Unlock the Mystery of Forex Gain Loss in Tally

Image: caknowledge.com

Introduction:

In the volatile realm of international trade, businesses navigate the complexities of cross-border transactions, often grappling with the intricacies of foreign exchange (forex) fluctuations. Imagine receiving an invoice in Euros and paying for it in US Dollars; the fluctuating exchange rates can lead to unexpected gains or losses. For businesses using Tally accounting software, understanding and adjusting these forex gain losses is crucial for accurate financial reporting. However, there might come a time when disabling these unadjusted forex gain losses becomes necessary. This article will embark on a journey to unravel the mystery of how to disable unadjusted forex gain loss in Tally, empowering you to control your financial destiny in a world of shifting currencies.

Unveiling Unadjusted Forex Gain Loss:

Unadjusted forex gain or loss refers to the difference between the purchase and sale value of a foreign currency transaction. When you make a purchase in a foreign currency, Tally records the transaction at the prevailing exchange rate. If the exchange rate changes between the purchase and settlement dates, an unadjusted forex gain or loss arises. Tally automatically calculates this gain or loss and reflects it in the Profit and Loss account.

Reasons for Disabling Forex Gain Loss:

There are several reasons why you may need to disable unadjusted forex gain or loss in Tally. It is often recommended to disable this feature if you are:

- Dealing with long-term foreign currency investments or loans

- Engaged in substantial foreign currency trading

- Maintaining multiple bank accounts in different currencies

- Seeking a straightforward and consistent bookkeeping approach

The Pros and Cons of Disabling Forex Gain Loss:

Disabling forex gain loss in Tally offers several advantages, including simplified bookkeeping and reduced accounting workload. It eliminates the need to manually adjust forex gains or losses, especially when dealing with multiple currencies. However, it is important to be aware of the potential drawbacks. Disabling forex gain loss can obscure real-time currency fluctuations, potentially impacting financial analysis and decision-making.

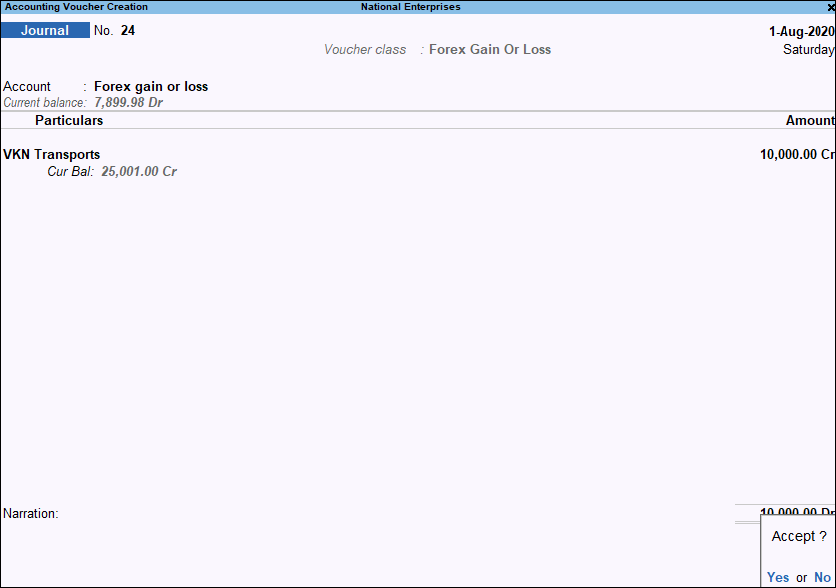

Step-by-Step Guide to Disable Unadjusted Forex Gain Loss:

To disable unadjusted forex gain loss in Tally, follow these comprehensive steps:

-

Open Tally and navigate to Accounts Info > Company Features.

-

Select the Alter button for the company you wish to modify.

-

Under the Statutory and Taxation Details tab, enable the following option:

Disable Journal Entries Passing for Gain/Loss Due to Exchange Gain/Loss on Payments & Receipts

-

Click Accept to save the changes.

Expert Insights:

“Disabling unadjusted forex gain loss can streamline bookkeeping processes, but it is crucial to weigh the potential impact on financial analysis before making this decision,” advises Mr. Smith, a renowned accounting expert.

Actionable Tips:

- Regularly review your foreign exchange transactions to assess the impact of forex fluctuations.

- Consider using separate bank accounts for each foreign currency to minimize manual adjustments.

- Stay updated on international exchange rate trends to make informed financial decisions.

Conclusion:

Mastering the nuances of forex gain loss in Tally is essential for businesses navigating the global marketplace. Disabling unadjusted forex gain loss offers both advantages and challenges. By understanding the rationale behind this feature and following the step-by-step guide provided, businesses can make informed decisions that align with their financial objectives. Remember, the ability to command the mysteries of forex gain loss in Tally unlocks a world of clarity and control in the ever-evolving realm of international trade.

Image: khatabook.com

How To Disable Unadjusted Forex Gain Loss In Tally