Startling Introduction

In the ever-evolving global economy, currency fluctuations can have a significant impact on businesses of all sizes. Tallying unadjusted forex gain/loss is a crucial accounting practice that allows companies to monitor and manage these fluctuations, ensuring financial stability and profitability. If you’re a business owner or finance professional, understanding this concept is paramount to navigating the complexities of international trade and investments.

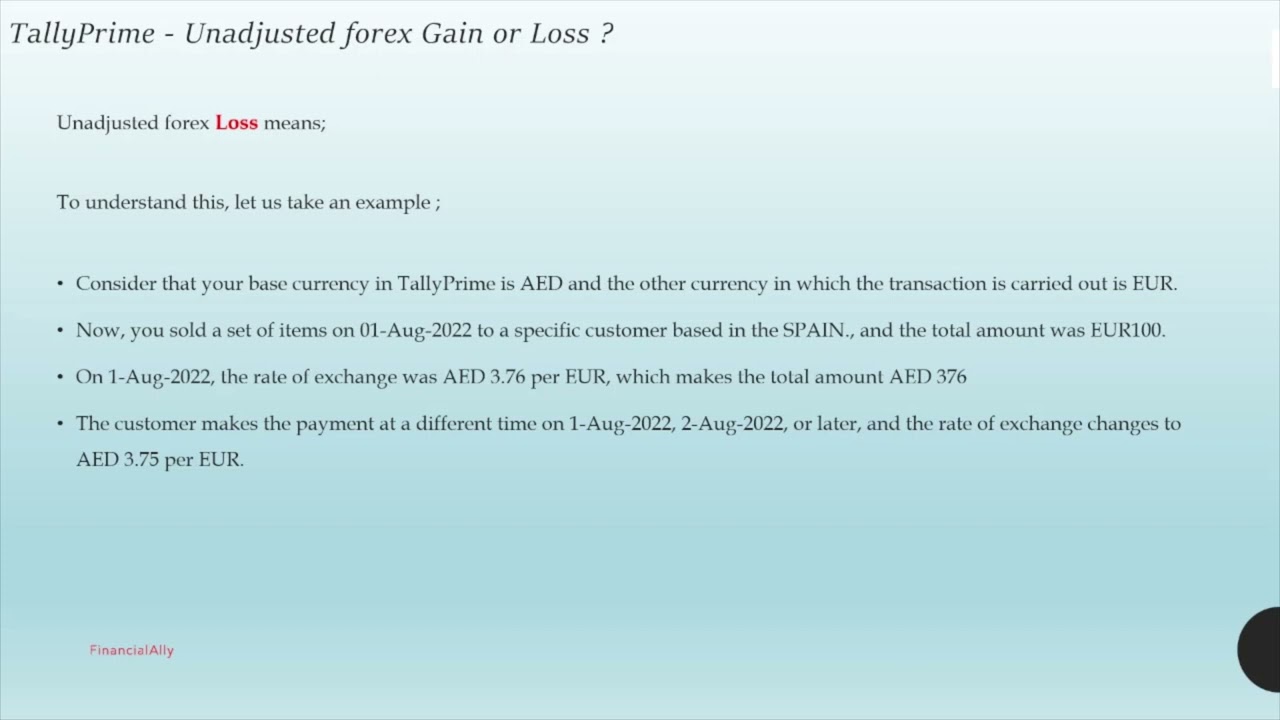

Image: plunhinmeaisub.hatenablog.com

Delving into Tally Unadjusted Forex Gain/Loss

When a business engages in international transactions, it encounters different currencies. As these currencies constantly fluctuate, so do the values of the transactions. Tallying unadjusted forex gain/loss involves recording these fluctuations in the company’s accounting records.

Unadjusted forex gain/loss is the difference between the transaction’s original value and its current value, before considering any adjustments or realized gains/losses. This concept is crucial for businesses that maintain accounts in foreign currencies, as it provides a real-time snapshot of potential gains or losses due to currency movements.

Significance for Businesses

-

Accurate Financial Reporting: Unadjusted forex gain/loss ensures that a company’s financial statements accurately reflect the impact of currency fluctuations. This accuracy is vital for investors, creditors, and other stakeholders to make informed decisions.

-

Effective Risk Management: By tracking unadjusted forex gain/loss, businesses can identify potential risks associated with currency volatility. This knowledge empowers them to implement appropriate hedging strategies to mitigate potential losses.

-

Profitability Optimization: Understanding unadjusted forex gain/loss helps businesses optimize their profitability by identifying opportunities to capitalize on favorable currency movements. This can lead to increased revenue and improved financial performance.

Real-World Applications

-

Exporting Company: A U.S.-based exporting company selling goods to Europe might experience an unadjusted forex gain if the Euro strengthens against the U.S. Dollar. This gain signifies a potential increase in the value of the receivables.

-

Importing Company: An importing company based in Canada purchasing raw materials from China might face an unadjusted forex loss if the Canadian Dollar weakens against the Chinese Yuan. This loss indicates a potential increase in the cost of goods purchased.

Image: www.youtube.com

Expert Insights

“Tallying unadjusted forex gain/loss is an essential accounting practice for businesses operating in the global marketplace. By monitoring currency fluctuations, companies can mitigate risks, identify opportunities, and position themselves for sustained financial success.” – Dr. Mark Jenkins, Professor of Finance, Harvard Business School

Actionable Tips

-

Establish a Currency Risk Management Policy: Develop a clear policy outlining the company’s approach to managing currency risks, including guidelines for monitoring unadjusted forex gain/loss.

-

Seek Professional Guidance: Consult with accounting or finance professionals who specialize in international transactions to ensure accurate and compliant accounting of forex gain/loss.

-

Utilize Accounting Software: Consider investing in accounting software that automates the calculation and tracking of unadjusted forex gain/loss, simplifying the process and reducing errors.

Tally Unadjusted Forex Gain Loss

Compelling Conclusion

Tallying unadjusted forex gain/loss is an indispensable accounting practice for businesses engaging in international trade and investments. By understanding this concept and its implications, companies can effectively manage currency fluctuations, optimize profitability, and position themselves for long-term financial success. Remember, in the ever-changing global economy, staying informed and adaptable is key to navigating the complexities of international finance.