In the realm of financial markets, the allure of Forex trading beckons countless individuals seeking financial freedom and prosperity. However, consistent profitability in this volatile arena remains elusive for many. To bridge this chasm, I embarked on a meticulous exploration of Forex strategies, meticulously scrutinizing their strengths and weaknesses. From this extensive analysis, a definitive strategy emerged – the key to unlocking consistent Forex profits.

Image: kumeyuroj.web.fc2.com

Defining the Cornerstone: Best Forex Strategy

A robust Forex strategy serves as a roadmap, guiding traders through the intricate labyrinth of currency markets. It encompasses a comprehensive set of rules and parameters that dictate entry and exit points, risk management techniques, and profit maximization strategies. By adhering to a well-defined strategy, traders can instill discipline and minimize the impact of emotional decision-making, which often leads to financial pitfalls.

Components of a Winning Strategy

The bedrock of a successful Forex strategy rests upon three fundamental pillars:

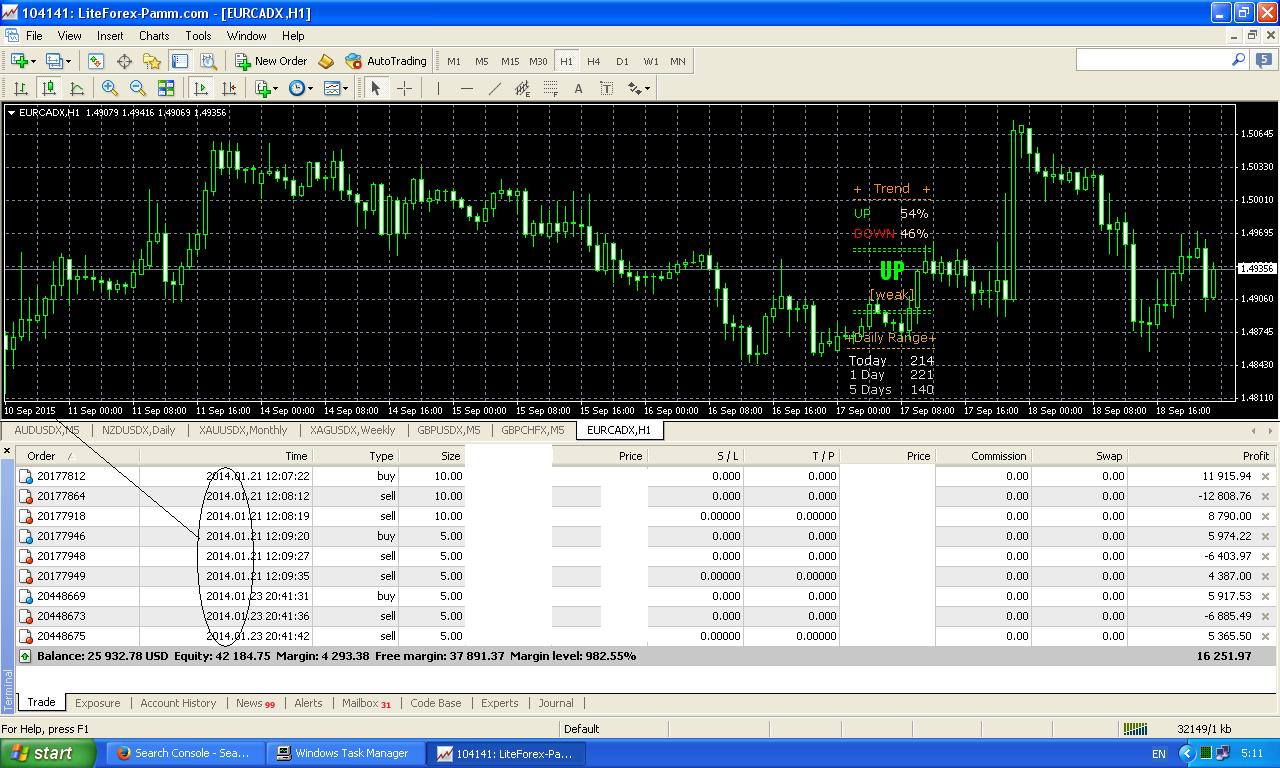

- Technical Analysis: This involves meticulously studying historical price data to identify patterns, trends, and support and resistance levels. Technical indicators, such as moving averages and trendlines, empower traders to make informed decisions based on objective market analysis.

- Risk Management: Prudent risk management techniques are paramount to safeguard capital. Establishing clear risk-reward ratios, implementing stop-loss orders, and diversifying positions help mitigate potential losses.

li>Discipline: Adhering to a predefined strategy requires discipline. This entails strictly following entry and exit rules, avoiding impulsive trading, and maintaining a clear and objective mindset.

Unveiling the Proven Strategy

The crux of our recommended strategy lies in harnessing the power of technical analysis and risk management. This synergistic approach involves:

Identifying Trends: Utilizing moving averages, traders can determine the prevailing market trend. Trading in alignment with the trend increases the probability of success.

Support and Resistance Levels: Identifying support and resistance levels provides insights into potential areas of price reversal. Trading near these levels allows traders to capitalize on predictable price movements.

Entry and Exit Points: Technical indicators, such as Bollinger Bands and Ichimoku Cloud, provide signals for entry and exit points. Waiting for confirmation from multiple indicators enhances the reliability of these signals.

Risk Management: Implementing stop-loss orders at predefined levels limits potential losses. Additionally, maintaining a risk-to-reward ratio of at least 1:2 ensures the potential profit outweighs the potential loss on each trade.

Image: forexindicatormt4.com

Benefits of Adopting a Winning Strategy

Embracing a proven Forex strategy offers numerous advantages for aspiring traders:

- Increased Profitability: A well-defined strategy provides a systematic framework for making informed trading decisions, enhancing the potential for consistent profits.

- Reduced Risk: Effective risk management techniques safeguard capital against excessive losses, fostering financial stability.

- Improved Discipline: Adhering to a strategy instills discipline, mitigating the impact of emotional trading and promoting rational decision-making.

Tips and Expert Advice from an Experienced Trader

As a seasoned Forex trader, I’ve accumulated valuable insights that can help you optimize your trading experience:

- Thorough Market Research: Conduct thorough research on currency pairs, market conditions, and economic events to gain a comprehensive understanding of the Forex market.

- Practice on a Demo Account: Hone your skills in a risk-free environment using a demo account to test strategies and develop confidence.

- Seek Mentorship: Connect with experienced traders or join online communities to learn from seasoned professionals.

FAQs about Forex Trading Strategies

Q: Can anyone succeed in Forex trading?

A: Consistent success in Forex trading requires dedication, hard work, and a commitment to learning and refining strategies.

Q: How much capital is required to start Forex trading?

A: While it is possible to start with a small amount of capital, having sufficient funds provides a buffer against market fluctuations and allows for better risk management.

Q: Is it possible to automate Forex trading?

A: While automated trading tools exist, they should be used cautiously and in conjunction with a solid understanding of the market. Relying solely on automated systems can be risky.

Best Forex Strategy For Consistent Profits

Conclusion: Embark on the Path to Consistent Profits

In the competitive arena of Forex trading, embracing a proven strategy is the key to unlocking consistent profitability. By adopting a systematic approach that combines technical analysis, risk management, and discipline, you can elevate your trading skills and navigate the complexities of the Forex market with confidence. Remember, success is not an overnight sensation; it requires dedication, resilience, and a relentless pursuit of financial literacy. Are you ready to embark on the path to consistent Forex profits?