Introduction: Understanding Forex Conversion and GST

Foreign exchange (forex) conversion plays a crucial role in international trade, travel, and investments. Businesses and individuals engaging in transactions involving different currencies often face the need to convert currencies. With the implementation of the Goods and Services Tax (GST) in India, it becomes essential to understand its implications on forex conversion charges. In this comprehensive guide, we will del delve into the GST on forex conversion charges, its impact on businesses and travelers, and provide practical insights to navigate this aspect of financial transactions.

Image: ricardacooney.blogspot.com

GST on Forex Conversion Charges: A Detailed Explanation

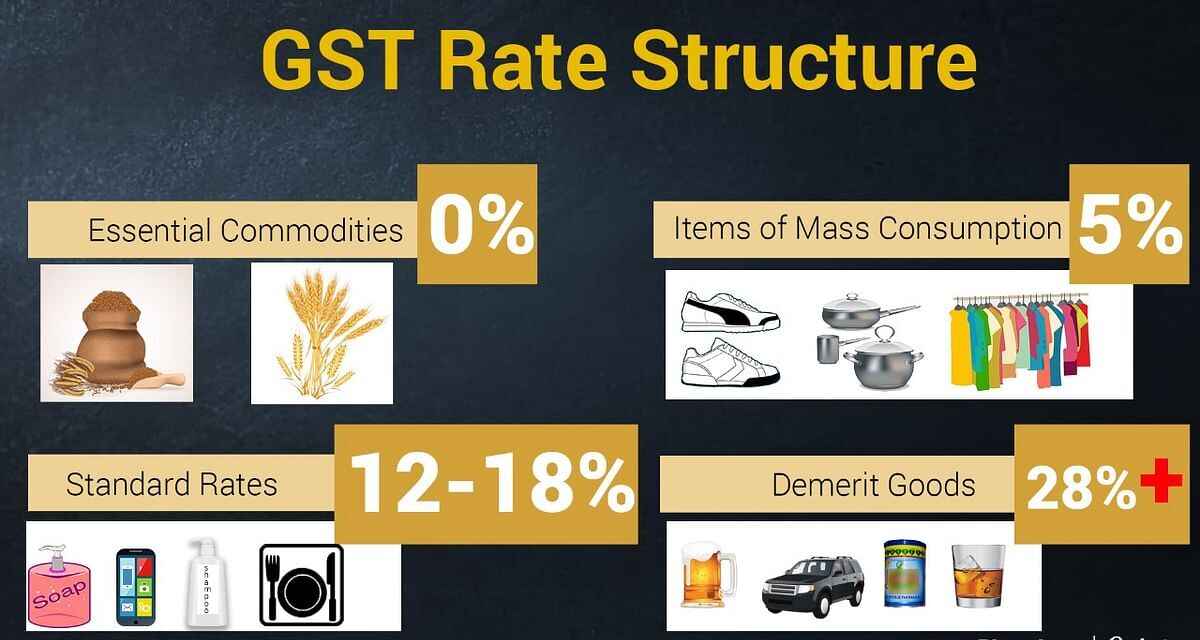

The GST, introduced in India in 2017, is a comprehensive indirect tax levied on the supply of goods and services. Forex conversion, being a service, falls under the ambit of GST. The GST rate on forex conversion charges has been set at 18%. This means that when an individual or business converts foreign currency to Indian rupees or vice versa, they are required to pay an additional 18% GST on the conversion fee charged by the bank or exchange house.

Applicability and Impact on Businesses

The GST on forex conversion charges applies to all businesses that engage in foreign currency transactions. Exporters and importers are directly impacted by this tax, as they frequently convert currencies to facilitate international trade. The GST on forex conversion charges adds an additional cost to their overall transaction expenses. Businesses should carefully consider the impact of this tax on their profit margins and pricing strategies.

Implications for Travelers

Foreign tourists and Indian residents traveling abroad also come under the purview of GST on forex conversion charges. When exchanging currencies at banks, exchange houses, or airports, they are subject to the 18% GST on the conversion fee. This tax can add up to a significant amount, especially for travelers exchanging large sums of money. It is advisable for travelers to factor in the additional GST charges when planning their foreign exchange requirements.

Image: www.regalfinserv.com

Exemptions and Exceptions

There are certain exemptions and exceptions under GST regarding forex conversion charges. For instance, no GST is levied on foreign exchange conversion charges for transactions related to:

- Import or export of goods

- Remittances towards education or medical expenses

- Purchase or sale of foreign currency for personal use (up to a specified limit)

GST Invoicing and Compliance

Businesses that provide forex conversion services are required to issue GST invoices to their customers. These invoices must include details such as the GST rate, the conversion fee, and the total amount payable (including GST). Proper invoicing and record-keeping are crucial for GST compliance and avoiding any penalties.

Managing GST on Forex Conversion

Businesses and travelers can take certain steps to manage the impact of GST on forex conversion charges effectively:

- Negotiate with Banks/Exchange Houses: Businesses can negotiate with banks or exchange houses to reduce the conversion fee and minimize the overall GST liability.

- Explore Alternative Exchange Options: Travelers should explore alternative exchange options, such as using a foreign exchange broker or online platforms, which may offer competitive conversion rates and lower fees.

- Proper Documentation and Compliance: Businesses must maintain proper documentation of their forex conversion transactions, including GST invoices, to ensure compliance with tax regulations.

- Seek Professional Advice: Consulting with a qualified chartered accountant or tax advisor can provide valuable guidance and assistance in understanding and managing GST on forex conversion charges.

Gst On Forex Conversion Charges

Conclusion

GST on forex conversion charges is an important aspect that businesses and travelers need to be aware of. By understanding the implications of this tax and taking appropriate measures, individuals and businesses can effectively manage the additional costs and ensure compliance with GST regulations. A thorough knowledge of the GST framework and seeking professional assistance when necessary can help navigate the complexities of forex conversion charges while maximizing cost savings and optimizing financial transactions.