The foreign exchange (forex) market presents a dynamic and lucrative arena for traders worldwide. Navigating this vast and complex landscape requires a deep understanding of trading strategies, risk management techniques, and order execution methods. Among these methods, buy limit and buy stop orders stand out as two essential tools that every trader should master to maximize their potential for success.

Image: www.youtube.com

Unveiling the Essence of Forex Orders

Forex orders empower traders with the ability to execute trades at specific prices, ensuring that their desired transactions are carried out seamlessly. Buy limit orders allow traders to purchase a currency pair at a price below the current market price, while buy stop orders allow them to initiate a buy position when the price reaches a predefined level above the current market price.

Understanding the nuances of buy limit and buy stop orders is crucial for traders who wish to harness their full potential. By strategically deploying these orders, traders can gain a competitive edge in the fast-paced forex market.

Buy Limit Orders: Seizing Favorable Price Drops

Buy limit orders serve a specific purpose: to secure the purchase of a currency pair once the market falls to a predetermined price level. Traders employ buy limit orders when they anticipate a downward trend in the market. This allows them to capitalize on a drop in price by initiating a buy position at a more favorable rate.

Consider the following scenario: Trader A believes that the EUR/USD currency pair is due for a correction. They set a buy limit order at 1.0800, below the current market price of 1.0830. If the EUR/USD pair falls to or below this predefined level, the buy limit order is automatically executed, allowing Trader A to enter a long position at the more advantageous price of 1.0800.

Buy Stop Orders: Capitalizing on Price Surges

In contrast to buy limit orders, buy stop orders are utilized when traders anticipate an upward trend in the market. They place buy stop orders above the current market price, with the intention of entering a buy position if the price reaches the specified level.

Imagine that Trader B has identified a bullish trend in the GBP/USD currency pair. They set a buy stop order at 1.3100, above the current market price of 1.3070. If the GBP/USD pair rallies to or surpasses 1.3100, the buy-stop order is triggered, automatically initiating a buy position for Trader B, allowing them to capitalize on the price surge.

Image: websitereports451.web.fc2.com

Choosing the Right Order: Adapting to Market Dynamics

The choice between a buy limit order and a buy stop order hinges on the prevailing market conditions and the trader’s predictions. Buy limit orders are ideal for bearish or corrective market scenarios, while buy stop orders shine in bullish or breakout scenarios. Understanding the dynamics of both types of orders and implementing them strategically is essential for effective trade execution.

Additional Considerations for Traders

When utilizing buy limit and buy stop orders, traders should consider the following factors:

-

Spread: It is crucial to factor in the spread, which is the difference between the bid and ask prices, when placing orders.

-

Slippage: Execution prices may differ from the predefined levels due to market volatility, affecting the profitability of the trade.

-

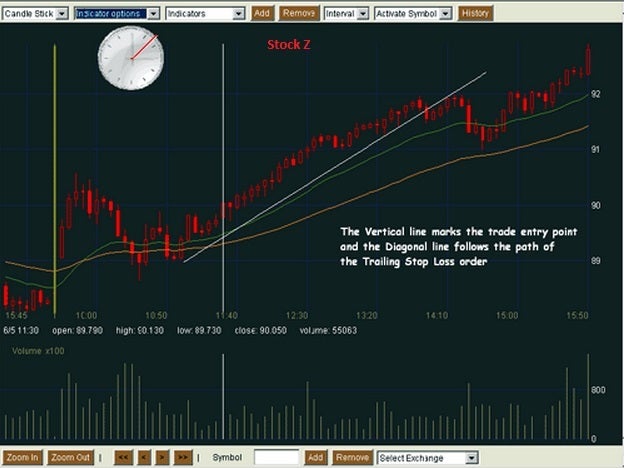

Stop-loss orders: Traders should combine limit or stop orders with stop-loss orders to manage risk and protect their capital from substantial losses.

-

Discipline: Sticking to the trading plan and avoiding emotional decision-making is vital for successful trade execution.

Buy Limit Vs Buy Stop Forex

Conclusion

In the arena of forex, mastering the intricacies of buy limit and buy stop orders can elevate a trader’s game to the next level. These versatile tools empower traders to take advantage of market fluctuations, enter and exit positions at advantageous prices, and maximize their chances for success. By incorporating these orders into their trading arsenal, traders can enhance their execution strategies and sharpen their competitive edge in the dynamic forex market.