Image: www.calibrateindia.com

In the labyrinthine world of forex trading, where the ebb and flow of currencies dictate financial destinies, savvy traders seek reliable tools to navigate the unpredictable markets. Among the most esteemed of these tools is the Fibonacci Retracement, a geometrical marvel that has stood the test of time. Understanding how to draw Fibonacci retracement is not merely a technical exercise; it grants traders the power to identify potential turning points, predict price movements, and maximize their trading strategies. Its harmonious proportions and elegant simplicity have made Fibonacci retracement a trusted ally for traders of all levels, from novice to seasoned veteran.

Laying the Foundation: Unraveling the Fibonacci Sequence and its Golden Ratio

The Fibonacci sequence, an enigmatic numerical pattern, holds the key to unlocking the secrets of Fibonacci retracement. Ascribed to the 13th-century Italian mathematician Leonardo Pisano, known as Fibonacci, the sequence unfolds in a fascinating way: each number (except the first two) is the sum of the two preceding ones. The sequence, represented as 0, 1, 1, 2, 3, 5, 8, 13, 21…, displays an intriguing relationship between consecutive numbers: the ratio of any two consecutive numbers, as the sequence progresses, approaches the golden ratio, also known as Phi (1.618). This enigmatic ratio, found in innumerable natural phenomena, from seashells to galaxies, has a peculiar allure that captivates both artists and scientists alike.

From Sequence to Retracement: Mapping the Fibonacci Horizons

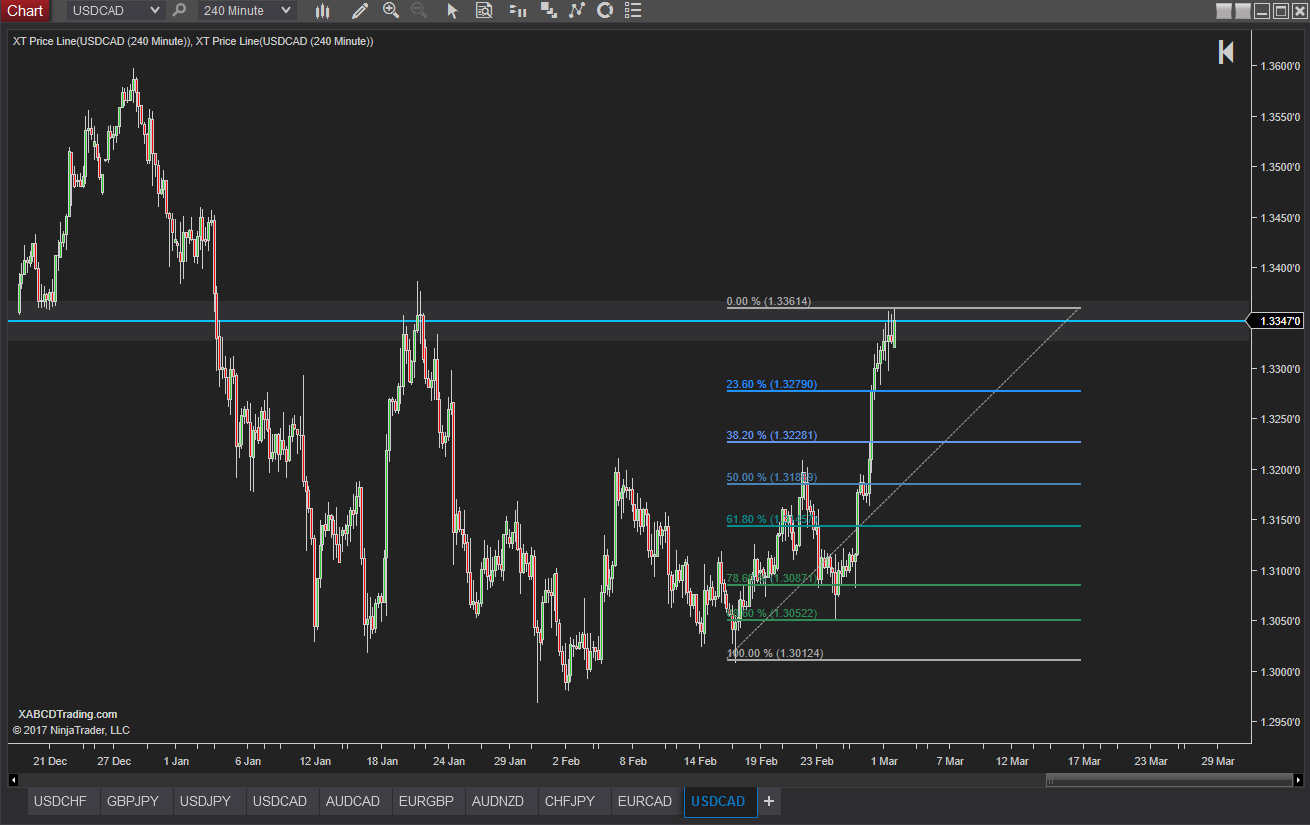

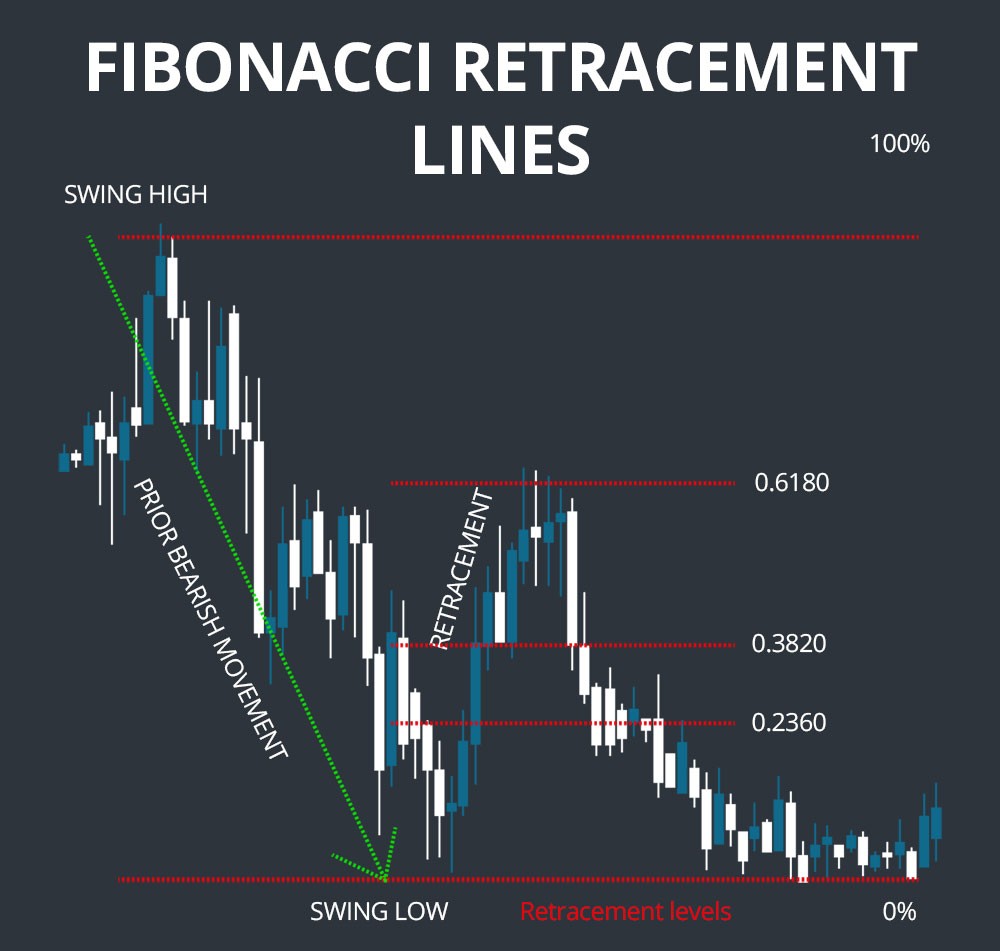

Fibonacci retracement, in essence, is a method of identifying potential areas where price might find support or resistance after a significant market move. It involves overlaying a series of horizontal lines on a price chart, with each line representing a key Fibonacci ratio level (23.6%, 38.2%, 50%, 61.8%, and 100%). These levels serve as potential turning points, guiding traders in pinpointing areas where prices may pause, reverse, or continue their trend.

绘制斐波那契回撤的第一步是从图表上选择一个明显的市场波动,例如强劲的上升或下降趋势。然后,通过将波动的最高点和最低点连接成一段线段来确定波动区间。这一段线段被定义为100%的水平。接下来,利用斐波那契比率,在100%的水平下绘制其他水平线。这些水平线是23.6%、38.2%、50%、61.8%。

Navigating the Forex Markets with Fibonacci Insight

Fibonacci retracement analysis is a versatile tool that can be applied to all financial markets, including the notoriously complex forex market. By identifying retracement levels, traders can better understand how the market might react at specific price levels, empowering them to make more informed trading decisions.

例如,如果货币对经历了一段上升趋势,然后回调到38.2%的回撤水平,交易者就可以考虑这是否是一个潜在的买入机会。反之亦然,如果货币对经历了一段下降趋势,然后反弹到38.2%的回撤水平,交易者可以考虑这是否是一个潜在的卖出机会。

Beyond its fundamental function, Fibonacci retracement also offers a unique perspective on market sentiment. By observing the market’s behavior at key Fibonacci levels, traders can assess the overall sentiment and gauge the likelihood of a trend continuation or reversal. This information can be invaluable in shaping trading strategies and optimizing risk management.

Image: homecare24.id

How To Draw Fibonacci Retracement In Forex