In the relentless world of global finance, the foreign exchange (forex) market stands as a colossal titan, facilitating trillions of dollars in currency transactions each day. But even this mighty entity bows to the necessity of rest, observing specific closing hours that leave traders eagerly anticipating its reopening. Join us as we delve into the reasons behind these periodic pauses and uncover the factors that dictate when the forex market slumbers.

Image: victoriana.com

An Eternal Dance of Currencies

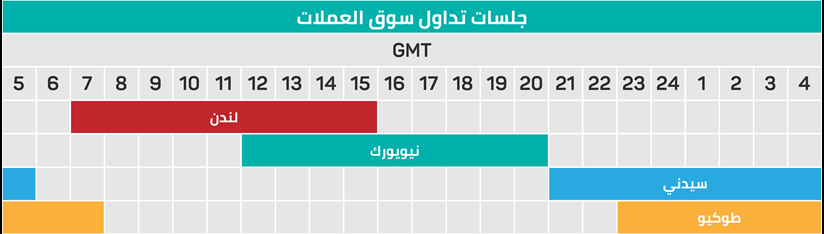

The forex market is an over-the-counter marketplace where currencies are traded 24 hours a day, five days a week. This perpetual motion allows traders to seize opportunities and mitigate risks irrespective of time zones. However, like all engines, the forex market requires occasional periods of inactivity to recalibrate and prepare for the ensuing trading day.

When Shadows Fall: Acknowledging Market Closures

Recognizing the need for orderly market operations, forex market participants have established standardized closing hours. While specific times may vary depending on the underlying asset being traded, the following general guidelines apply:

- Spot Forex: Typically closes at 5:00 PM EST on Fridays and reopens at 5:00 PM EST on Sundays.

- Futures and Options: Adhere to the closing times of their respective exchanges. For instance, the Chicago Mercantile Exchange (CME) closes at 4:00 PM EST for forex futures and options.

Reasons for the Respite: Delving into the Rationale

The rationale behind forex market closures stems from a confluence of factors:

Settlement and Reconciliation: Closing hours facilitate the settlement and reconciliation of trades, ensuring accurate record-keeping and minimizing operational risks.

Market Liquidity: Pausing trading activity allows market participants to assess their positions, manage risk, and prepare for the upcoming trading day.

Technical Maintenance: Closures provide an opportunity for exchanges and trading platforms to perform essential maintenance and upgrades.

Regulatory Compliance: Adhering to closing hours helps exchanges and brokers comply with regulatory requirements and maintain market stability.

Image: mbfxforexsystemfreedownload.blogspot.com

Embracing the Silence: Leveraging Closures for Strategic Advantage

While market closures may temporarily halt trading activity, savvy traders can harness this period to their advantage:

-

Position Review: Utilize the respite to scrutinize open positions, identify areas for improvement, and devise refined trading strategies.

-

Risk Management: Assess overall risk exposure and make necessary adjustments to minimize potential losses during the next trading day.

-

Education and Research: Dedicate time to expanding market knowledge, honing analytical skills, and exploring new trading opportunities.

-

Market News Analysis: Stay abreast of market-moving events and news releases that may impact future trading decisions.

Why Is Forex Market Closed

Conclusion: Embracing the Rhythms of the Forex Market

The forex market’s periodic closures are an integral aspect of its operation, providing a necessary pause for recalibration, settlement, and strategic planning. By understanding the reasons behind these closures and leveraging the downtime effectively, traders can optimize their trading strategies and position themselves for success when the market reopens. As the sun sets on the forex market, embrace the silence not as a hindrance but as an opportunity to refine your skills and emerge stronger on the next trading day.