Forex trading, the vast and exhilarating realm where global currencies dance and intertwine, presents traders with a tantalizing prospect: the allure of consistent profit. Traders across the globe have long sought the holy grail of a foolproof strategy that guarantees steady gains, and the concept of “10 pips a day” has emerged as a beacon of hope in this relentless pursuit. In this comprehensive guide, we will delve into the intricacies of this trading strategy and unravel the secrets to achieving consistent profitability in the forex market.

Image: tradingstrategyguides.com

What is the “10 Pips a Day” Strategy?

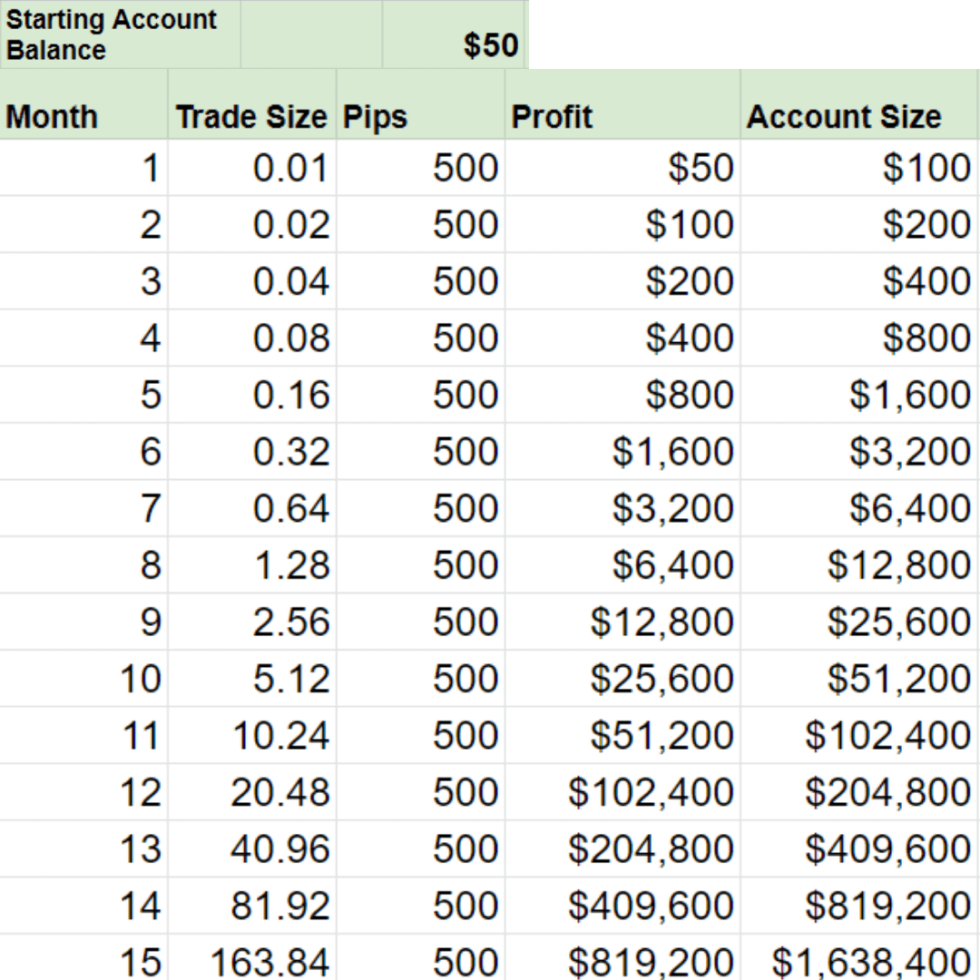

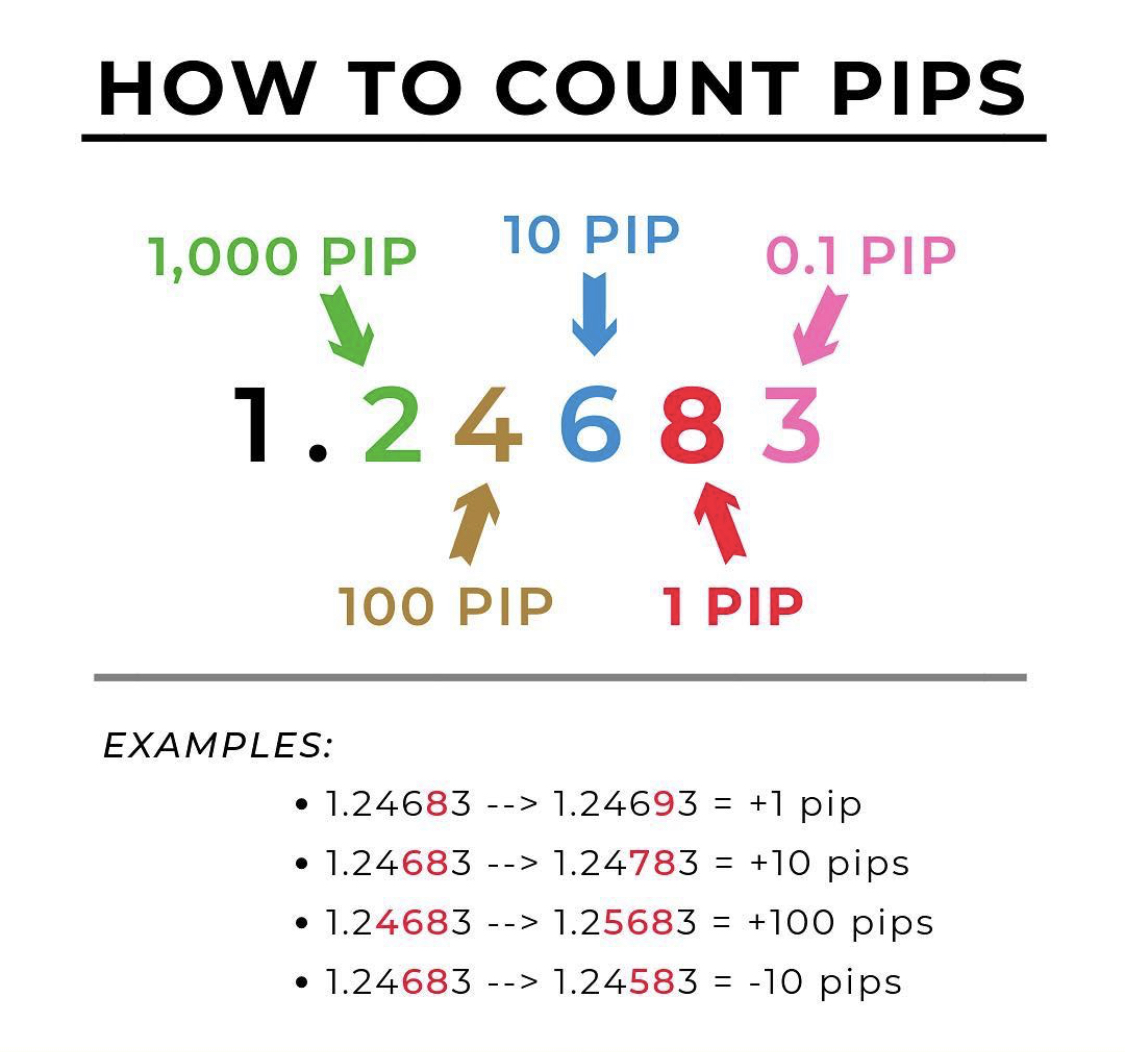

The “10 pips a day” strategy revolves around the premise that traders can secure consistent profits by aiming to make small, but consistent, gains each trading day. A pip, or “point in percentage,” represents the smallest unit of movement in currency exchange rates. Hence, targeting 10 pips a day translates to seeking a consistent profit of 10 basis points (0.0010) in a single currency pair. While this may seem modest, the power of compounding these small gains over time can lead to significant returns.

Why is Consistency Crucial in Forex Trading?

The forex market is renowned for its volatility and unpredictability. Market conditions can shift rapidly, and even seasoned traders can experience periods of loss. Embracing the “10 pips a day” strategy emphasizes consistency over unpredictable windfalls. By focusing on accumulating small but steady gains, traders can mitigate the impact of market fluctuations and build a robust foundation for long-term profitability.

How to Implement the “10 Pips a Day” Strategy

-

Choose the Right Currency Pair: Not all currency pairs are created equal in terms of volatility and liquidity. Traders aiming for 10 pips a day should focus on currency pairs known for their consistent price movements, such as EUR/USD, GBP/USD, or USD/JPY.

-

Establish a Trading Plan: A well-defined trading plan is the cornerstone of successful forex trading. Determine your entry and exit points, as well as your stop-loss and take-profit levels. A clear trading plan helps eliminate emotional decision-making and instills discipline in your approach.

-

Utilize Technical Analysis: Technical analysis involves studying price charts to identify price patterns and trends. Indicators such as moving averages, Fibonacci retracements, and support and resistance levels can provide valuable insights into potential trading opportunities.

-

Risk Management: Forex trading involves risk, and it is essential to implement sound risk management strategies. Determine your risk tolerance and trade within your limits. Utilize stop-loss orders to mitigate potential losses and protect your capital.

-

Discipline and Psychology: Forex trading is a marathon, not a sprint. Maintaining discipline and controlling emotions is paramount. Avoid rash decisions or chasing losses. Embracing a patient and logical approach will enhance your chances of long-term success.

Image: www.newtraderu.com

Benefits of Aiming for 10 Pips a Day

-

Consistency: By targeting small, achievable goals, traders can establish a foundation for consistent profit generation.

-

Risk Mitigation: Targeting 10 pips a day encourages smaller position sizes, thereby reducing potential losses.

-

Psychological Advantage: Achieving consistent small gains can boost confidence and reduce stress, fostering a positive trading mindset.

-

Compounding Gains: Over time, these consistent small gains can accumulate into substantial returns through the power of compounding.

Forex 10 Pips A Day

Conclusion

The “10 pips a day” strategy is a viable approach for forex traders seeking consistent profitability. By adhering to a disciplined trading plan, utilizing sound risk management techniques, and embracing a patient mindset, traders can navigate the complexities of the forex market and secure steady gains. While no trading strategy guarantees foolproof success, targeting 10 pips a day can provide a roadmap to long-term profitability and empower traders to achieve their financial aspirations. Remember, trading forex involves risk, and it is essential to conduct thorough research and understand the market before making any trades.