Navigating the Highs and Lows of Forex Trading

Forex trading, or foreign exchange trading, is a global marketplace where currencies are traded. It’s the largest financial market in the world, with daily trading volumes soaring into trillions of dollars. In this dynamic arena, traders buy and sell currencies, betting on fluctuations in their values to make a profit. It’s a world of high stakes and potential rewards, but for those with the right tools and mindset, forex trading can be an exhilarating journey.

Image: gaincapitalreview.blogspot.com

Diving into the Forex Market

The forex market is a decentralized ecosystem, encompassing a vast network of financial institutions, corporations, and individual traders. Currencies are traded in pairs, with the value of one determined relative to another. Forex traders monitor economic news, political events, and market sentiments to forecast currency movements and make informed trading decisions.

At the heart of forex trading lies the concept of leverage. Leverage allows traders to control significant positions with relatively small deposits. While this can amplify potential profits, it can also magnify losses, making it crucial to manage risk effectively. Forex platforms offer various order types and risk-management tools to help traders protect their capital and maximize their chances of success.

Embracing the Evolution of Forex Trading

The forex market is constantly evolving, with technological advancements and regulatory changes shaping its landscape. The rise of electronic trading platforms has brought transparency and accessibility to the market, enabling traders to execute trades swiftly and efficiently. Artificial intelligence and machine learning are also transforming forex trading, providing traders with sophisticated tools for analysis and decision-making.

Unlocking Success in Forex Trading

Navigating the forex market requires a combination of knowledge, skill, and discipline. Forex traders must develop a deep understanding of fundamental and technical analysis. Fundamental analysis delves into economic and political factors that impact currency values, while technical analysis focuses on market patterns and trend identification. Rigorous risk management is paramount, as even the most experienced traders can encounter volatility and unforeseen events.

Furthermore, successful forex traders possess a keen eye for news and market updates. They stay abreast of global economic developments and political turmoil that can influence currency movements. Market sentiment plays a significant role in forex trading, and traders who can gauge the collective mood of the market tend to make more informed decisions.

Image: www.youtube.com

Tips and Expert Advice for Forex Traders

- Define a Trading Plan: Outline your trading strategy, including entry and exit points, profit targets, and risk tolerance.

- Manage Risk Effectively: Use stop-loss orders to limit potential losses and position size wisely to avoid over-leveraging.

- Analyze the Market Thoroughly: Combine fundamental and technical analysis to gain insights into currency trends and potential trading opportunities.

- Stay Informed: Monitor economic news, political events, and market sentiment to anticipate shifts in currency dynamics.

- Practice Discipline and Patience: Forex trading requires patience and discipline. Avoid emotional trading and stick to your trading plan.

Frequently Asked Questions about Forex Trading

Q: What are the benefits of forex trading?

A: Forex trading offers potential profit opportunities, flexible trading hours, and accessibility for traders with varying capital levels.

Q: Is forex trading a good investment?

A: Forex trading can be a profitable endeavor, but it’s important to approach it with a realistic mindset. Success requires knowledge, skill, and risk management.

Q: How do I get started with forex trading?

A: Begin by educating yourself, choosing a reputable forex broker, and practicing on a demo account.

Q: Is forex trading risky?

A: Forex trading involves risk due to market volatility. It’s essential to manage risk effectively by using stop-loss orders and appropriate position sizing.

Q: What are the common mistakes made by forex traders?

A: Over-leveraging, emotional trading, and ignoring risk management are some common pitfalls in forex trading.

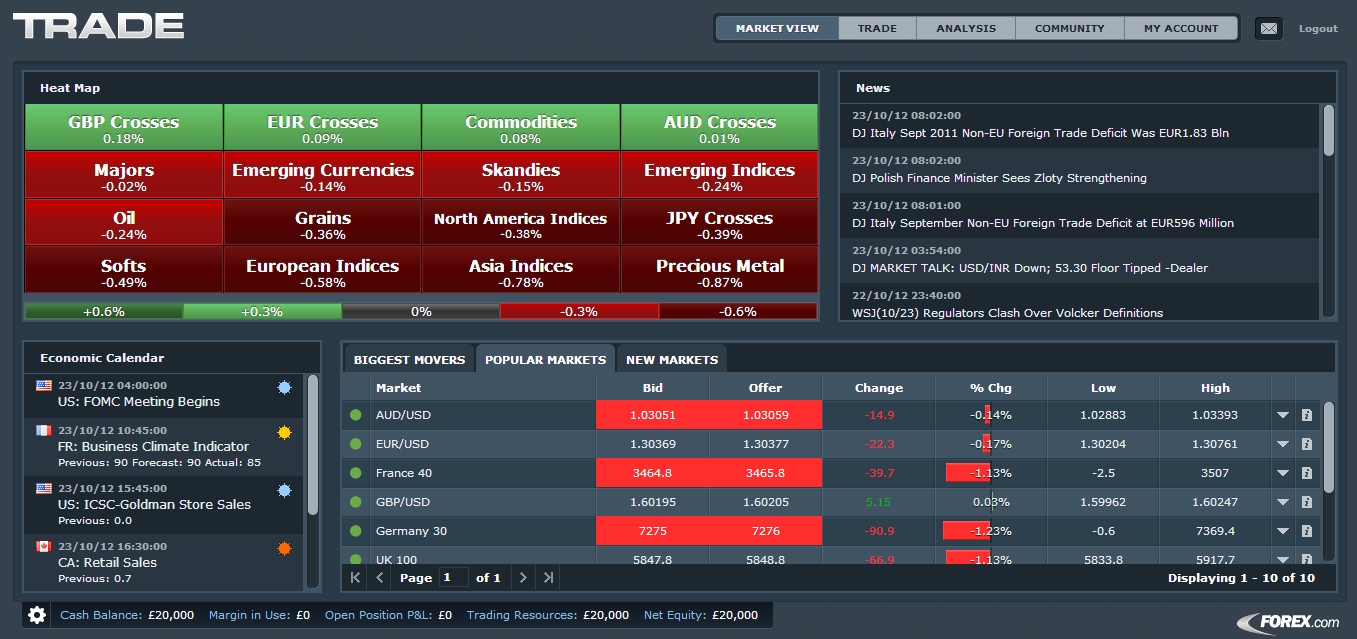

Forex Trade Platform

Conclusion: Embarking on Your Forex Journey

Forex trading offers a dynamic and potentially lucrative opportunity for traders seeking financial success. By understanding the intricacies of the market, employing sound trading strategies, and managing risk effectively, you can unlock the potential of this global currency marketplace. Are you ready to embark on your forex trading adventure?