Introduction:

Image: mytradingskills.com

In the dynamic realm of forex trading, where currency exchange rates fluctuate relentlessly, understanding the underlying forces that drive these movements is paramount. Enter fundamental analysis, a potent analytical tool that empowers traders by examining macroeconomic and geopolitical factors to unravel the intrinsic value of currencies. This intricate process delves into financial, economic, and political data to provide traders with invaluable insights that can illuminate market trends and predict future currency movements. Join us on this comprehensive journey as we delve into the intricacies of fundamental analysis for forex, unearthing its secrets and unlocking its potential to transform your trading strategies.

Understanding Fundamental Analysis: A Cornerstone of Currency Market Insight

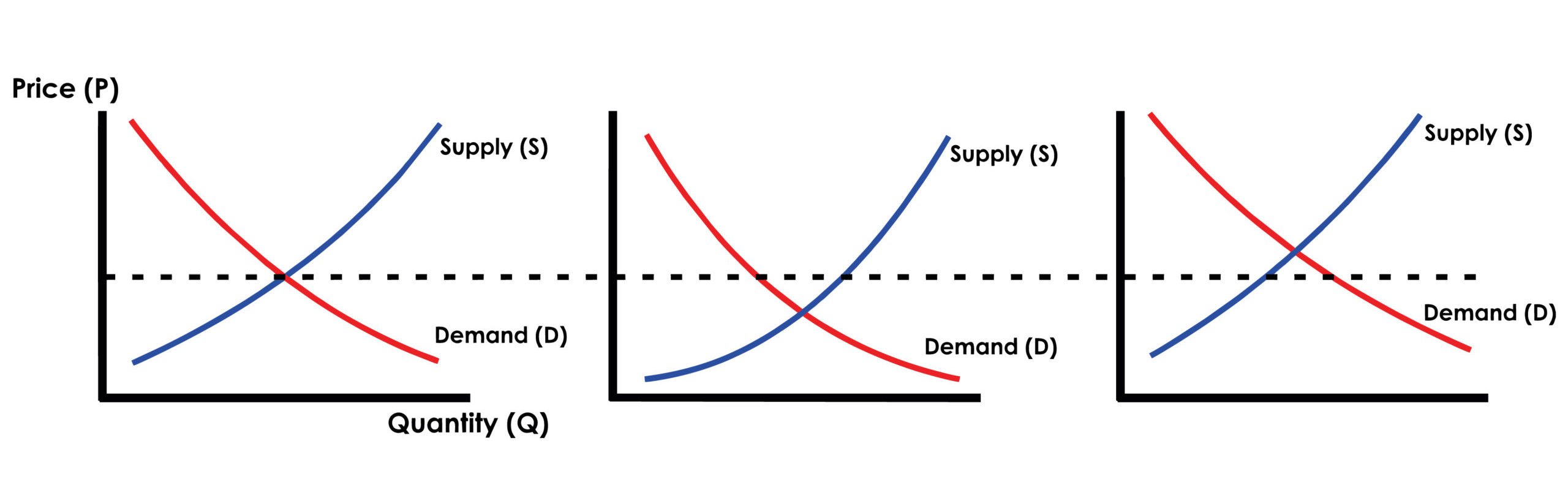

Fundamental analysis, the backbone of currency trading, scrutinizes the economic, political, and societal factors that influence the value of a currency. It’s not just about analyzing company financials; it’s about understanding the health of an entire country or region. By dissecting factors like GDP growth, inflation, interest rates, political stability, and trade balances, fundamental analysis provides a comprehensive understanding of the intrinsic value of a currency, illuminating the reasons behind its fluctuations.

Navigating the Macroeconomic Labyrinth: Key Economic Indicators

Central to fundamental analysis is the mastery of macroeconomic indicators, statistical signposts that provide real-time insights into a nation’s economic health. Gross Domestic Product (GDP), the total market value of all goods and services produced within a country’s borders, stands as a crucial metric for economic growth and stability. Inflation, the rate at which prices for goods and services rise, holds significant sway over central bank policies and currency valuations. Interest rates, the cost of borrowing money, influence investment decisions and currency flows, while unemployment rates reflect labor market conditions and overall economic vitality.

Political and Social Landscapes: Unveiling the Intangibles

Beyond economic data, fundamental analysis delves into the political and social landscapes of nations, recognizing their profound impact on currency valuations. Political stability, governance quality, and international relations can significantly affect investor confidence and currency demand. Social unrest, geopolitical tensions, and natural disasters can trigger market volatility and alter currency trajectories. By staying abreast of current events and understanding their potential implications, traders gain an edge in anticipating market shifts.

Central Bank Policies: Deciphering the Masters of Currency

Central banks, the guardians of monetary policy, play a pivotal role in shaping currency values. Their decisions on interest rates, quantitative easing, and other measures can have a profound impact on currency markets. Understanding central bank mandates and policy stances becomes essential for anticipating future rate hikes or cuts, which can significantly influence currency values and trading strategies.

Real-World Applications: Unleashing the Power of Fundamental Analysis

The practical applications of fundamental analysis in forex trading are far-reaching, empowering traders with the ability to make informed decisions based on a holistic understanding of market fundamentals. By aligning trades with underlying economic trends, identifying undervalued or overvalued currencies, and anticipating central bank actions, traders gain a competitive edge in navigating market fluctuations. From long-term strategic planning to short-term tactical moves, fundamental analysis provides the necessary insights to optimize trading outcomes.

Case Study: Unraveling the Euro’s Economic Entanglement

To illustrate the practical power of fundamental analysis, let’s examine the euro. As the currency of the Eurozone, comprising 19 member states, the euro’s value is influenced by a complex interplay of economic indicators and political dynamics. By closely monitoring Eurozone GDP growth, inflation, interest rate decisions by the European Central Bank (ECB), and political developments within individual member states, traders can gauge the overall health of the currency and make informed trading decisions.

Conclusion: Unlocking Currency Market Mastery with Fundamental Analysis

Mastering fundamental analysis is akin to acquiring a superpower in the competitive forex trading arena. It empowers traders with the ability to decipher the intricate interplay of economic, political, and social factors that drive currency movements. By embracing this analytical approach, traders gain a profound understanding of the intrinsic value of currencies, enabling them to navigate market fluctuations with greater precision and achieve consistent trading success. As the famous trader George Soros once said, “The more you know about the fundamentals, the better you can anticipate market moves.” Delve into the world of fundamental analysis today and unlock the secrets of currency market dominance.

Image: forextraderprofit.com

How To Do Fundamental Analysis Forex