In the intricate world of forex trading, understanding the nuances of unadjusted forex gain loss is crucial to mitigate risks and maximize profitability. Tally, a renowned accounting software, provides a platform to seamlessly record and track these financial transactions. In this comprehensive guide, we delve into the intricacies of unadjusted forex gain loss in Tally, empowering you to navigate the tumultuous seas of currency fluctuations with confidence.

Image: howtotradeonforex.github.io

Defining Unadjusted Forex Gain Loss

Unadjusted forex gain loss refers to the unrealized gains or losses that arise due to fluctuations in the exchange rates of foreign currencies held by a business. It represents the difference between the transaction amount and the current exchange rate. These gains/losses are not recognized in the profit or loss statement until the foreign currency transaction is settled.

Understanding Its Significance

In today’s globalized business environment, companies often engage in transactions denominated in foreign currencies. These transactions expose businesses to currency risks, as fluctuations in exchange rates can lead to significant gains or losses. Unadjusted forex gain loss provides a real-time assessment of these potential gains/losses, enabling businesses to make informed decisions regarding currency hedging strategies.

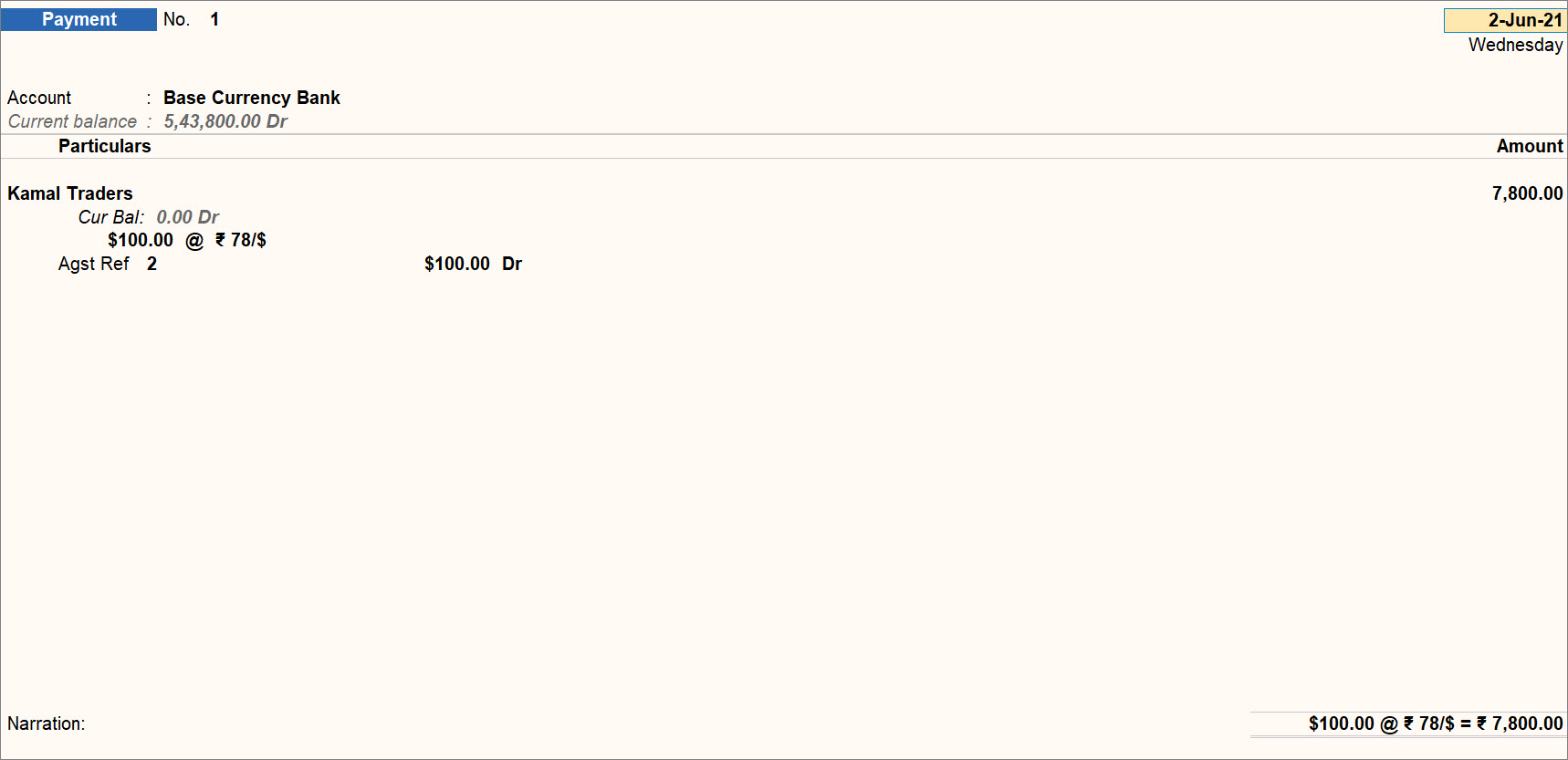

Recording in Tally

Tally offers a user-friendly interface to record unadjusted forex gain loss. When recording a foreign currency transaction, specify the transaction amount, currency, and exchange rate. Tally automatically calculates the unadjusted forex gain/loss based on the difference between the transaction rate and the current exchange rate.

The unadjusted forex gain/loss is recorded under the “Forex Gain/Loss” account in Tally. If the gain/loss is a positive value, it represents a gain; if negative, it represents a loss.

Image: help.tallysolutions.com

Example for Illustration

Consider a company that purchases goods worth $100,000 when the exchange rate is ₹75 per dollar. At the time of purchase, the company records the transaction as:

- Purchase A/c Dr. ₹7,500,000 (100,000 * 75)

- Creditors A/c Cr. $100,000

Assuming the exchange rate rises to ₹80 per dollar before the goods are paid for, the unadjusted forex loss would be ₹5,00,000 (100,000 * (80-75)).

Impact on Financial Statements

Unadjusted forex gain/loss is a temporary gain/loss that does not impact the profit or loss statement until the foreign currency transaction is settled. Instead, it appears as a separate line item in the balance sheet under “Current Assets” or “Current Liabilities,” depending on whether it represents a gain or a loss.

Managing Forex Risk

Understanding unadjusted forex gain loss is the first step towards managing forex risk effectively. Businesses can employ various strategies to mitigate these risks, such as:

- Forward contracts

- Currency options

- Hedging through derivatives

Expert Insights for Success

Seasoned forex traders emphasize the importance of monitoring unadjusted forex gain/loss regularly to stay abreast of potential risks and opportunities. They advise businesses to work closely with their bankers and financial advisors to develop robust risk management strategies tailored to their specific needs.

Unadjusted Forex Gain Loss Appears In Tally

Navigating Forex Fluctuations with Confidence

Mastering the intricacies of unadjusted forex gain loss in Tally empowers businesses to navigate the volatile landscape of foreign currency transactions with confidence. By leveraging Tally’s robust capabilities, companies can streamline their accounting processes, identify potential risks, and make informed decisions to maximize profits and minimize losses. Embrace the power of unadjusted forex gain loss in Tally and unlock the path to financial success amidst the ever-changing currency landscape.