In the ever-evolving financial landscape, the foreign exchange (forex) market stands as a colossal arena where currencies are traded incessantly around the globe. With its vast scale and unparalleled liquidity, the forex market offers traders and investors alike the opportunity to capitalize on market fluctuations and potentially reap significant rewards. However, to navigate this fast-paced environment effectively, having a clear understanding of the market’s opening times is crucial. This article delves into a comprehensive guide to the opening times of forex markets, highlighting time zones across major financial hubs, factors that influence market availability, and strategies for maximizing trading potential during specific market hours.

Image: www.sohomarkets.eu

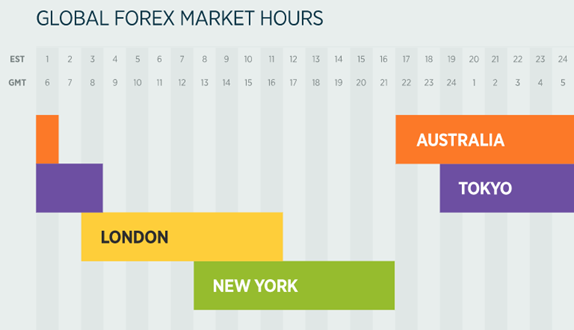

Navigating Global Time Zones: A Map to the Forex Market’s Doors

The forex market operates 24 hours a day, spanning multiple time zones and financial centers. This global reach allows traders to engage in trading activities virtually around the clock. The market opens at 5:00 AM GMT (Greenwich Mean Time) in Sydney, Australia, and closes at 10:00 PM GMT in New York, United States, with different regions opening and closing their markets at designated times throughout the day.

Comprehending the time zone differences and corresponding market opening hours is paramount for traders to align their trading strategies effectively. By understanding which markets are operational during specific time periods, traders can capitalize on market movements and liquidity at optimal times.

A Closer Look at Key Market Hubs: When the Doors Open

Sydney (5:00 AM GMT): The Australian financial hub serves as the gateway to the forex market, opening its doors at 5:00 AM GMT, coinciding with the start of the business day in Asia.

Tokyo (7:00 AM GMT): The bustling metropolis of Tokyo brings the Asian market into full swing, opening its forex market at 7:00 AM GMT, fueling activity and setting the tone for the rest of the day.

London (8:00 AM GMT): A pivotal hub in the global forex landscape, London’s forex market opens at 8:00 AM GMT, marking the commencement of European trading operations.

New York (1:00 PM GMT): As the sun rises in the Americas, New York, the financial powerhouse of the United States, opens its forex market at 1:00 PM GMT, injecting a significant volume and liquidity into the global market.

Understanding the Market’s Rhythm: Market Opening Hours and Interbank Liquidity

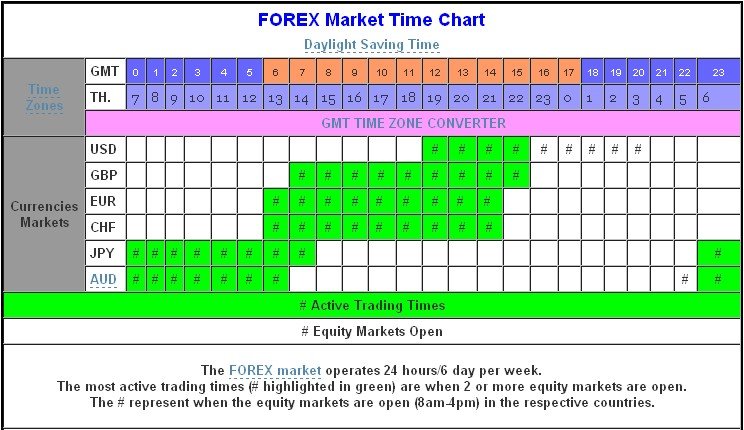

The opening hours of forex markets are not merely arbitrary timestamps but are meticulously aligned with the interbank market, where the majority of global currency trading takes place. The interbank market is composed of large financial institutions that facilitate transactions directly with each other, setting the benchmark rates for currency pairs.

By aligning market opening hours with the interbank market’s active trading periods, forex brokers and traders can access the highest liquidity, which translates to tighter spreads and reduced slippage. This enhanced liquidity provides traders with more favorable trading conditions and, consequently, increased profit potential.

Exploiting Market Overlaps: Maximizing Trading Opportunities

The forex markets’ extended hours across different time zones create unique opportunities for traders to maximize their trading strategies. When markets in one region close, another region is just opening, ensuring an uninterrupted flow of trading activity throughout the day.

Capturing the overlaps between market openings can be a lucrative strategy, as it allows traders to take advantage of the increased liquidity and price volatility during these periods. By understanding these overlaps, traders can strategically position themselves to enter or exit trades at optimal times.

Image: www.mql5.com

Special Market Events and Holiday Closures: Adapting to Market Rhythms

Apart from the regular market opening hours, traders must also consider special events and holidays that can impact market availability. Central bank announcements, economic data releases, and geopolitical events can cause temporary market disruptions or closures, altering trading schedules and potentially creating volatile market conditions.

To navigate these events effectively, traders should remain informed about upcoming market closures and adjust their trading strategies accordingly. By anticipating such disruptions, traders can mitigate the impact of market downtime and capitalize on opportunities that may arise during periods of heightened volatility.

Opening Times Of Forex Markets Gmt

Conclusion: Unlocking the Forex Market’s Potential with Precision Timing

In conclusion, understanding the opening times of forex markets across different time zones is an essential aspect of successful forex trading. By aligning trading strategies with market hours and leveraging the overlaps between market openings, traders can increase their chances of capitalizing on market movements and maximizing profit potential. Additionally, staying informed about special market events and holiday closures enables traders to adapt their strategies and minimize the impact of market disruptions. With a comprehensive understanding of forex market opening times, traders can unlock the global forex market’s full potential and confidently navigate its ever-changing terrain.