Mastering the Art of Identifying Higher Highs and Lower Lows: A Guide to Forex Success

Image: indicatorspot.com

Introduction

In the ever-evolving world of forex trading, understanding the intricacies of identifying higher highs and lower lows is crucial for consistent profitability. These price levels represent pivotal points in market trends, offering valuable insights into potential price reversals and profitable trading opportunities. By honing your skills in calculating and interpreting these levels, you can gain a significant advantage in navigating the forex market and maximizing your returns.

Understanding Higher Highs and Lower Lows: A Foundation for Success

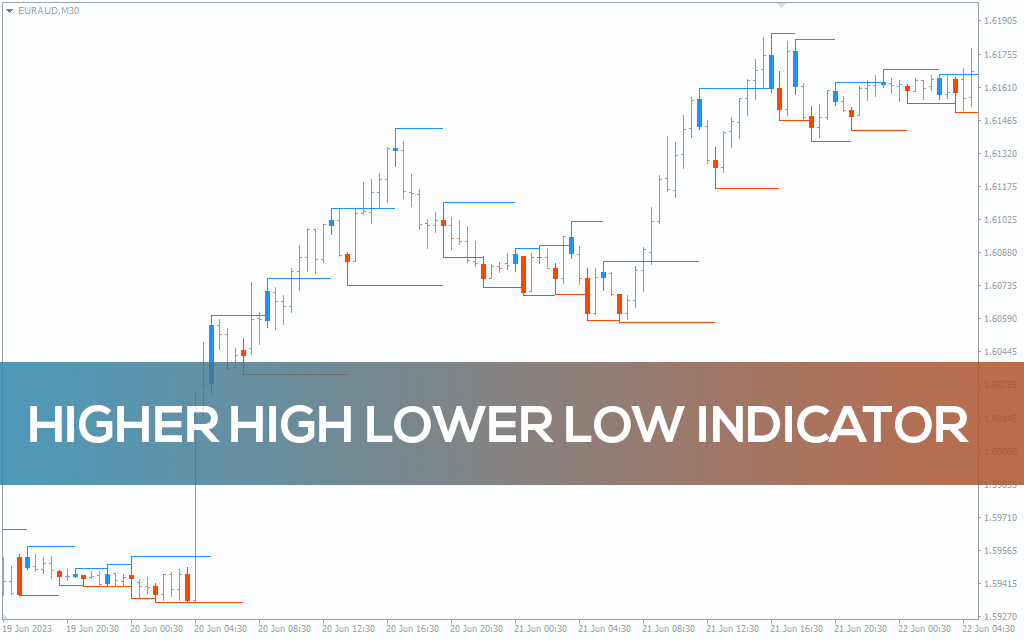

A higher high occurs when the current price exceeds the previous swing high, indicating a potential upward trend continuation. Conversely, a lower low occurs when the current price falls below the previous swing low, signaling a potential downward trend continuation. Traders refer to these levels as swing highs and swing lows, respectively.

Identifying these levels not only helps you determine the trend direction but also provides opportunities for strategic entry and exit points in your trades. By understanding how to calculate and interpret higher highs and lower lows, you can develop a solid foundation for developing effective trading strategies.

A Step-by-Step Guide to Calculating Higher Highs and Lower Lows

1. Identify Swing Highs and Lows

- Swing high: Look for a peak in price where the previous candle’s high is lower and the subsequent candle’s high is higher.

- Swing low: Find a trough in price where the previous candle’s low is higher and the subsequent candle’s low is lower.

2. Mark the Swing Highs and Lows

- Use technical analysis software or charts to mark the swing highs and lows on your price chart.

- Indicate swing highs with up arrows or another clear marking method.

- Indicate swing lows with down arrows or a similar marking system.

3. Calculate Higher Highs and Lower Lows

- Higher high: The current price surpasses the previous swing high.

- Lower low: The current price breaks below the previous swing low.

Expert Insights and Practical Applications

1. Utilize Higher Highs and Lower Lows in Trend Confirmation

- A series of higher highs and higher lows confirms an uptrend, indicating bullish momentum.

- Conversely, a series of lower highs and lower lows solidifies a downtrend, signaling bearish sentiment.

2. Identify Potential Trend Reversals

- A lower low after a series of higher highs suggests a potential trend reversal to the downside.

- A higher high after a string of lower lows indicates a potential trend change to the upside.

3. Set Strategic Entry and Exit Points

- Enter a long position when the price breaks above a higher high, indicating a potential uptrend continuation.

- Close the long position when the price falls below the previous swing low, signaling a potential trend reversal.

- Enter a short position when the price breaks below a lower low, revealing a potential downtrend continuation.

- Exit the short position when the price rises above the previous swing high, hinting at a potential trend change.

Conclusion

Mastering the art of identifying higher highs and lower lows is an essential skill for any serious forex trader. By applying the techniques outlined in this guide, you can gain a deeper understanding of price trends, predict potential reversals, and make informed trading decisions that maximize your profitability. Remember, practice and patience are key to developing expertise in this crucial aspect of forex analysis. Embark on this journey to enhance your trading acumen and achieve lasting success in the exhilarating realm of forex markets.

Image: www.youtube.com

How To Calculate Higher High And Lower Low In Forex