As an avid trader in the dynamic forex market, I often grappled with the perplexing question of how many currency pairs to incorporate into my trading portfolio. Initially, I delved into the thrilling world of currency trading with an ambitious objective of conquering as many pairs as possible. However, I swiftly realized that this approach was akin to juggling countless balls simultaneously, swiftly leading to dropped opportunities and diminished profitability.

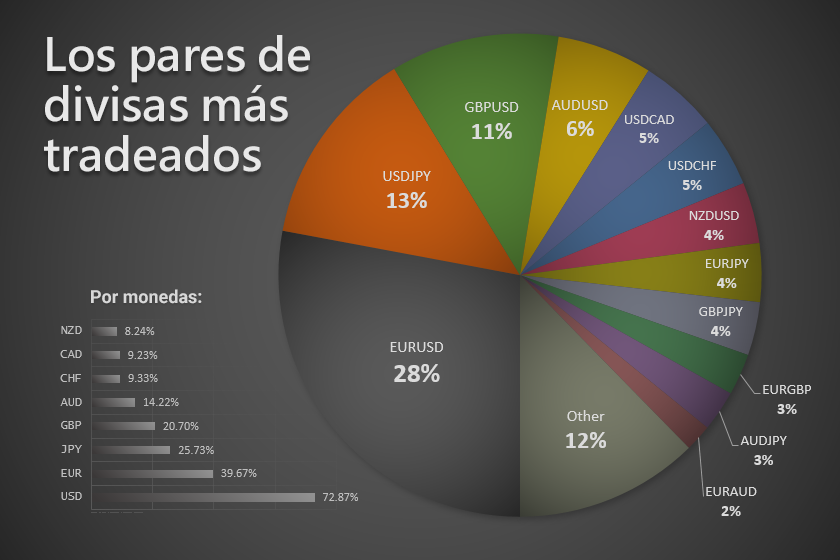

Image: es.fxssi.com

Over time, through diligent research and valuable mentorship, I stumbled upon a pivotal revelation – mastering a select few currency pairs holds the key to unlocking consistent success in forex trading. Embarking on this journey, I am eager to share my insights and guide you towards determining the optimal number of currency pairs for your trading endeavors.

Deciphering the Depth of Currency Pairs: A Primer

Before unraveling the intricacies of selecting the ideal number of currency pairs, let’s lay a solid foundation by exploring their essence. A currency pair, as the name suggests, comprises two distinct currencies, with one being the base currency and the other the quote currency. The base currency serves as the reference point, while the quote currency represents the price of the base currency in terms of the quote currency.

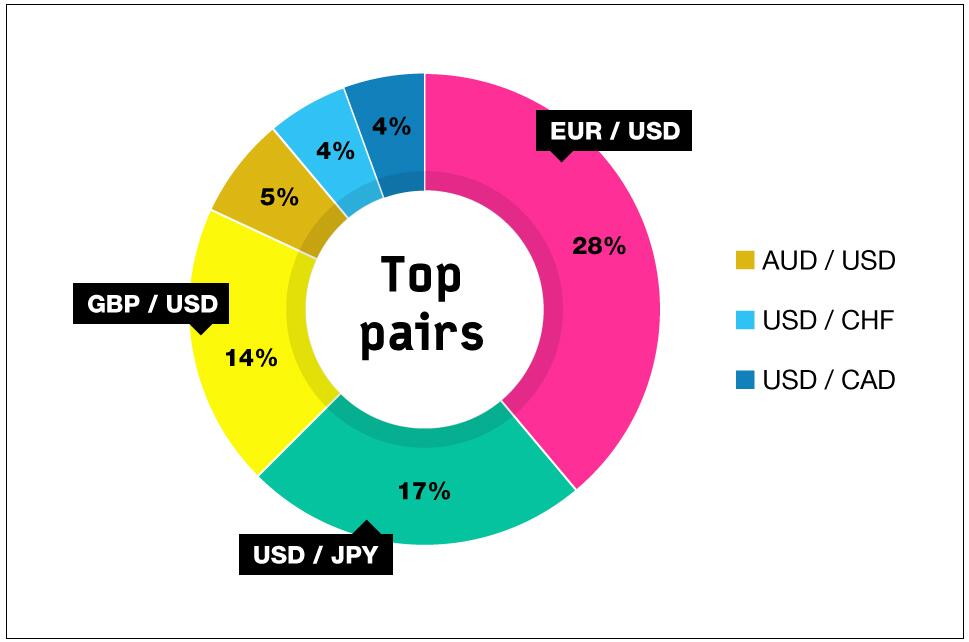

In the vast tapestry of global financial markets, an array of currency pairs awaits intrepid traders, each boasting unique characteristics, volatilities, and trading volume. Major currency pairs, such as EUR/USD, GBP/USD, and USD/JPY, command substantial trading volumes and offer traders a robust liquidity environment.

The Delicate Balance: Finding Your Optimal Trading Cadence

Selecting the ideal number of currency pairs for your trading endeavors is not a one-size-fits-all proposition. It demands careful consideration of your unique trading style, risk tolerance, and available time. Beginners often find solace in starting small, confining their focus to a single currency pair. This approach allows them to develop a thorough understanding of the pair’s dynamics, trading patterns, and potential pitfalls.

Seasoned traders, on the other hand, may opt to expand their currency pair repertoire. By diversifying their portfolio across multiple pairs, they can mitigate risk, seize opportunities presented by diverse market conditions, and potentially enhance their overall profitability. However, it’s crucial to strike a delicate balance, as attempting to juggle too many pairs simultaneously can lead to trading fatigue, diminished concentration, and compromised decision-making.

Charting a Course: Crafting an Informed Trading Plan

Before diving headfirst into currency trading, meticulously crafting a comprehensive trading plan is paramount. This plan should lay out your trading objectives, risk management strategies, and the criteria you will employ to select the currency pairs that best align with your trading style and aspirations. Embarking on this meticulous planning process will provide you with a clear roadmap for navigating the complexities of the forex market.

When selecting currency pairs, it is imperative to consider factors such as volatility, liquidity, and correlation. Volatility gauges the magnitude of price fluctuations, liquidity measures the ease with which a currency pair can be traded, and correlation gauges the degree to which the price movements of two currency pairs mirror each other. Prudent traders seek a harmonious blend of these factors, striking a balance between potential profit opportunities and manageable risk.

Image: www.litefinance.org

Expert Insights: Unveiling the Wisdom of Seasoned Traders

In the annals of forex trading, renowned traders have generously shared their insights, offering invaluable guidance to aspiring traders. One such sage is George Soros, whose Quantum Fund achieved remarkable success in the 1990s. Soros emphasized the importance of thorough technical analysis, advocating for a deep understanding of price patterns and market trends.

Another luminary in the trading arena is Bill Lipschutz, founder of Hathersage Capital Management. Lipschutz stressed the significance of risk management, cautioning traders to preserve their capital above all else. He advised traders to define their risk tolerance and adhere to it steadfastly.

Frequently Asked Questions: Empowering Your Trading Knowledge

**Q: How can I identify the best currency pairs for trading?**

A: Conducting thorough research is paramount. Analyze historical price data, market conditions, and economic indicators to ascertain which currency pairs exhibit favorable trading characteristics.

**Q: Is it advisable to trade multiple currency pairs simultaneously?**

A: Diversifying across multiple currency pairs can mitigate risk, but it’s crucial to select a manageable number of pairs. Focus on pairs that align with your trading style and risk tolerance.

**Q: Are major currency pairs always the most profitable?**

A: Not necessarily. Minor currency pairs can also provide lucrative trading opportunities. Consider factors such as volatility, liquidity, and correlation when evaluating currency pairs.

How Many Forex Pairs Should I Trade

Epilogue: A Call to Action

The captivating allure of forex trading beckons traders of all experience levels to test their mettle against the ebbs and flows of the financial markets. If you are contemplating embarking on this thrilling journey, I urge you to approach it armed with knowledge, a well-defined trading plan, and an unwavering commitment to continuous learning. By discerning the optimal number of currency pairs for your trading endeavors, you can step forth with confidence, ready to navigate the intricacies of the forex market and pursue your financial aspirations.

Are you ready to delve into the captivating world of forex trading, unlocking its boundless potential for financial gain and personal growth? Gather your resolve, embrace the trading strategies outlined in this comprehensive guide, and seize the opportunities that await in the thrilling realm of currency trading.