Introduction

The allure of the elusive forex “Holy Grail” has tantalized traders for decades, promising a path to consistent profitability in the treacherous waters of currency markets. While no single indicator can guarantee infallible success, there are certain MT4 indicators that, when wielded skillfully, can significantly enhance trading strategies. This comprehensive guide will delve into the world of forex Holy Grail MT4 indicators, empowering you with the knowledge to discern their strengths and weaknesses, and harness their potential to maximize your trading prowess.

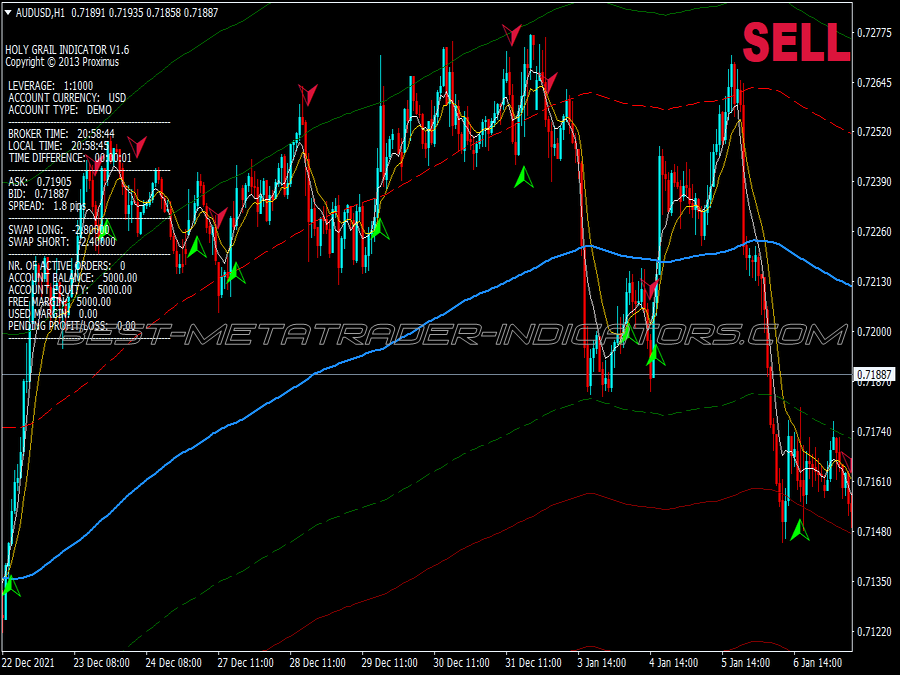

Image: www.best-metatrader-indicators.com

Understanding Forex Holy Grail MT4 Indicators

Holy Grail indicators are technical analysis instruments that profess to provide traders with an edge over the market by identifying high-probability trading opportunities. These indicators are typically characterized by sophisticated algorithms and complex calculations, and their creators often tout them as the ultimate solution to the unpredictable nature of currency markets. While some indicators may indeed offer valuable insights, it’s crucial to approach them with healthy skepticism and a clear understanding of their limitations.

A Journey into the World of MT4 Indicators

Trend Indicators

Trend indicators gauge the overall direction of the market and help traders identify potential trend reversals. Popular trend indicators include Moving Averages, Bollinger Bands, and Relative Strength Index (RSI). By analyzing price movements in relation to these indicators, traders can gain insights into prevailing market trends and make informed decisions.

Image: www.metatrader4indicators.com

Oscillators

Oscillators measure price action within a defined range and indicate whether the market is overbought or oversold. Some well-known oscillators include Stochastic Oscillator, MACD, and Williams’ %R. Oscillators are particularly useful for detecting potential market turning points, helping traders to anticipate potential reversals.

Volume Indicators

Volume indicators measure the volume of trades executed within a specified period. By analyzing market volume, traders can gauge the underlying strength or weakness of a trend, providing valuable insights into the market’s sentiment and potential future price movements. Popular volume indicators include Volume, Chaikin Money Flow, and On Balance Volume (OBV).

Custom Indicators

Beyond the standard set of MT4 indicators, traders can also create their own custom indicators using the MetaTrader programming language, MQL4. Custom indicators allow traders to tailor technical analysis tools to their specific trading styles and preferences. However, it’s important to note that custom indicators should be approached with caution and subjected to rigorous testing before being deployed in live trading.

Expert Insights and Actionable Tips

The Wisdom of Experienced Traders

“Holy Grail indicators should be used as complementary tools to enhance your trading strategies, not as standalone decision-making systems,” advises renowned forex trader George Soros. “Trust your instincts, manage your risk, and never chase losses.”

Using Indicators Effectively

- Integrate multiple indicators to provide a more comprehensive view of the market.

- Use indicators to confirm existing trading signals rather than rely solely on them.

- Backtest and forward-test indicators thoroughly before using them in live trading.

- Calibrate indicators to match your trading style and market conditions.

Forex Holy Grail Mt4 Indicators

Conclusion

Forex Holy Grail MT4 indicators can be powerful tools in the hands of skilled traders. By understanding the strengths and limitations of these indicators, and applying them judiciously within a comprehensive trading strategy, you can significantly enhance your chances of navigating the turbulent seas of currency markets. Remember, trading success is not merely about finding the perfect indicator but rather about developing a well-rounded approach that leverages both technical analysis and sound money management principles. Embrace the knowledge presented in this guide, continue to refine your trading skills, and embark on a path toward consistent profitability.