Introduction: The Currency of International Trade

Forex transactions form the backbone of global commerce, facilitating cross-border trade between individuals, businesses, and nations. Valuing these transactions accurately is crucial for both tax authorities and business entities, as it directly impacts the computation of Goods and Services Tax (GST). In this comprehensive guide, we will delve into the intricate details of forex transaction valuation, exploring its GST implications and providing expert insights to ensure compliance and financial efficiency.

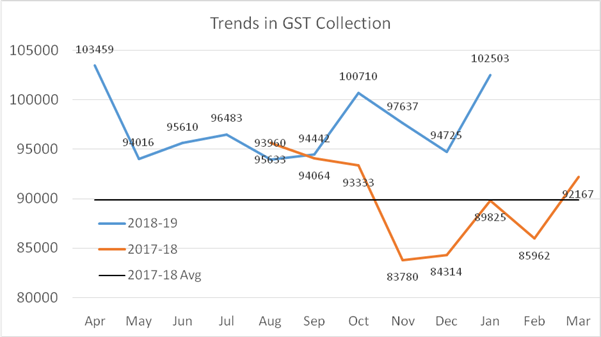

Image: pib.gov.in

Decoding Forex Transaction Valuation

Forex transaction valuation refers to the process of determining the monetary worth of a foreign exchange transaction. It involves converting one currency into another based on the prevailing foreign exchange (forex) rates. The resulting valuation serves as the basis for calculating GST liability on the underlying transaction.

Understanding GST Implications

GST, implemented in India in 2017, has significantly influenced the valuation of forex transactions. GST is a comprehensive indirect tax levied on the supply of goods and services, including those involving foreign currency exchange. The valuation of forex transactions for GST purposes is governed by specific rules and regulations.

Rules for Valuation of Forex Transactions under GST

- For imports: The transaction value shall be the price paid or payable for the goods or services, excluding GST, import duty, and other miscellaneous charges.

- For exports: The transaction value shall be the price agreed to be paid or received for the goods or services, excluding GST, export duty, and other miscellaneous charges.

- For services (including foreign exchange services): The transaction value shall be the total amount charged, excluding GST, by the supplier to the recipient.

It’s important to note that GST is levied on the value of the foreign exchange transaction in Indian Rupees (INR). The forex rate used for conversion should be the rate prevailing on the date of the transaction.

Image: in.duhocakina.edu.vn

Latest Trends and Developments

The domain of forex transaction valuation is constantly evolving. Recent updates include:

- GST Rate Rationalization: The Indian government has recently introduced a rationalized GST rate structure, impacting the valuation of forex transactions.

- Digitized GST Returns: Advancements in technology have simplified GST return filing, including the electronic submission of forex transaction details.

Tips and Expert Advice for Accurate Valuation

Here are some valuable tips and expert advice for ensuring accurate forex transaction valuation:

- Maintain Proper Documentation: Keep accurate records of invoices, bank statements, and other relevant documents to support forex transactions.

- Use Recognized Sources for Exchange Rates: Utilize reliable sources such as Reserve Bank of India (RBI) or authorized dealers for prevailing forex rates.

- Seek Professional Assistance: Consider consulting with a chartered accountant or tax advisor for expert guidance on forex transaction valuation.

Interpreting the Tips and Expert Advice

Documenting forex transactions meticulously provides a solid foundation for accurate valuation. Using recognized exchange rate sources ensures compliance with GST regulations and eliminates potential discrepancies. Seeking professional assistance when necessary ensures adherence to complex tax laws and minimizes the risk of non-compliance.

FAQs on Forex Transaction Valuation

Q: What is the basis for valuing forex transactions in India?

A: The valuation of forex transactions in India is governed by the provisions of the Goods and Services Tax (GST) Act and relevant regulations.

Q: How does GST impact forex transactions?

A: GST is levied on the value of forex transactions, which is determined based on the prevailing foreign exchange rates. The transaction value is subject to GST at the applicable rates.

Valuation Of Forex Transanctions Gst

Conclusion: The Importance of Accurate Valuation

Accurate valuation of forex transactions is paramount for GST compliance and efficient financial management. Understanding the GST implications and adhering to the prescribed rules are essential for businesses involved in international trade. By implementing the tips and following expert advice, readers can ensure precise valuation and minimize the risk of potential tax liabilities. Regularly monitoring industry updates and professional guidance will further enhance their knowledge and ensure they stay abreast of the latest developments.

Let’s hear from our valuable readers! We would love to know your thoughts on this article. Was it informative and helpful? Share your feedback and queries in the comments section below.