex market operates on a specific schedule, dictated by the business hours of participating financial institutions. Typically, the market opens at 7:00 AM Central European Time (CET) and closes at 4:00 PM CET. This timeframe aligns with the regular business hours of London, one of the world’s leading financial centers and a primary hub for forex trading. The standardized opening hours ensure a coordinated and efficient market environment, enabling traders to execute transactions during a predictable time frame.

Factors Influencing Market Hours: A Dynamic Landscape

Certain factors can influence the opening hours of the European forex market. Daylight savings time adjustments, for instance, can shift the market’s operating schedule. Additionally, geopolitical events, economic data releases, and market holidays may warrant adjustments to the standard trading hours. Traders should remain informed of any changes to the market schedule to avoid disruptions in their trading activities.

Image: earnmoneyseoforex.blogspot.com

Maximizing Trading Opportunities: Strategies for Success

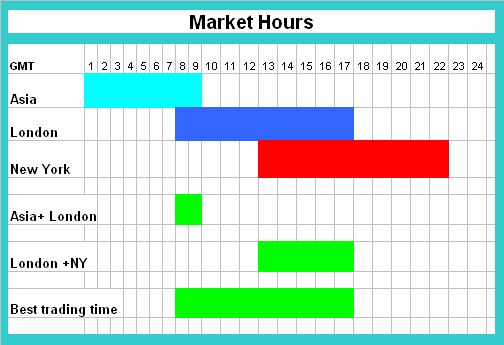

Traders can optimize their profitability by aligning their trading strategies with the European forex market’s opening hours. Volatility tends to be higher during the market’s initial hours, as traders react to overnight news and economic data. Capitalizing on this volatility requires vigilance and a swift execution of trades. As the market settles into the day, more experienced traders often engage in longer-term trading strategies that leverage shifts in market sentiment.

Traders should also consider the upcoming economic events and data releases during the European forex market’s operating hours. These events can significantly impact currency prices, creating opportunities for profitable trading. Staying informed about upcoming events and their potential impact on the market will help traders make informed decisions.

What Time Does The European Forex Market Open

Conclusion: Unlocking the European Forex Market’s Potential

Understanding the opening hours of the European forex market is an essential pillar for successful trading in this dynamic financial arena. By aligning trading strategies with the market’s operating schedule and considering influencing factors, traders can maximize their profitability. Embracing the opportunities presented by the European forex market requires a blend of knowledge, discipline, and strategic trading techniques. This guide offers a comprehensive understanding of the market’s opening hours, empowering traders and investors to navigate this complex landscape with confidence.