The foreign exchange (forex) market is a vast and complex network, where currencies are traded globally. Understanding the fundamentals of forex is essential for traders seeking success in this dynamic arena. One of the key concepts in forex is the pip, which is the smallest unit of measurement for price changes. Accurately counting pips is crucial for determining profit and loss values, as well as for effective risk management.

Image: howtotradeonforex.github.io

In this comprehensive guide, we will delve into the intricacies of pip counting in forex, providing a step-by-step approach to ensure precision and comprehension. Whether you are a seasoned trader or just starting your journey, this guide will empower you with the knowledge and skills necessary to master this fundamental aspect of forex trading.

Understanding Pips

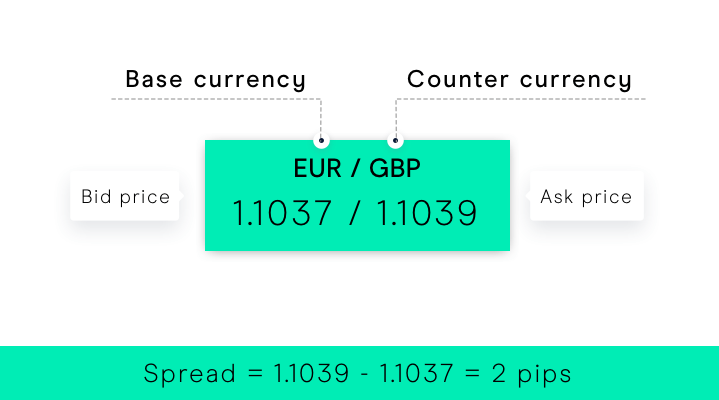

Pips, which is an abbreviation for “point in percentage,” represent the smallest measurable unit of price movement in a currency pair. In most currency pairs, one pip is equivalent to one hundredth of a percent (0.01%) or one basis point. This means that a one-pip movement in a currency pair represents a change of 0.0001.

However, in some currency pairs, such as the USD/JPY, one pip is equivalent to one-tenth of a percent (0.10%) or ten basis points. This variation is due to the historical significance of the Japanese yen, which had a much lower value compared to other currencies. As a result, a larger pip value was adopted for currency pairs involving the yen to maintain accuracy and consistency in price movements.

Pip Calculation

Calculating pips involves a simple formula that takes into account the following factors: the size of the trade, the exchange rate, and the number of pips moved.

**Formula:** Number of Pips = (Trade Size / Exchange Rate) x Pip Value

Here’s how each factor plays a role in pip calculation:

-

Trade Size: This refers to the value of the currency pair being traded. The trade size is usually expressed in standard lots, where 1 lot is equivalent to 100,000 units of the base currency.

-

Exchange Rate: This is the current price of one currency quoted in terms of another. Pip values are directly associated with the exchange rate.

-

Pip Value: The pip value represents the value attached to each pip movement. Typically, this value is 0.0001 or 0.10%, depending on the currency pair.

Determining Pip Value

As mentioned earlier, the pip value varies depending on the currency pair. The easiest way to determine the pip value is to refer to a forex broker’s trading platform, which typically provides real-time pip values for different currency pairs. Alternatively, you can calculate the pip value manually using the following formula:

**Formula:** Pip Value = 1 / (Exchange Rate)

For instance, if the exchange rate for USD/JPY is 110.507, the pip value would be 1 / 110.507 = 0.00009.

Image: www.cmcmarkets.com

Example Pip Calculation

Let’s say you have a long position in EUR/USD with a trade size of 0.50 lots, and the exchange rate moves from 1.12500 to 1.12550. To calculate the number of pips gained, we apply the pip calculation formula:

**Number of Pips:** (0.50 / 1.12500) x 0.00001 = 5 pips

Therefore, the profit gained from this trade is 5 pips.

Importance of Pip Counting

Accurately counting pips is essential for several reasons in forex trading:

1. Profit and Loss Calculation: Calculating pips enables traders to determine the precise gain or loss on their trades. By tracking pip movements, traders can assess their profitability and make necessary adjustments to their strategies.

2. **Risk Management:** Pip counting allows traders to measure the potential risk associated with a trade. By determining the maximum number of pips that can be lost before hitting a predetermined stop-loss level, traders can effectively manage their risk exposure.

3. **Trade Evaluation:** By counting pips, traders can evaluate the performance of their trades. They can identify profitable and unprofitable strategies, allowing them to refine their approach and achieve consistent results.

Tips for Counting Pips

To become proficient in pip counting, consider the following tips:

1. Use a Trading Platform:** Forex brokers provide trading platforms that display real-time pip values and automatically calculate pip movements. Utilize these platforms to simplify your pip-counting process.

2. Understand Pip Value:** Familiarize yourself with the pip values of various currency pairs. This knowledge will help you interpret price movements and calculate pips accurately.

3.Practice with a Demo Account:** Before trading with real funds, open a demo account. This allows you to practice pip counting without risking capital. Execute trades and monitor pips gained or lost to reinforce your understanding.

How To Count Pips In Forex

FAQs on Pip Counting

- What is a pip? A pip represents the smallest unit of price movement in forex trading, typically equal to 0.01% or 0.10% of the base currency.

- How do I calculate the pip value? To calculate the pip value, divide 1 by the exchange rate of the currency pair.

- Why is it important to count pips? Accurately counting pips is crucial for determining profit and loss, managing risk, and evaluating trade performance.

- Where can I find pip values? You can find real-time pip values on forex trading platforms provided by brokers or use formulas to calculate them manually.

- What is the difference between a positive and negative pip? A positive pip signifies a gain, while a negative pip represents a loss in the value of the base currency.

As you navigate the complexities of forex trading, understanding and mastering pip counting will empower you to make informed decisions, optimize risk management, and achieve lasting success in this dynamic market. Whether you are a seasoned trader or embarking on your forex journey, embrace these principles to elevate your trading proficiency.