Introduction

In the dynamic world of global finance, foreign exchange (forex) trading stands as a pivotal force, facilitating seamless currency exchange and shaping global economic landscapes. Among the myriad of nations involved in this financial arena, a select few have emerged as dominant players, leaving an indelible mark on the forex ecosystem. Join us on an enthralling journey as we delve into the countries most deeply entwined with the pulsating heartbeat of forex trading, uncovering their secrets to success and exploring the ripple effects they create.

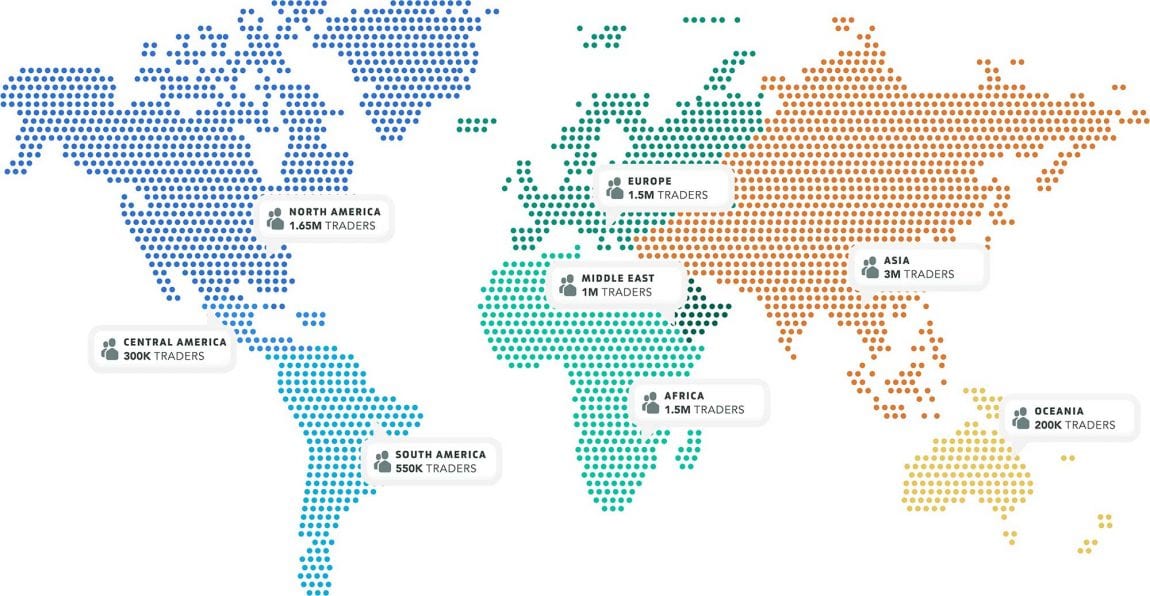

Image: www.asktraders.com

Unveiling the Currency Trading Giants

At the apex of the forex trading landscape, a select group of nations reigns supreme. These financial powerhouses account for the lion’s share of global trading volumes, driving market movements and influencing currency valuations. Behold, the formidable lineup:

- United States

- United Kingdom

- Japan

- Singapore

- Switzerland

- Hong Kong

- Germany

- France

- Australia

- Canada

These countries collectively account for a staggering 80% of global forex trading, shaping exchange rates and dictating currency trends. However, their involvement and impact vary greatly, driven by a multitude of factors.

The United States: The Unrivaled Champion

The United States stands as an undisputed titan, reigning as the undisputed king of global forex trading. Its dominant position stems from the nation’s unparalleled economic might, underpinned by a robust financial infrastructure and a vast array of traded currency pairs. The US dollar reigns as the world’s reserve currency, cementing its status as the currency of choice for international commerce and financial transactions.

The United Kingdom: A Global Financial Hub

The United Kingdom, a bastion of global finance, holds its own as one of the preeminent forex trading hubs. London, its vibrant capital, has long been a melting pot of financial institutions, boasting a legacy of expertise and innovation. The pound sterling, a bastion of stability and trust, draws traders from far and wide.

Image: homecare24.id

Japan: A Forex Powerhouse in the East

Japan, a nation renowned for its technological prowess, has forged a formidable position in forex trading. Tokyo has emerged as a leading financial center, home to a formidable lineup of banks and trading firms. The Japanese yen’s reputation for stability and its role as a safe-haven currency during times of global uncertainty make it a highly sought-after asset.

Singapore: A Financial Haven in Southeast Asia

Singapore has skillfully established itself as a forex trading haven in Southeast Asia. Its strategic location, coupled with a robust financial infrastructure and a proactive government, has lured countless foreign banks and financial institutions to set up operations within its borders. The Singapore dollar has gained prominence as a key currency in the Asian forex market.

Switzerland: A Bastion of Stability and Security

Switzerland, famed for its neutrality and political stability, has carved out a reputation as a haven for forex traders seeking safe and secure transactions. Zurich, its financial hub, hosts a thriving community of banks and trading firms. The Swiss franc is widely regarded as a safe-haven currency, underpinning its allure for those seeking stability amidst market volatility.

Hong Kong: An International Financial Gateway

Hong Kong, a vibrant metropolis and a gateway to China, has ascended as a formidable player in the forex trading arena. Its free market economy and robust financial infrastructure have attracted a multitude of international banks and financial institutions. The Hong Kong dollar has established itself as a major currency in the Asian forex market.

Germany: A Powerhouse with a Strong Euro

Germany, a pillar of the European Union, wields considerable clout in the global forex market. Its economic prowess and the strength of the euro, the second most traded currency globally, have fueled its status as a major player in forex trading. Frankfurt, Germany’s financial capital, is home to a vibrant community of banks and financial institutions.

France: A Currency Trading Center within Eurozone

France, a cornerstone of the European economy, plays an influential role in forex trading. Paris, its bustling financial hub, hosts a multitude of banks and trading firms. The euro, being the second most traded currency globally, lends significant weight to France’s position in the forex market.

Australia: A Commodity-Linked Forex Player

Australia, a nation rich in natural resources, has forged a unique path in the forex market, with its currency heavily influenced by commodity prices. Sydney, its financial center, is a hub for forex trading. The Australian dollar, with its strong correlation to commodity prices, presents unique opportunities for traders.

Canada: A Stable Currency in a Resource-Rich Economy

Canada, blessed with abundant natural resources, has established itself as a significant player in forex trading. Toronto, its financial hub, plays host to a thriving community of banks and trading firms. The Canadian dollar’s stability, backed by Canada’s robust economy, makes it a popular choice for forex traders.

Factors Fueling Forex Trading Dominance

The factors propelling these nations to the forefront of forex trading are multifaceted and complex. A tapestry of factors, including economic strength, political stability, advanced financial infrastructure, skilled workforce, favorable regulatory frameworks, and strategic locations, all intertwine to create the ideal breeding ground for vibrant forex trading ecosystems.

-

Strong Economic Foundation: A robust and stable economy provides a solid foundation for forex trading to flourish. It ensures a steady flow of capital, attracting international investors and traders. Strong GDP growth, low inflation, and a stable currency all contribute to a favorable environment for forex trading.

-

Political Stability: Political stability is a crucial factor in attracting foreign investment and fostering trust in the financial system. Countries with stable governments, clear policies, and a well-established rule of law create an environment conducive to forex trading.

-

Advanced Financial Infrastructure: A sophisticated financial infrastructure is essential for efficient and reliable forex trading. This includes well-developed banking systems, electronic trading platforms, and robust clearing and settlement mechanisms. It facilitates seamless execution of trades and reduces operational risks.

-

Skilled Workforce: A skilled workforce with expertise in finance and technology plays a vital role in forex trading. This includes financial analysts, traders, and IT professionals who possess the knowledge and experience to navigate the complexities of the market.

-

Favorable Regulatory Framework: A clear and supportive regulatory framework provides stability and protection for forex market participants. It establishes guidelines for market conduct, dispute resolution mechanisms, and measures to prevent fraud and manipulation.

-

Strategic Location: Strategic geographical locations can provide countries with advantages in forex trading. Being situated in time zones that overlap with major financial centers or near major trading hubs can facilitate seamless access to global markets.

The Impact of Forex Trading on Global Economies

The forex trading industry has a profound impact on global economies. It facilitates international trade and investment, providing a channel for businesses and individuals to exchange currencies and access global markets. The smooth functioning of forex markets ensures the efficient flow of capital and supports economic growth. Forex trading also plays a role in stabilizing exchange rates, reducing uncertainty for businesses and promoting economic stability.

Countries Most Involved In Forex Trading

https://youtube.com/watch?v=1fj9q_sdY1k

Conclusion: Embracing the Forex Trading Landscape

As the tapestry of global financial markets continues to evolve, the countries mentioned above remain the titans of forex trading, shaping its contours and influencing its dynamics. By understanding the factors that underpin their dominant positions, traders can better navigate this complex and ever-changing landscape. Embrace the insights unveiled in this exploration and harness the power of forex trading, whether as a conduit for global commerce, a hedging tool against currency fluctuations, or a means of pursuing financial opportunities. May this journey into the heart of forex trading empower your financial decisions and enrich your understanding of the economic intricacies that shape our world.