In the realm of foreign exchange (forex) trading, the 10 pips a day strategy stands out as a compelling approach for aspiring traders seeking consistent returns. This strategy revolves around targeting a modest profit of 10 pips per day, effectively aiming for a realistic and achievable goal amidst the inherent volatility of currency markets.

Image: thisisforextrading.blogspot.com

Unlike the allure of overnight riches that often permeates forex marketing, the 10 pips a day strategy embraces a steady and disciplined approach. By focusing on accumulating small, incremental gains, traders can mitigate the psychological burden of pursuing unrealistic targets and enhance their long-term profitability.

Understanding the Concept of Pips and Leverage

Before delving into the intricacies of the 10 pips a day strategy, it’s crucial to elucidate the concept of pips and leverage. Pips, short for “percentage in points,” represent the smallest price increment in which a currency pair can fluctuate. Forex brokers offer varying types of leverage, which allows traders to effectively magnify their buying power. While leverage can amplify potential profits, it’s equally important to exercise caution and implement proper risk management techniques to mitigate potential losses.

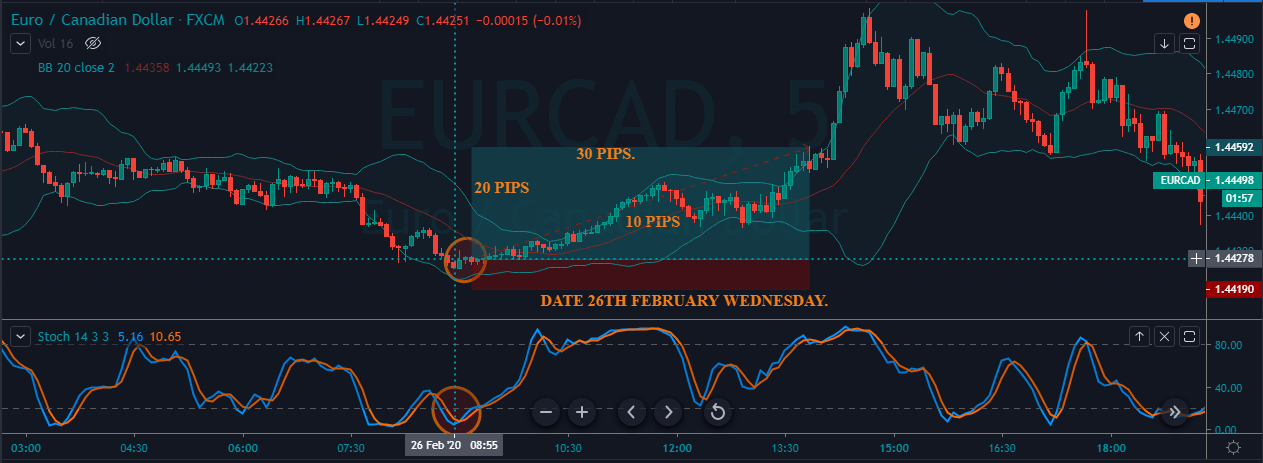

Defining the 10 Pips a Day Strategy

As the cornerstone of this strategy, the 10 pips a day target translates to 10 units of the currency being quoted. For instance, if you trade the EUR/USD currency pair, 10 pips would equate to 10 units of the quoted currency (USD). This equates to a potential profit of $10 for every 100,000 units traded, yielding a daily return of 0.01%.

Market Selection and Volatility Assessment

In selecting suitable currency pairs for the 10 pips a day strategy, it’s imperative to consider market volatility. Currency pairs with higher volatility, such as EUR/USD or GBP/USD, tend to present greater opportunities for achieving daily pips targets. The rationale behind this lies in the wider price swings, which facilitate the accumulation of 10 pips within a single trading session.

However, it’s equally important to assess risk-to-reward ratios. While higher volatility offers increased profit potential, it concomitantly amplifies potential losses. Hence, a judicious balance between volatility and risk appetite is key to successful trading.

Image: www.forex.academy

Trading Techniques and Risk Management

The 10 pips a day strategy encompasses a wide array of trading techniques, ranging from scalping and day trading to trend following and swing trading. Scalping involves capitalizing on minute price movements, aiming to extract profits from fleeting market inefficiencies. Day trading encompasses buying and selling within a single trading day, while trend following entails aligning trades with prevailing market momentum. Swing trading seeks to capture price swings that span multiple days or even weeks.

Risk management remains paramount in all trading endeavors, and the 10 pips a day strategy is no exception. Adhering to a robust risk-to-reward ratio, implementing stop-loss orders to limit potential losses, and allocating only a fraction of one’s capital to each trade are integral components of prudent trading practices.

Advantages and Pitfalls of the 10 Pips a Day Strategy

The 10 pips a day strategy offers several compelling benefits, including its realistic profit target, which aligns with the realities of forex market fluctuations. By aiming for a modest and achievable goal, traders can mitigate the psychological pressures associated with pursuing unsustainable targets. Additionally, the strategy’s suitability for a wide range of market conditions enhances its versatility.

Notwithstanding these advantages, the strategy is not devoid of potential pitfalls. The daily pips target may occasionally prove elusive, particularly during periods of low market volatility. Moreover, the strategy demands consistent discipline and adherence to predefined rules, which can be challenging to maintain over extended periods.

10 Pips A Day Forex Strategy

Conclusion

The 10 pips a day forex strategy presents a viable approach for aspiring traders seeking steady and manageable returns. By targeting achievable daily profits, employing prudent risk management techniques, and exercising discipline in trade execution, traders can increase their chances of long-term profitability. While the markets will inevitably present periods of challenge, the 10 pips a day strategy provides a solid foundation for navigating the ever-evolving forex landscape. Remember, consistent profits in forex trading are not a sprint but a marathon, and the 10 pips a day strategy embodies this ethos, offering a path towards gradual and sustainable wealth accumulation.