As a seasoned trader, I’ve witnessed firsthand the power of technical analysis in navigating the ever-evolving financial markets. One such technique that has consistently proven its worth is Pip Count FX, a metric that measures the number of pips a currency pair has moved over a specific period. In this article, I’ll delve into the depths of Pip Count FX, providing a comprehensive overview, exploring its significance, and offering tips to harness its potential for successful trading.

Image: www.virakortho.com

Understanding Pip Count FX

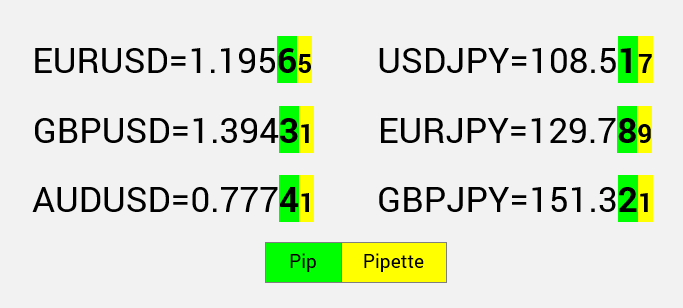

The term “pip” stands for “point in percentage.” In the context of currency pairs, a pip represents the smallest increment of change in value. Pip Count FX involves tracking the total number of pips a currency pair moves from its opening price to its closing price. This metric provides valuable insights into market volatility, momentum, and overall price action.

Significance of Pip Count FX

Pip Count FX serves as a key indicator for a number of reasons:

- **Market Volatility:** A high pip count suggests increased market volatility, making it essential for risk management.

- **Momentum:** Pip Count FX helps assess the strength or weakness of a trend based on the number of pips gained or lost.

- **Trend Direction:** The direction of the Pip Count FX movement provides clues about the prevailing trend in the market.

- **Support and Resistance:** Pip Count FX helps identify key support and resistance levels where price movements may pause.

- **Trading Opportunities:** Combining Pip Count FX with other technical indicators can highlight potential trading opportunities.

Comprehensive Overview of Pip Count FX

The Pip Count FX metric is typically calculated over a specific period, such as an hour, day, or week. It can be applied to any currency pair and calculated using the following formula:

Pip Count FX = (Closing Price – Opening Price) / Pip Value

Where:

- **Closing Price:** The end price of the currency pair for the specified period

- **Opening Price:** The start price of the currency pair for the specified period

- **Pip Value:** The value of one pip for the given currency pair

Image: otrabalhosocomecou.macae.rj.gov.br

Pip Value Calculation

The Pip Value for a currency pair is inversely proportional to its base currency’s value. For most currency pairs involving the US Dollar (USD) as the base currency, the Pip Value is as follows:

Pip Value = 0.0001

For currency pairs not involving USD as the base currency, the Pip Value can be calculated using this formula:

Pip Value = 1 / Spot Rate

Where:

- **Spot Rate:** The current market exchange rate for the currency pair

Expert Tips for Exploiting Pip Count FX

Harnessing the full potential of Pip Count FX requires careful consideration and implementation. Here are some tips to guide you:

1. Combine with Other Indicators:** Pip Count FX is an excellent indicator but should not be used in isolation. Complement it with other technical indicators like moving averages, RSI, and Bollinger Bands for a comprehensive view of market movements.

2. Contextualize Pip Count FX:** The significance of Pip Count FX varies depending on the time frame and market conditions. Assess the overall market sentiment and trading volume to gain a better understanding of the metric.

FAQs on Pip Count FX

Q: What is the typical time frame for measuring Pip Count FX?

A: Pip Count FX can be calculated for any time frame, but common intervals include hourly, daily, weekly, and monthly charts.

Q: Can Pip Count FX predict future price movements?

A: Pip Count FX on its own cannot predict future prices but provides valuable historical and current market context to inform trading decisions.

Q: How do I interpret a high Pip Count FX?

A: A high Pip Count FX indicates increased volatility, momentum, and potential market uncertainties. Traders should adjust their risk management strategies accordingly.

Pip Count Fx

Conclusion

Pip Count FX is an invaluable tool for Forex traders, offering insights into market volatility, trend momentum, and potential trading opportunities. By mastering its calculation and application, traders can enhance their understanding of market movements and make more informed trading decisions. Whether you’re a seasoned professional or a novice trader, I encourage you to add Pip Count FX to your technical analysis toolbox. delving into the latest trends, expert advice, and strategies will help you maximize the power of Pip Count FX for successful trading.

Are you ready to elevate your trading game with Pip Count FX? If this article has ignited your interest, I highly recommend exploring additional resources and engaging in discussions with fellow traders to deepen your knowledge and unlock the full potential of this powerful technical indicator.