Are you worried about your Forex derivative contract expiring? Don’t panic! Understanding the nuances of derivative contracts and their expiration can help you navigate this process seamlessly. This comprehensive guide will empower you with the knowledge and strategies to effectively manage your Forex derivative contract expiry, ensuring that you make informed decisions and protect your investments.

Image: www.forex.academy

Forex Derivative Contracts: An Introduction

Forex derivative contracts are an agreement between two parties to exchange a specific amount of currency at a predetermined rate on a future date. They serve as powerful tools for managing risk, speculation, and hedging in the Forex market. Forex derivative contracts derive their value from the underlying asset, in this case, the currency pair, and provide leverage to traders, enabling them to control a larger position with a smaller investment.

Key Considerations for Contract Expiry

The expiry date of a Forex derivative contract is a crucial factor that determines the settlement and potential profit or loss outcome. Here are the key considerations to keep in mind:

- Settlement Date: This is the date on which the contract expires and the exchange of currencies occurs.

- Expiration Price: The expiration price is the exchange rate of the currency pair at the time of contract expiry.

- Settlement Price: The settlement price is the average of the expiration price and the closing price of the currency pair on the settlement date.

- Profit and Loss (P&L): Your P&L is calculated based on the difference between the contract price and the settlement price.

Understanding the Contract Expiry Process

The expiry process of a Forex derivative contract is straightforward:

- Notification: Prior to contract expiry, you will receive a notification from your broker.

- Physical Settlement (Deliverable Futures): Deliverable futures are physically settled, meaning you will physically exchange the agreed-upon currencies.

- Cash Settlement (Non-Deliverable Forwards): Non-deliverable forwards are settled in cash. The difference between the contract price and the settlement price is paid to or by you.

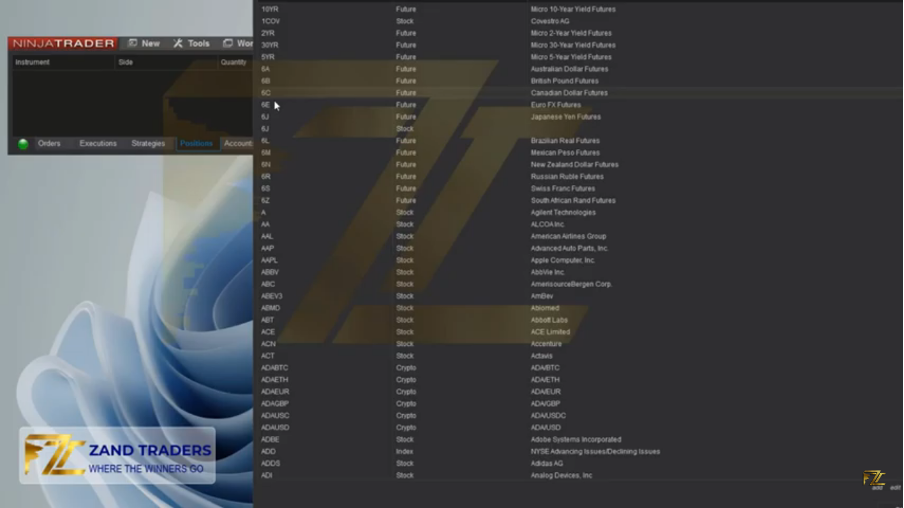

Image: zandtraders.com

Tips and Expert Advice for Managing Expiry

To effectively manage your Forex derivative contract expiry, consider these tips from seasoned traders:

- Monitor Market Conditions: Keep a close eye on the market conditions and currency pair performance leading up to expiry.

- Adjust Positions: If market conditions are unfavorable, consider adjusting your positions or using hedging strategies to mitigate risk.

- Plan for Settlement: Decide how you will settle the contract, whether through physical or cash settlement, and ensure you have sufficient funds or currency for delivery.

- Seek Professional Advice: Consult with your broker or a financial advisor for guidance and support.

Frequently Asked Questions (FAQs)

Q: What happens if I hold a Forex derivative contract past its expiry?

A: Holding a contract past expiry is generally not advisable. You will likely incur additional charges and may be forced to close the position at an unfavorable rate.

Q: How do I know if my contract is physically or cash settled?

A: Check the contract specifications or contact your broker to confirm the settlement method.

Q: Can I extend the expiry date of my contract?

A: In some cases, you may be able to roll over your contract to a later date, but this can incur additional costs.

The Forex Derivative Contract Expires On The

Conclusion

The world of Forex derivative contracts and their expiry can seem daunting at first, but by equipping yourself with the knowledge and strategies outlined in this guide, you can navigate the process with confidence. Remember to carefully consider the key factors, monitor market conditions, plan for settlement, and don’t hesitate to seek professional advice when needed. Embrace the opportunities and challenges that Forex derivative contracts present, and strive to make informed decisions that optimize your returns and mitigate risks.

Are you ready to embark on the exciting journey of Forex derivative contracts? Let us guide you every step of the way with our expert insights and comprehensive support.