Introduction:

Immerse yourself in the dynamic world of forex trading in India, where currency exchange plays a crucial role in the financial ecosystem. This comprehensive guide will unravel the intricacies of forex GST rates, empowering you to navigate this complex landscape with confidence.

Image: www.brinknews.com

Understanding Forex Trading in India:

Forex trading, short for foreign exchange trading, involves the exchange of currencies between different countries. In India, this activity is regulated by the Reserve Bank of India (RBI) under the Foreign Exchange Management Act (FEMA) of 1999. Forex trading in India primarily takes place on the Over-the-Counter (OTC) market, where participants trade directly with each other without involving an exchange.

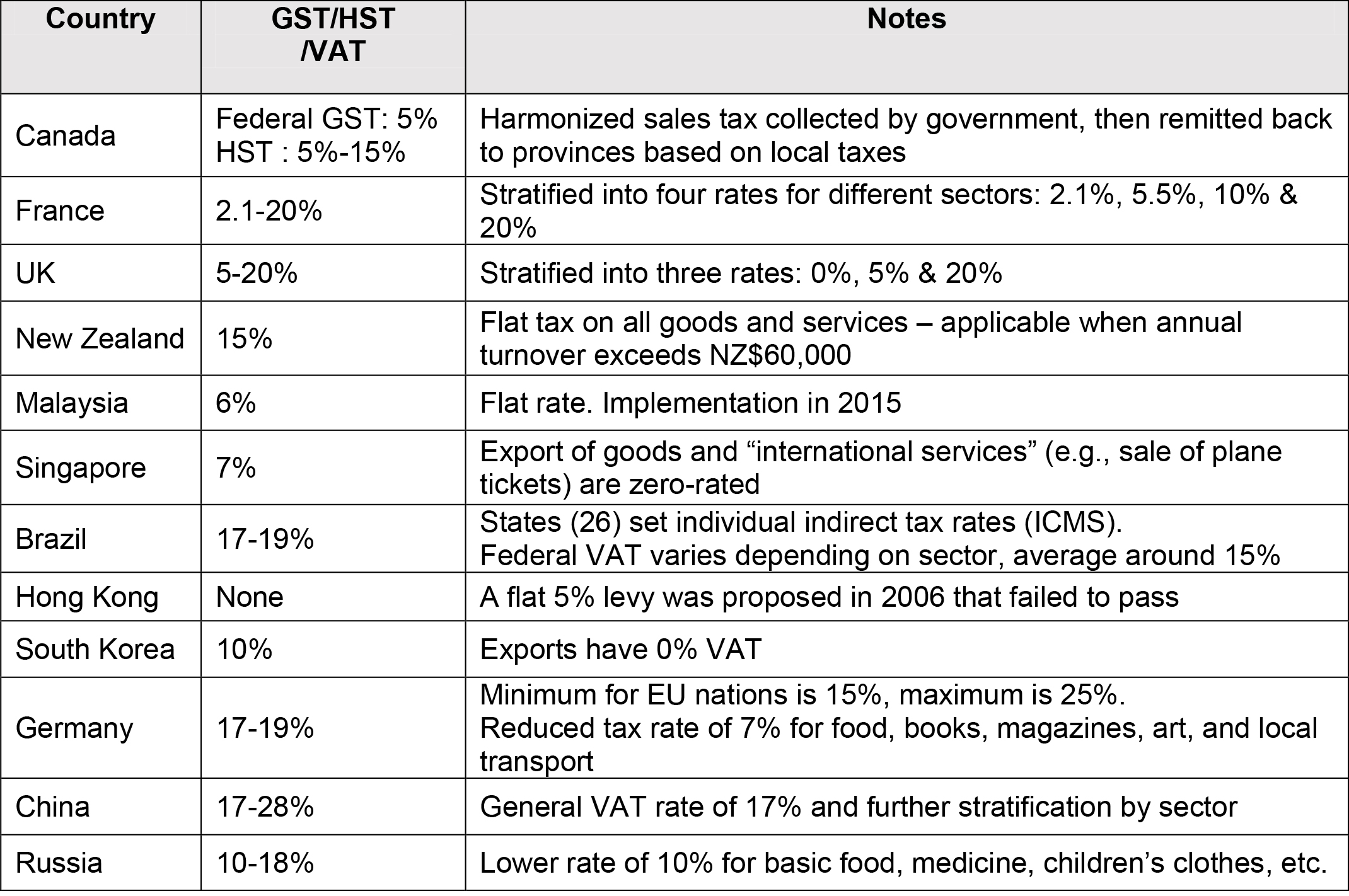

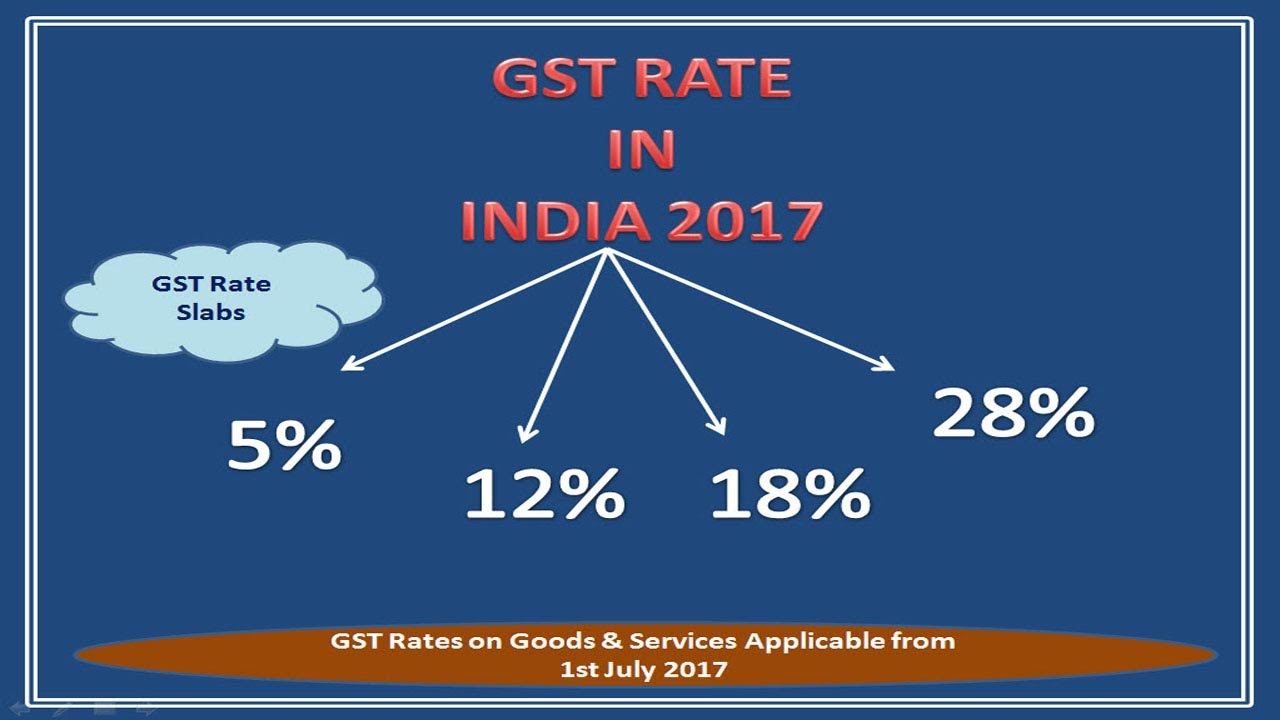

GST Rates for Forex Transactions:

Under the Goods and Services Tax (GST) regime implemented in India, forex transactions are subject to specific GST rates. The GST rate applicable to forex trades is 18%. This levy is charged on the service fee that forex brokers charge their clients for facilitating currency exchange. It is important to note that GST is not applicable on the profit or loss made through forex trading itself.

Latest GST Trends and Developments for Forex Trading:

The GST framework for forex trading in India has undergone several changes over the years. Initially, forex trading was subject to a 15% GST rate. However, this was revised to 18% in 2019. The government has been exploring the implementation of composite GST rates for forex brokers to simplify the taxation process.

Image: dontgetserious.com

Tips and Expert Advice for Forex Trading in India:

Seasoned forex traders offer invaluable advice to navigate the market effectively:

- Choose a reliable forex broker: Opt for a regulated and reputable broker that provides transparent services and competitive spreads.

- Understand market dynamics: Research currency trends, global economic events, and political developments that can impact forex prices.

- Manage risk judiciously: Implement sound risk management strategies, including stop-loss orders and risk-to-reward ratios, to mitigate potential losses.

FAQs on Forex GST Rates in India:

A: 18% GST is levied on the service fee charged by forex brokers.

A: No, GST is not levied on profits or losses made through forex trading itself.

A: GST refunds are not typically available for forex transactions.

Forex Gst Rate In India

Conclusion:

Mastering forex trading in India requires a thorough understanding of GST rates and prevailing regulations. By leveraging the expert advice and insights provided in this comprehensive guide, you can optimize your forex trading strategies, minimize risks, and maximize your earning potential. Embrace the opportunities presented by the dynamic forex market and explore the world of currency exchange with confidence.

Are you intrigued by the fascinating world of forex trading in India? Share your thoughts and questions in the comments section below!