Ever heard seasoned traders talk about “pips” and wondered what exactly those tiny units represent? Pips, short for “points in percentage,” might seem like a minor detail, but understanding them is crucial for grasping the true mechanics of Forex trading and calculating your potential profits and losses. In the intricate world of currency exchange, where even the smallest fluctuations can impact your portfolio, deciphering pips becomes an essential skill.

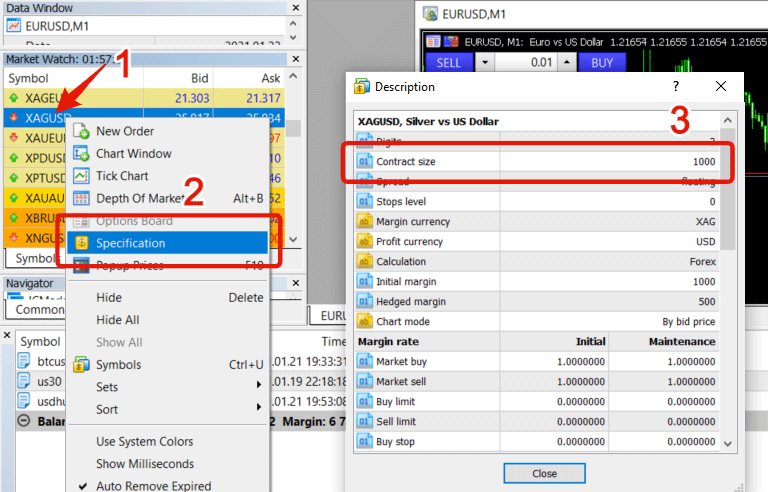

Image: www.cashbackforex.com

This comprehensive guide will delve into the intricacies of pips, providing a clear and concise explanation that will empower you to confidently navigate the complexities of Forex trading. We’ll explore the history of pips, the underlying principles of their calculation, and how they translate into real-world financial gains or losses. Get ready to unravel the mystery of pips and equip yourself with the knowledge to make informed trading decisions.

Understanding the Basics: What are Pips?

Imagine a game of musical chairs where the chair represents the value of a currency. As the music plays, players move around, representing the ever-changing exchange rates. Each time two players switch chairs, the value shifts – this represents a “pip” in Forex trading. Pips are the smallest unit of price change in currency pairs.

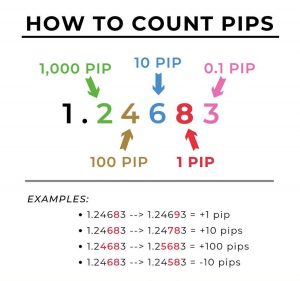

In simpler terms, a pip is the fourth decimal place movement in most currency pairs. For example, if the EUR/USD exchange rate changes from 1.1234 to 1.1235, the difference of 0.0001 represents one pip. However, there are exceptions, like the Japanese Yen (JPY) pairs, where a pip is only the second decimal place movement.

Why are Pips Important for Forex Traders?

Pips play a crucial role in determining your profit or loss on a Forex trade. The value of each pip depends on the lot size you trade, which represents the amount of currency you are buying or selling. For example, a standard lot size of 100,000 units of a base currency will result in a larger pip value than a mini lot size of 10,000 units.

To illustrate this, imagine you buy 1 standard lot of EUR/USD at an exchange rate of 1.1234. If the price rises to 1.1235, you’ve gained a pip. The actual profit in your account will depend on the pip value for a standard lot, which varies depending on the broker and the currency pair. A higher pip value means higher potential profit (or loss) for a given pip movement.

Calculating Pips: A Step-by-Step Guide

Now that you understand the concept of pips, let’s delve into the actual calculation process. The formula for calculating pips may seem daunting at first, but with a few simple steps, it becomes quite straightforward.

Image: www.newtraderu.com

1. Determining the Pip Size:

The pip size is determined based on the currency pair you are trading. For most currency pairs, the pip size is 0.0001 as mentioned earlier. However, with JPY pairs, the pip size is 0.01.

2. Finding the Pip Value:

The pip value is the monetary equivalent of one pip. It fluctuates depending on the lot size, the exchange rate, and the broker’s pricing structure.

To calculate the pip value, you can use the following formula:

Pip Value = (Pip Size / Exchange Rate) * Lot Size

Let’s break down this formula with an example.

Example: Calculating Pip Value for EUR/USD

Assume you are trading a standard lot (100,000 units) of EUR/USD, and the current exchange rate is 1.1234. Following the formula:

Pip Value = (0.0001 / 1.1234) * 100,000

Pip Value ≈ $8.90

Therefore, for this trade, each pip movement in EUR/USD is worth approximately $8.90.

Pips and Profit/Loss: A Practical Perspective

Understanding the relationship between pips and profit/loss is crucial for making informed trading decisions. The value of each pip directly impacts your potential profit or loss for a given trade.

Imagine you buy 1 mini lot (10,000 units) of EUR/USD at 1.1234 and the price rises to 1.1244, representing a 10-pip gain. With a pip value of $0.89 for a mini lot (calculated using the formula above), your total profit would be approximately $8.90 (10 pips * $0.89/pip).

However, if the price moves against you and drops to 1.1224, you’ll experience a 10-pip loss, resulting in a $8.90 loss in your account.

Strategic Considerations: Utilizing Pip Knowledge

Understanding the significance of pips allows you to develop a more strategic approach to Forex trading. This knowledge plays a crucial role in trade setup, risk management, and profit maximization.

1. Trade Setup:

Pip values can influence your choice of trade entry and exit points. For instance, when trading high-volatility currency pairs with larger pip values, you might choose to enter trades with smaller lot sizes to minimize risk per pip movement. Conversely, for low-volatility pairs with smaller pip values, you can potentially trade with larger lot sizes for greater profit potential.

2. Risk Management:

Pips also play a vital role in risk management. By calculating pip values based on your lot sizes and the currency pair you are trading, you can determine your potential maximum loss per trade. This allows you to set stop-loss orders to limit losses, protecting your capital from excessive drawdown.

3. Profit Maximization:

Understanding pips enables you to optimize your trading strategy for potential profit. You can adjust your lot sizes based on your risk tolerance and the pip values of different currency pairs. For example, you can choose to trade with larger lot sizes for high-probability setups with larger potential pip gains.

Emerging Trends and Resources: Staying Informed

The Forex market constantly evolves, and it’s crucial to stay updated on the latest trends and advancements. The concept of pips remains fundamental, but the tools and resources used for calculating and utilizing pip information continue to evolve.

Numerous online calculators and Forex trading platforms provide real-time pip value calculations based on the specific currency pairs and lot sizes you are trading. These tools make it easier to plan your trades and manage your risk in a dynamic market environment.

How Do You Calculate Pips

Conclusion: Embracing the Power of Pips

Understanding pips is not just a technical detail; it’s a fundamental key to unlocking the potential of Forex trading. By mastering the art of pip calculation and strategic application, you can navigate the intricacies of currency exchange with greater confidence and precision. Remember to stay informed about the latest trends and utilize the wealth of resources available to enhance your trading journey. Now, armed with this newfound knowledge, you are ready to embark on your Forex trading adventure, confidently leveraging the power of pips to your advantage.