In the ever-evolving world of forex trading, technical analysis reigns supreme. Among the myriad of indicators that traders rely upon, the 200 Exponential Moving Average (200 EMA) stands as a beacon of reliability and effectiveness. Whether you’re a seasoned professional or a burgeoning novice, understanding the nuances of this remarkable indicator can empower you to unlock trading opportunities and navigate market fluctuations with confidence.

Image: www.forextrading200.com

Delving into the Essence of the 200 EMA

The 200 EMA, a powerful trend-following indicator, is a moving average that assigns greater weight to recent price action. It provides traders with a clear visualization of the long-term trend of a currency pair, helping them identify potential support and resistance levels.

The calculation of the 200 EMA involves considering the closing prices of a currency pair over the past 200 trading periods. By smoothing out price fluctuations, the 200 EMA eliminates noise and reveals the underlying trend, which is crucial for making informed trading decisions.

Unveiling the Multifaceted Applications of the 200 EMA

The versatility of the 200 EMA extends far beyond its ability to depict long-term trends. Traders employ it in a multitude of scenarios, including:

-

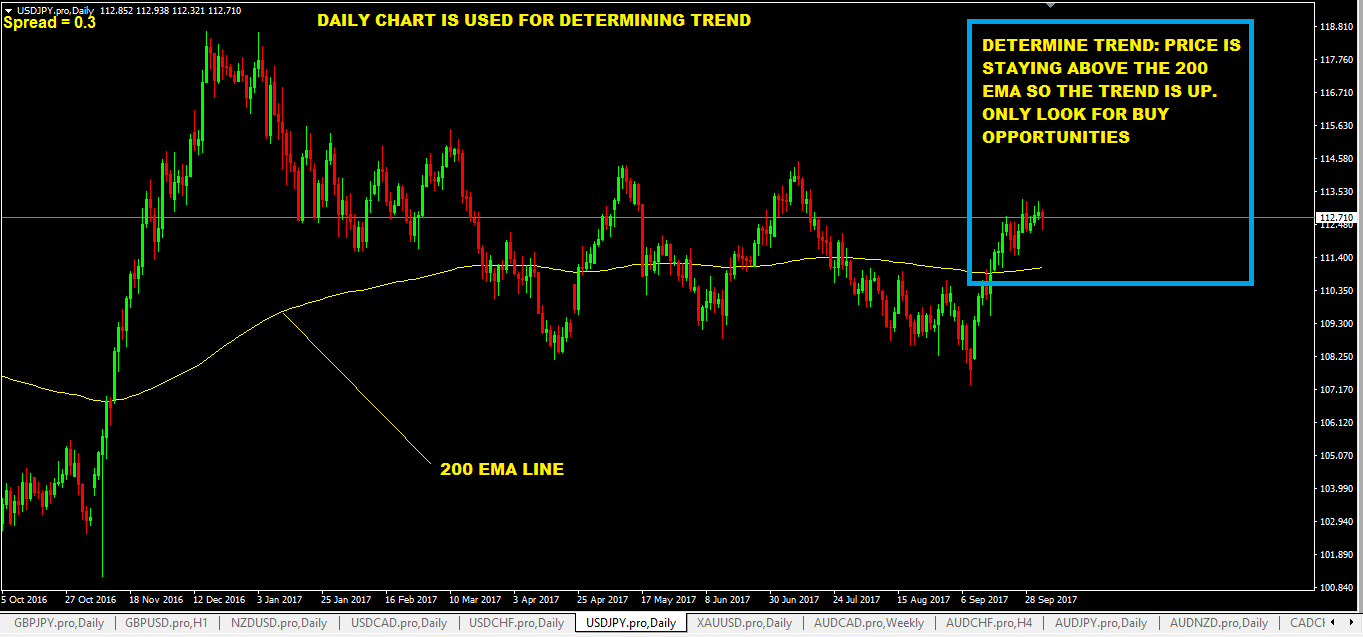

Identifying Trading Opportunities: When the price of a currency pair crosses above the 200 EMA, it often signals a potential buying opportunity. Conversely, a price crossing below the 200 EMA may indicate a selling opportunity.

-

Determining Support and Resistance Levels: The 200 EMA frequently acts as a dynamic support or resistance level. A sustained break above the 200 EMA suggests a bullish trend, while a sustained break below indicates a bearish trend.

-

Confirming Trend Reversals: A change in the relationship between the price and the 200 EMA can provide valuable insights into potential trend reversals.

Navigating the intricacies of 200 EMA Trading Strategies

While the 200 EMA is an invaluable tool, its effective utilization requires a strategic approach:

-

Identifying Long-Term Trends: Before implementing any trading strategy, it is essential to assess the overall trend of the currency pair using the 200 EMA. Trading in alignment with the trend increases the probability of success.

-

Employing a Confirmation Indicator: Combining the 200 EMA with other technical indicators, such as the Relative Strength Index (RSI) or the Stochastic Oscillator, can provide additional confirmation for trading decisions.

-

Managing Risk: Implementing a sound risk management strategy is paramount. This includes setting appropriate stop-loss and take-profit levels and managing position sizing prudently.

-

Adapting to Market Conditions: The forex market is highly dynamic, and traders must adapt their 200 EMA strategies accordingly. This may involve adjusting the parameters of the moving average or incorporating additional indicators to account for changing market conditions.

Image: forexwot.com

Seeking Wisdom from Trading Experts

To refine your understanding of the 200 EMA and its practical applications, consider these insights from renowned trading experts:

-

“The 200 EMA is my anchor indicator. It provides me with a clear understanding of the long-term trend and helps me identify potential trading opportunities.” – George Soros, legendary hedge fund manager

-

“When the price is above the 200 EMA and the RSI is overbought, it’s time to take profits.” – Mark Douglas, author of “Trading in the Zone”

Embracing the Future of 200 EMA Trading

The 200 EMA continues to evolve, with advancements in technology and analytical techniques opening up new possibilities. Traders can now access sophisticated software that automates the calculation of the 200 EMA and provides real-time updates, streamlining the trading process.

Moreover, the integration of artificial intelligence (AI) is enhancing the accuracy and reliability of 200 EMA-based trading strategies. AI algorithms can analyze vast amounts of market data and identify patterns invisible to the naked eye, providing traders with a competitive edge.

200 Ema Forex Trading Strategy

Conclusion: Unlocking the Power of the 200 EMA

The 200 EMA stands as an indispensable tool for forex traders seeking to navigate the complexities of the market. By understanding its nuances, incorporating it into your trading strategies, and embracing its ongoing evolution, you can unlock the potential to make informed trading decisions and achieve your financial goals. Remember that mastery of the 200 EMA is a journey, and with dedication and practice, you can harness its power to unlock trading success. Embrace the 200 EMA, and witness the transformative impact it can have on your forex trading endeavors.