Navigating the world of forex trading can be a daunting task, especially for beginners. One of the initial hurdles you may encounter is the dreaded forex application rejection. HDFC Bank, among India’s leading financial institutions, has stringent criteria for its forex services. Facing a rejection from their forex application can be disheartening, but understanding the reasons behind it can help you rectify the situation and secure a successful application.

Image: www.forex.academy

Defining Forex and HDFC’s Role

Forex, short for foreign exchange, involves the exchange of currencies between different countries. HDFC Bank offers forex services to facilitate international transactions for individuals and businesses alike. These services include remittances for overseas education, travel, and business ventures, as well as currency hedging and trading.

Understanding Reasons for HDFC Forex Application Rejection

HDFC Bank meticulously evaluates forex applications to ensure compliance with regulatory guidelines and safeguard against potential risks. Here are some common reasons why your application may have been rejected:

- Incomplete or inaccurate information: Ensure all the information provided in your application, including personal details, financial statements, and travel documents, is accurate and complete.

- Insufficient documentation: Gather all the necessary documents as per HDFC Bank’s requirements. These may include income proof, identity proof, and purpose of transaction.

- Eligibility criteria not met: HDFC Bank has specific eligibility criteria for forex applicants, such as a minimum income level or purpose of transaction within specific limits. Check if you meet these criteria before applying.

- Adverse credit history: HDFC Bank may review your credit history to assess your financial standing. Any late payments or outstanding balances can impact your application.

- Suspicious transaction or misuse: Forex services are often monitored to prevent illegal activities. Any suspicious activity or concern regarding misuse of forex facilities can lead to application rejection.

Rectifying and Reapplying for Your HDFC Forex Application

If your HDFC forex application has been rejected, don’t be disheartened. Here are steps to rectify the issue and reapply:

- Review the rejection letter: Carefully examine the rejection letter to understand the specific reason for denial.

- Gather additional documentation: If incomplete documentation was the cause, gather the missing documents and attach them to your new application.

- Check eligibility criteria: Ensure you meet all the eligibility criteria, such as income level and purpose of transaction.

- Improve credit history: If adverse credit history is a concern, work on improving your score by making timely payments and managing debt.

- Avoid suspicious transactions: Use forex services strictly for legitimate purposes and avoid activities that may raise red flags.

- Reapply with accuracy: Submit a new application with accurate and complete information, addressing the concerns raised in the rejection letter.

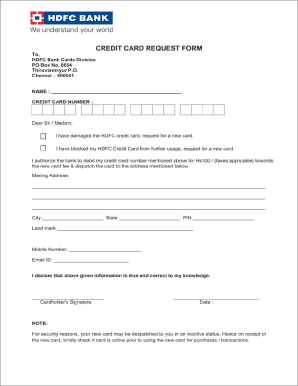

Image: www.pdffiller.com

Additional Tips for Successful Reapplication

- Contact HDFC Bank’s customer service to clarify any doubts or seek assistance with the application process.

- Keep a record of your application and supporting documents for future reference.

- Be patient and follow HDFC Bank’s guidelines closely. Reapplying with the necessary corrections will increase your chances of approval.

My Hdfc Forex Application Is Rejected

Conclusion

Navigating the complexities of forex application rejections can be challenging. However, by understanding the reasons behind rejections and taking the necessary steps to rectify them, you can increase your chances of securing an approved HDFC forex application. Remember to double-check your application for accuracy, gather relevant supporting documents, and adhere to the bank’s guidelines. With a proactive approach, you can overcome the hurdles and embark on your forex endeavors without further delays.