Navigating the Currency Conversion Conundrum

In the tapestry of global financial transactions, understanding currency exchange rates is paramount. When venturing beyond your home borders, the task of navigating currency conversions can often elicit trepidation. Amidst a myriad of options, the Syndicate Bank Forex Card offers a compelling solution for seamless and cost-effective currency conversions. Embark on this journey as we unravel the intricacies of the Syndicate Bank Forex Card rate, empowering you with the knowledge to make informed decisions and conquer the foreign exchange landscape with confidence.

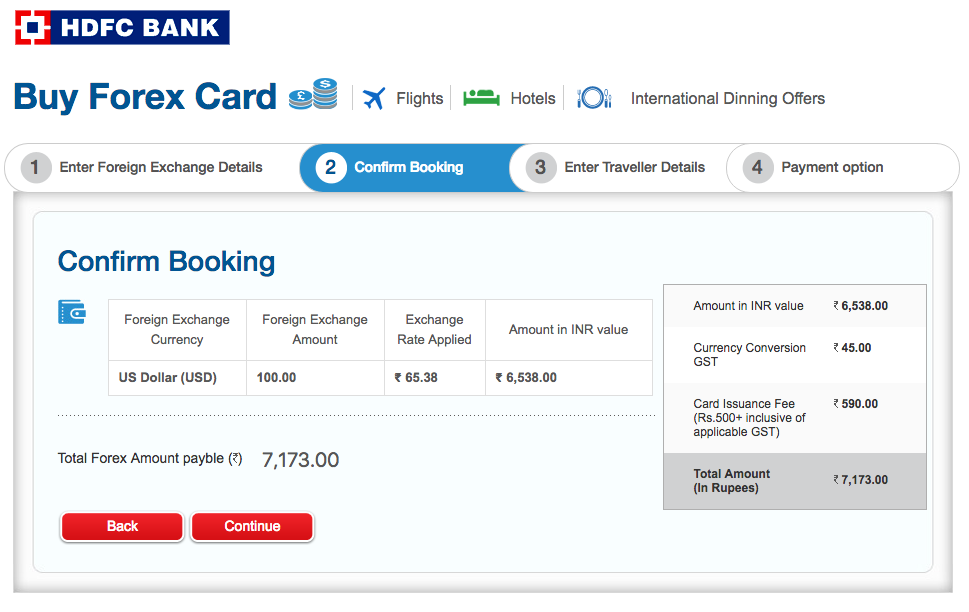

Image: www.livemint.com

Unveiling the Syndicate Bank Forex Card Rate

The Syndicate Bank Forex Card, a prepaid card issued by Syndicate Bank, has gained prominence as an indispensable tool for travelers and individuals engaged in international transactions. Its key advantage lies in its competitive exchange rates, ensuring you get the most value for your currency exchange needs.

The Syndicate Bank Forex Card rate is calculated based on various factors, including:

- The prevailing interbank exchange rate

- Administration fees

- Transaction charges

By leveraging its robust infrastructure and partnerships with global financial institutions, Syndicate Bank is able to offer highly competitive exchange rates. The interbank exchange rate serves as the foundation for the card’s rate, with the bank incorporating modest administration fees and transaction charges to sustain its operations.

Advantages of Using the Syndicate Bank Forex Card

Beyond its favorable exchange rates, the Syndicate Bank Forex Card boasts an array of advantages that make it an ideal choice for travelers and those involved in international transactions:

-

Convenience: Enjoy instant access to foreign currencies at your fingertips, eliminating the need for cash transactions.

-

Security: The card is equipped with robust security features, ensuring the safety of your funds and protecting you against fraud.

-

Wide Acceptance: The card is widely accepted at ATMs, retail outlets, and online merchants, providing you with unparalleled flexibility.

-

Account Management: Access your account details and track your transactions conveniently through the bank’s online portal or mobile application.

Trends in Forex Card Rates

The currency exchange market is a dynamic and interconnected ecosystem, influenced by a plethora of economic and political factors. To stay abreast of the latest trends and developments impacting the Syndicate Bank Forex Card rate, consider the following sources:

-

Economic News and Updates: Stay informed on the latest macroeconomic and geopolitical events that may affect exchange rates.

-

Currency Markets Commentary: Seek insights from industry experts and analysts on their perspectives regarding currency markets.

-

Social Media Platforms: Engage with financial enthusiasts and professionals on social media platforms to gain diverse viewpoints on exchange rate movements.

Image: www.pdfprof.com

Tips for Optimizing Your Currency Conversions

Maximize your currency conversion efficiency by implementing these expert tips:

-

Compare Rates: Explore various exchange providers and compare their rates to secure the most competitive deal.

-

Consider Transaction Volume: Exchange larger amounts of currency at once to benefit from potentially better rates.

-

Use Debit Cards Judiciously: While debit cards offer greater convenience, their exchange rates may be less favorable compared to dedicated forex cards.

-

Avoid Currency Exchange Bureaus: Tourist-oriented exchange bureaus often charge exorbitant fees and offer unfavorable rates.

FAQs on Syndicate Bank Forex Card Rate

Q: Are there any hidden charges associated with the Syndicate Bank Forex Card?

A: The Syndicate Bank Forex Card is designed to be transparent, with all fees and charges clearly disclosed in the contract you receive upon issuance. The bank’s goal is to ensure you are fully informed about all expenses related to using the card.

Q: How do I load funds onto my Syndicate Bank Forex Card?

A: Adding funds to your Syndicate Bank Forex Card is a seamless process. You can accomplish this through various channels, including online banking, mobile app, or visiting any Syndicate Bank branch. The bank provides step-by-step instructions to guide you through the process.

Q: Is there a daily limit on the amount I can spend using the Syndicate Bank Forex Card?

A: Yes, the Syndicate Bank Forex Card has daily spending limits implemented to safeguard against fraudulent activities. The default limit is typically sufficient for most travelers. However, you can request a higher limit if your travel plans necessitate it.

Syndicate Bank Forex Card Rate

Conclusion

Embracing the Syndicate Bank Forex Card as your currency conversion companion empowers you to embark on your global financial adventures with confidence. By leveraging its competitive exchange rates and unparalleled convenience, you can navigate the complexities of international transactions with ease. Whether you’re a seasoned traveler or engaging in cross-border commerce, the Syndicate Bank Forex Card equips you with the tools you need to maximize your currency exchange efficiency.

Are you ready to simplify your international money matters? Delve into the world of Syndicate Bank Forex Card rate and unlock a world of opportunities and currency conversions.