Managing foreign exchange transactions is crucial for businesses operating globally. Tally ERP 9, a popular enterprise resource planning software, offers comprehensive solutions for recording and reporting unadjusted forex gains and losses. This article delves into the intricacies of unadjusted forex gain loss in Tally ERP 9, providing a comprehensive understanding of its concepts, accounting treatment, and implications.

Image: help.tallysolutions.com

What is Unadjusted Forex Gain Loss?

Unadjusted forex gain or loss arises when the functional currency of a business differs from the currency of a transaction. When a transaction is recorded in a currency other than the functional currency, the system creates a separate “Foreign Currency Gain/Loss” account to capture the difference between the transaction’s exchange rate and the exchange rate at the time of settlement.

Accounting Treatment

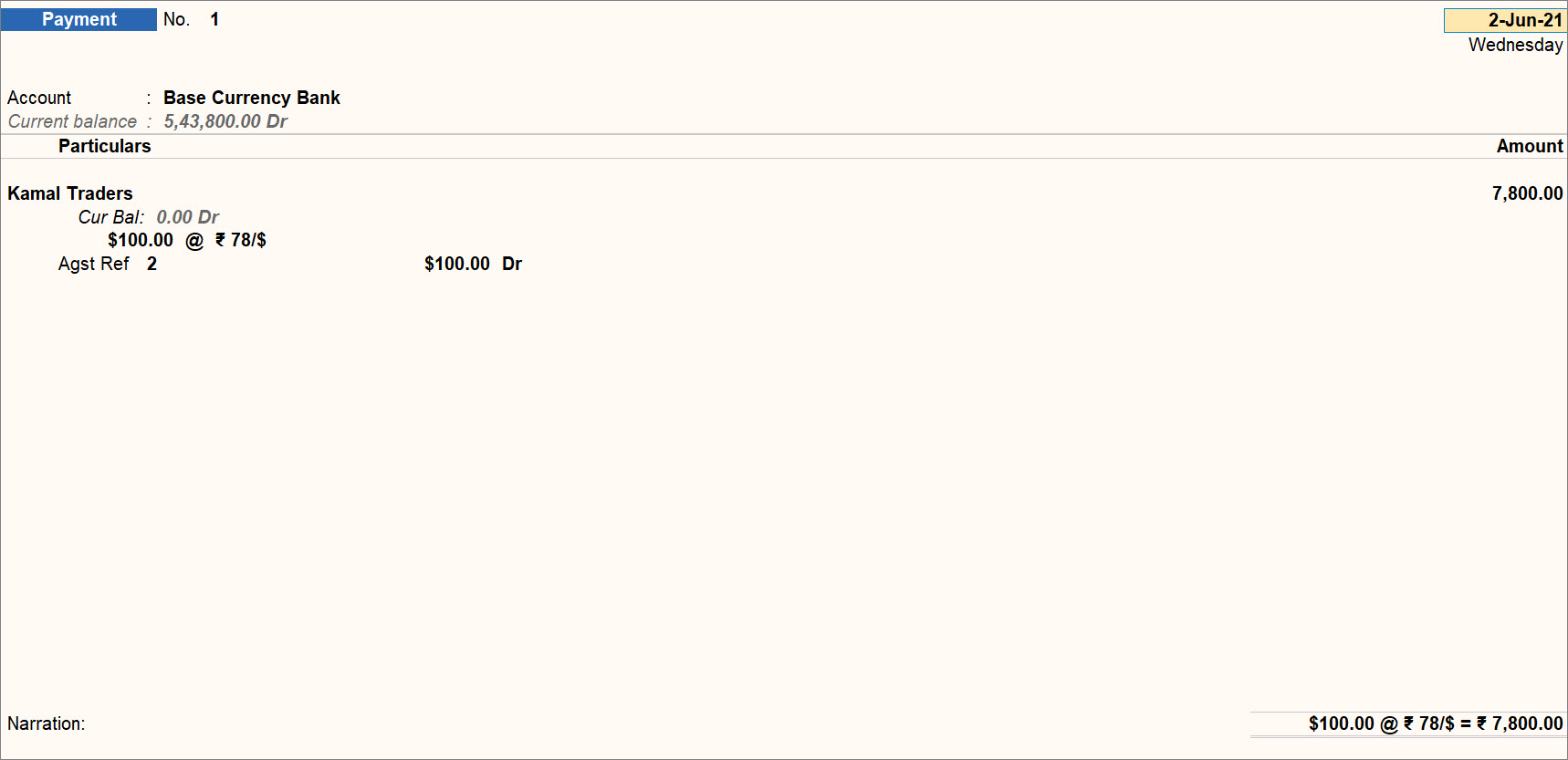

In Tally ERP 9, unadjusted forex gain loss is recognized on the date of the transaction, irrespective of whether the settlement occurs. The following journal entry records the transaction:

Debit: Foreign Currency Gain/Loss Account

Credit: Bank/Cash Account

Upon settlement, if the exchange rate has changed, the difference between the transaction exchange rate and the settlement exchange rate is adjusted to the Foreign Currency Gain/Loss account. This ensures that the transaction is recorded at the correct exchange rate.

Implications

Unadjusted forex gain loss has significant implications for businesses:

- Financial Performance: Forex gains or losses can impact a company’s financial performance and profitability.

- Risk Management: Businesses need to consider the risk associated with currency fluctuations and implement appropriate hedging strategies.

- Compliance Reporting: Companies must accurately report unadjusted forex gain loss in financial statements as per applicable accounting standards.

Image: www.forex.academy

Latest Trends and Developments

Recent advancements in forex accounting include:

- Automated Exchange Rate Updates: ERP systems like Tally ERP 9 integrate with exchange rate providers to automatically update exchange rates.

- Integrated Hedging Solutions: Some ERP systems provide built-in modules for managing foreign currency hedging and risk mitigation.

- Cloud-Based Solutions: Cloud-based ERP systems enable real-time currency conversions and access to global exchange rate data.

Tips and Expert Advice

Experts recommend the following tips for managing unadjusted forex gain loss:

- Maintain a Clear Currency Policy: Define the functional currency and establish clear guidelines for foreign currency transactions.

- Regular Currency Reconciliation: Reconcile foreign currency transactions regularly to identify and correct any errors.

- Monitor Exchange Rate Fluctuations: Keep abreast of exchange rate fluctuations and consider hedging strategies to mitigate risks.

By implementing these tips, businesses can effectively manage unadjusted forex gain loss, ensuring accurate financial reporting and mitigating potential risks.

FAQs on Unadjusted Forex Gain Loss

Q: What is the difference between unrealized and realized forex gain loss?

A: Unrealized forex gain loss is recorded when the transaction is entered and the settlement is pending, while realized forex gain loss is recognized when the settlement occurs.

Q: How to calculate unadjusted forex gain loss?

A: Unadjusted forex gain loss is calculated as the difference between the transaction amount converted at the transaction exchange rate and the settlement amount converted at the settlement exchange rate.

Q: What is the impact of unadjusted forex gain loss on financial statements?

A: Unadjusted forex gain losses are reported on the income statement as other income or expenses, impacting the net income and retained earnings.

Unadjusted Forex Gain Loss In Tally Erp 9

Conclusion

Unadjusted forex gain loss in Tally ERP 9 is an important aspect of foreign currency accounting. By understanding its concepts, accounting treatment, and implications, businesses can effectively manage their foreign currency transactions, mitigate risks, and ensure accurate financial reporting. Are you interested in further exploring the topic of unadjusted forex gain loss in Tally ERP 9?