Maintaining your finances while traveling abroad can be a daunting task. Currencies can fluctuate rapidly, and carrying large sums of cash poses security risks. The SBI Forex Card offers a convenient solution to these problems, providing a secure and versatile way to manage your finances abroad.

Image: blog.trading4giving.com

What is an SBI Forex Card?

The SBI Forex Card is a prepaid, reloadable card that stores multiple currencies. It eliminates the need to carry physical cash, reducing the risk of theft or loss and providing a more secure way to make payments. The card is widely accepted at millions of locations worldwide, including ATMs, point-of-sale terminals, and online retailers.

Benefits of Using an SBI Forex Card

Using an SBI Forex Card offers several advantages:

- Convenience: Easily manage multiple currencies on a single card.

- Security: Avoid carrying large amounts of cash, reducing the risk of theft.

- Competitive exchange rates: Enjoy favorable exchange rates offered by SBI.

- Global acceptance: Make payments at millions of locations worldwide.

- Real-time tracking: Monitor your transactions and balance in real-time through a dedicated app.

How to Apply for an SBI Forex Card Online

Applying for an SBI Forex Card online is a quick and straightforward process:

- Visit the SBI Forex website: Navigate to www.sbiforex.com and click on “Apply Now.”

- Choose your card type: Select the card type that suits your needs.

- Enter your personal details: Provide your name, address, contact information, and KYC documents.

- Set up your account: Create a user ID and password for your Forex Card account.

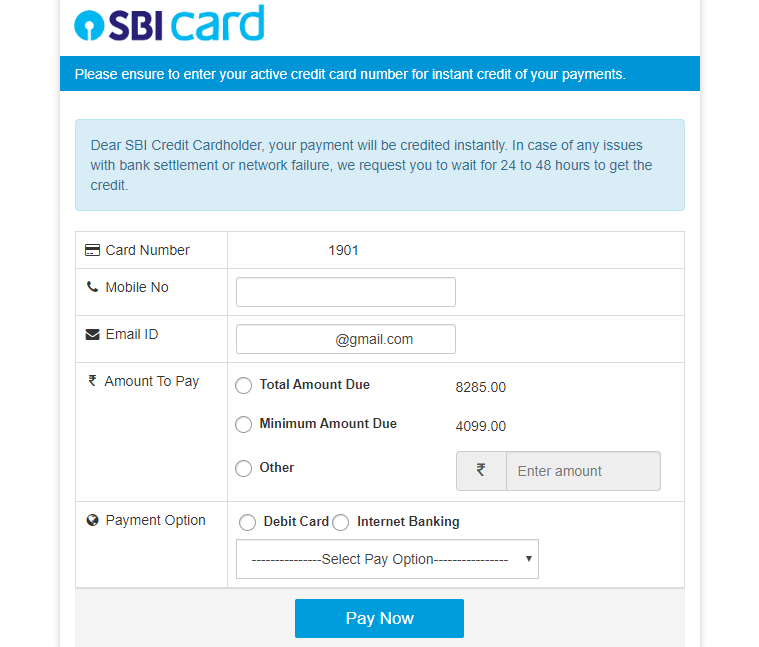

- Load funds: Transfer funds to your card account via NEFT or RTGS.

Image: www.paisabazaar.com

Tips for Using Your SBI Forex Card

To maximize the benefits of your SBI Forex Card:

- Use it at reputable merchants: Ensure you transact with authorized and trustworthy merchants.

- Be aware of exchange rate fluctuations: Monitor exchange rates and make informed decisions about your transactions.

- Replenish your card regularly: Keep your card funded to avoid any inconvenience while abroad.

- Activate your card before traveling: Call SBI Forex customer service to activate your card and set your PIN.

FAQs About SBI Forex Cards

Commonly asked questions about SBI Forex Card:

- What is the cost of an SBI Forex Card? There is a nominal issuance fee and annual maintenance charge associated with the card.

- Can I use my SBI Forex Card in multiple countries? Yes, the card is accepted worldwide at millions of locations.

- How can I check my SBI Forex Card balance? You can check your balance in real-time through the dedicated app or by contacting SBI Forex customer service.

Sbi Forex Card Apply Online

Conclusion

The SBI Forex Card is an indispensable tool for travelers who want to simplify their financial management abroad. With its convenience, security, and competitive exchange rates, the SBI Forex Card is the perfect solution for a hassle-free travel experience.

Are you ready to explore the world with peace of mind? Apply for your SBI Forex Card today and say goodbye to the worries of carrying physical cash.