Introduction

Embarking on the journey of forex trading necessitates a deep understanding of the underlying forces driving currency market fluctuations. Fundamental analysis, the cornerstone of informed trading decisions, empowers traders with the knowledge of economic, political, and sociological factors that shape currency behavior. This article delves into the realm of fundamental analysis, illuminating its significance and equipping traders with a comprehensive guide to the best books that will enhance their analytical prowess.

Image: www.forex4you.com

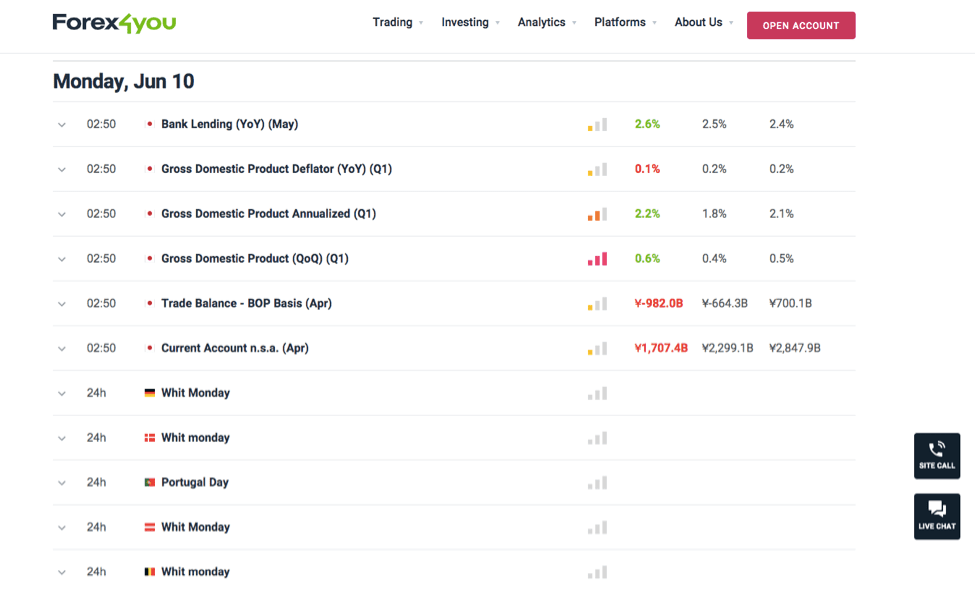

Fundamental analysis is an indispensable approach for traders seeking to uncover the intrinsic value of currencies. This rigorous methodology meticulously dissects macroeconomic indicators, such as gross domestic product (GDP), inflation data, interest rates, and political events, to discern patterns and gauge their impact on currency movements. By comprehending the cause-and-effect relationships within the global economy, traders can anticipate market trends and make informed trading decisions that capitalize on these shifts.

1. Mastering the Art of Currency Trading by Kathy Lien

Kathy Lien, a renowned expert in forex trading, unveils a treasure trove of insights within the pages of her seminal work. “Mastering the Art of Currency Trading” unravels the intricacies of fundamental analysis, enabling traders to decipher economic data and news events with precision. Lien’s lucid explanations and pragmatic approach empower readers to confidently navigate the ever-evolving currency markets.

2. Forex: A Guide to Fundamental Analysis by Chris Lori

This comprehensive tome from Chris Lori is a testament to the efficacy of fundamental analysis in the world of forex trading. Lori meticulously explores macroeconomic concepts, arming traders with a deep understanding of the factors that influence currency dynamics. Case studies and real-world examples provide a hands-on approach, solidifying the reader’s grasp of fundamental analysis techniques.

3. Forex Fundamental Analysis: The Art and Science of Predicting Currency Directions by John J. Murphy

A pioneer in technical analysis, John J. Murphy brings his expertise to the realm of fundamental analysis in this authoritative guide. Murphy meticulously examines the interplay between economic indicators and currency movements, illuminating the interconnections that drive market behavior. His insights empower traders to develop a discerning eye for detecting market shifts and exploiting trading opportunities.

Image: oliviacharlton.z21.web.core.windows.net

4. The Forex Trading Course: A Complete Guide to Fundamental and Technical Analysis by Larry Pesavento

Larry Pesavento’s magnum opus offers a holistic approach to currency trading, encompassing both fundamental and technical analysis. This comprehensive guide delves into the intricacies of economic indicators, providing a roadmap for interpreting their implications for currency performance. Pesavento’s clear writing style and practical examples make this book an invaluable resource for aspiring and seasoned traders alike.

5. Forex Trading Strategies: Discover How to Trade Forex Like a Pro by Jim Brown

Jim Brown’s “Forex Trading Strategies” uncovers the secrets to successful forex trading, emphasizing the profound role of fundamental analysis. Brown methodically guides readers through the analysis of economic data, political events, and central bank policies, demonstrating their impact on currency valuations. His cogent strategies empower traders to formulate well-informed trading decisions that exploit market inefficiencies.

Best Forex Fundamental Analysis Books

Conclusion

Fundamental analysis reigns supreme as the cornerstone of successful forex trading, elucidating the connections between economic events and currency movements. The books presented in this article equip traders with a profound understanding of this vital approach, empowering them to make informed trading decisions and navigate the complexities of the currency markets with confidence. By delving into these authoritative works, traders can unlock their full potential and embark on a path toward consistent profitability.